Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

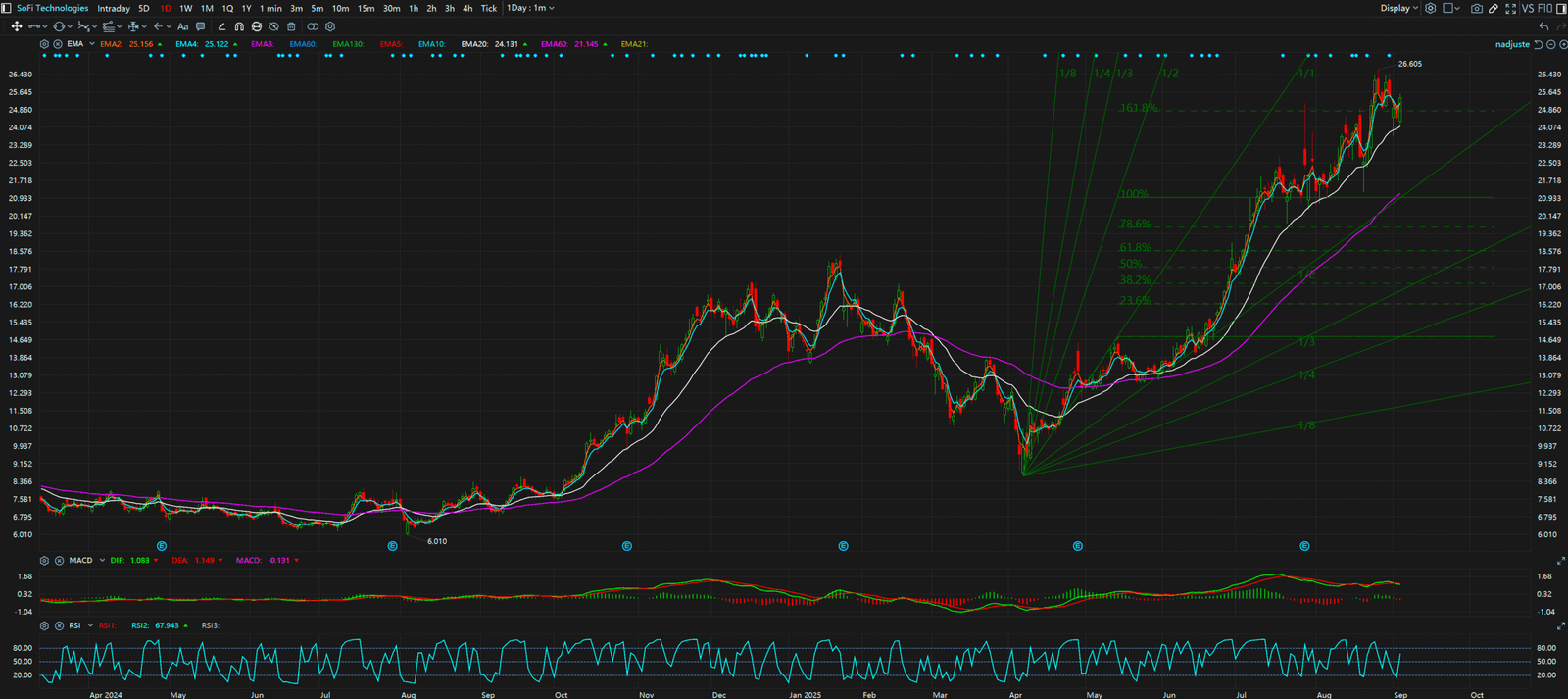

“Fintech is disrupting traditional banking!” “User growth hits another record high!” “Positive earnings outlook continues!” 😏

Open any financial news app, and you’ll be bombarded with exhilarating headlines like these. Wall Street analysts, company executives, and so-called “experts” are weaving a beautiful dream for you about the Financial Technology (Fintech) sector every single day. They present what appears to be irrefutable “evidence”—revenue growth rates, market share, P/E ratios, user data—to convince you that this is a wealth-generating rocket ship you can’t afford to miss. 🚀

But after you invest your hard-earned money with hope in your heart, you find your account undergoing a slow, agonizing bleed. You feel confused, angry, and even start to question your judgment. You constantly reread those “positive” news articles, trying to find solace, but the stock’s decline slaps you in the face like a series of loud, mocking insults to your naivety.

Let me tell you the truth. All the fundamental information you see is nothing more than a view in the rearview mirror—it records what has already happened but is blind to the cliff’s edge right in front of you. This information is a carefully designed narrative trap, a lullaby played in your ear by institutional giants while they offload their shares onto the retail public. They need you to believe the story so they can make their graceful exit at the top.

Believing in fundamentals is as absurd as planning a battle strategy based on the enemy’s propaganda leaflets. The real map, the only tool that can guide you to survive and profit in this market of lies, is hidden in the most public and honest place imaginable: the price chart. The chart does not lie. Every candlestick, every tick of volume, nakedly records the true intentions of all market participants—especially the “Smart Money” that truly controls the game.

Today, we will use three of the most iconic US Fintech leaders—PayPal (PYPL), Block (SQ), and SoFi (SOFI)—as our dissection specimens. We will show you how to tear off the gorgeous coat of fundamentals and, using the X-ray vision of technical analysis, see the structural weaknesses within. Get ready, for this will be a complete paradigm shift. You will learn to read the tracks left by the market like a professional hunter, instead of listening to the false promises of the shepherd like a lamb to the slaughter.

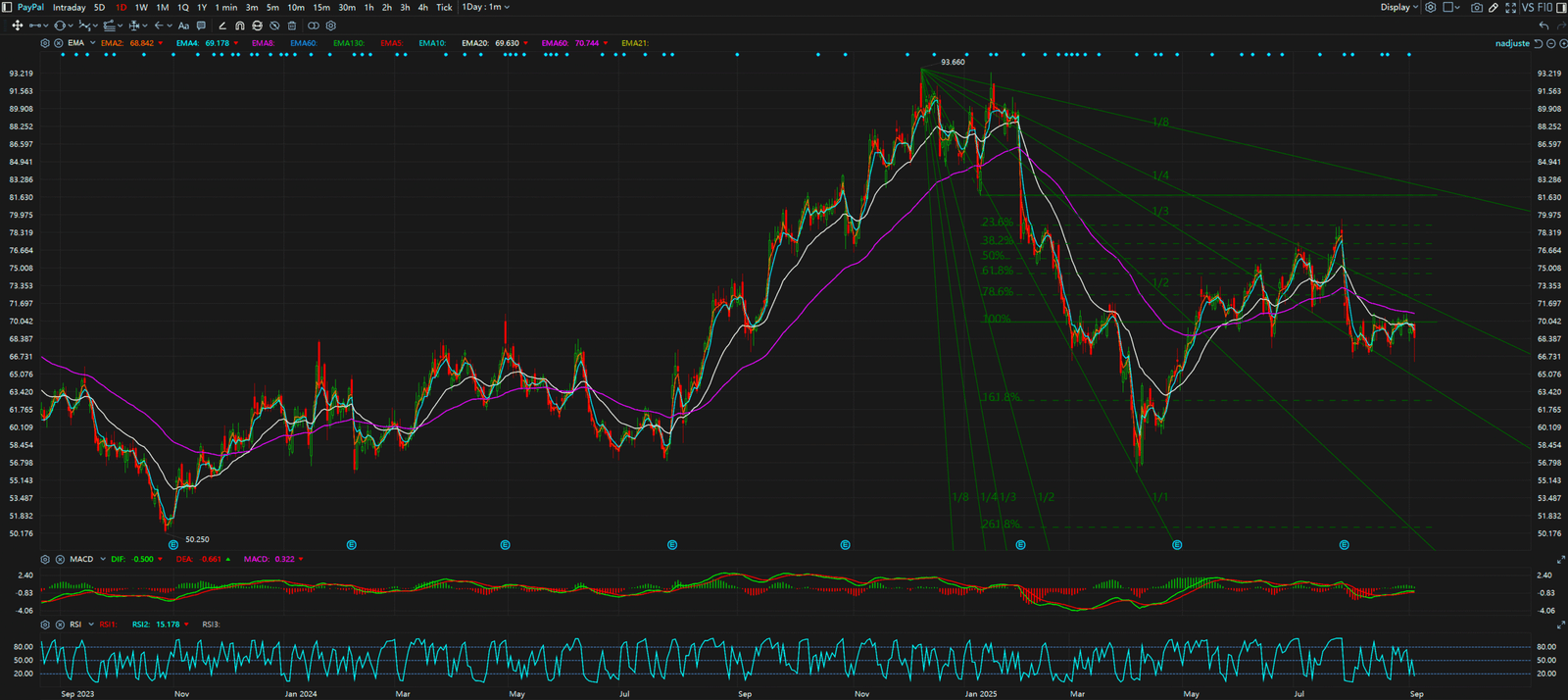

PayPal, once the titan of payments and a synonym for Fintech, now looks like a gift from the heavens to many “value investors.” They’ll tell you: “Look at its P/E ratio, it’s at a historic low!” “It still has a massive user base and a brand moat!” “Buying now is an absolute bargain!”

These words sound so sweet, so logical. But now, please, turn off the financial news shows and open PYPL’s weekly chart. What do you see?

I see a catastrophe that has been unfolding for three full years, a textbook example of a bear market trend. Since hitting its all-time high of $310 in July 2021, PYPL’s stock has been trapped in a merciless downward channel. Every seemingly powerful rally has ultimately proven to be a “Dead Cat Bounce,” creating yet another trap for the next wave of believers who entered late.

Let’s perform a professional chart autopsy.

1. The Iron Law of the Downward Channel: First, connect the major highs of 2021 and 2022, and you get a crystal-clear descending trendline. Similarly, connect the lows of 2022 and 2023, and you get a descending support line. These two parallel lines form a stable downward channel. For the past three years, PYPL’s price has been like a ball stuck on a slide, helplessly rolling downwards. Every time the price has touched the upper rail of this channel, it’s like hitting an invisible wall, followed by an even more violent sell-off.

The fundamentalist will ask, “Why? The company is still profitable!” The answer is right there in the chart. The downward channel itself is the manifestation of market consensus. It tells us that regardless of the earnings numbers, the big money in the market is continuously and systematically selling this stock. Their will to sell is far stronger than the will to buy. This simple geometric pattern carries more weight than hundreds of pages of analyst reports.

2. The Warning from the Volume Profile: Now, let’s bring in a more advanced tool: the Volume Profile. This tool shows the total volume traded at different price levels. On PYPL’s chart, you will see a colossal amount of volume clustered between $100 and $200. What does this mean?

It means that millions of shares, representing countless positions, are trapped in this massive “bagholder supply zone.” These investors, who bought into the “buy the dip” narrative in late 2021 and 2022, are now like a group of desperate prisoners, praying day and night for the price to return to their cost basis so they can “get out break-even.”

This enormous supply zone acts like a giant dam hanging over PYPL’s stock price. Any future attempt to break higher will be met with immense selling pressure from this zone. Every sell order from a trapped investor trying to escape becomes resistance to the stock’s ascent. A fundamental analyst will never tell you about this “dam,” because in their Excel models, there are only cold, hard numbers, not human fear and despair.

3. The Bearish Divergence Trap of the RSI: In late 2023 and early 2024, PYPL’s stock rallied from around $50 to $68, a nearly 40% gain. At that time, the market was once again filled with optimistic “the king has returned” sentiment. Headlines read, “PYPL has bottomed, the worst is over.”

However, a true technical analyst would have immediately spotted a dangerous signal: RSI Bearish Divergence.

While the price made a new high in March 2024, higher than the one in January 2024, the Relative Strength Index (RSI) failed to confirm it with a new high of its own. Instead, it formed a lower high. This is a classic warning sign that the internal momentum of the rally is fading. The price increase was more of an inertial movement, likely caused by short-covering or retail FOMO, rather than being driven by sustained buying from Smart Money.

Sure enough, after the bearish divergence signal appeared, PYPL’s price turned south again, falling back below $60. Those who chased the stock above $65 once again became fresh fuel for the downward channel.

Conclusion: What is a “Value Trap”? PYPL is the perfect specimen of a “Value Trap.” On a fundamental basis, it looks incredibly cheap. But on a technical basis, it is a powerless aircraft in a slow, downward spiral. Its structure is broken, and market confidence has collapsed. Until the chart shows a clear, multi-month bottoming formation (e.g., a solid double bottom or an inverse head and shoulders, confirmed by a high-volume breakout above key resistance), any purchase made based on the idea that it’s “cheap” is an attempt to catch a falling knife.

Forget the P/E Ratio. When a stock is in such a clear, long-term downtrend, its only valuation is “lower.” The chart is your only guide to safety.

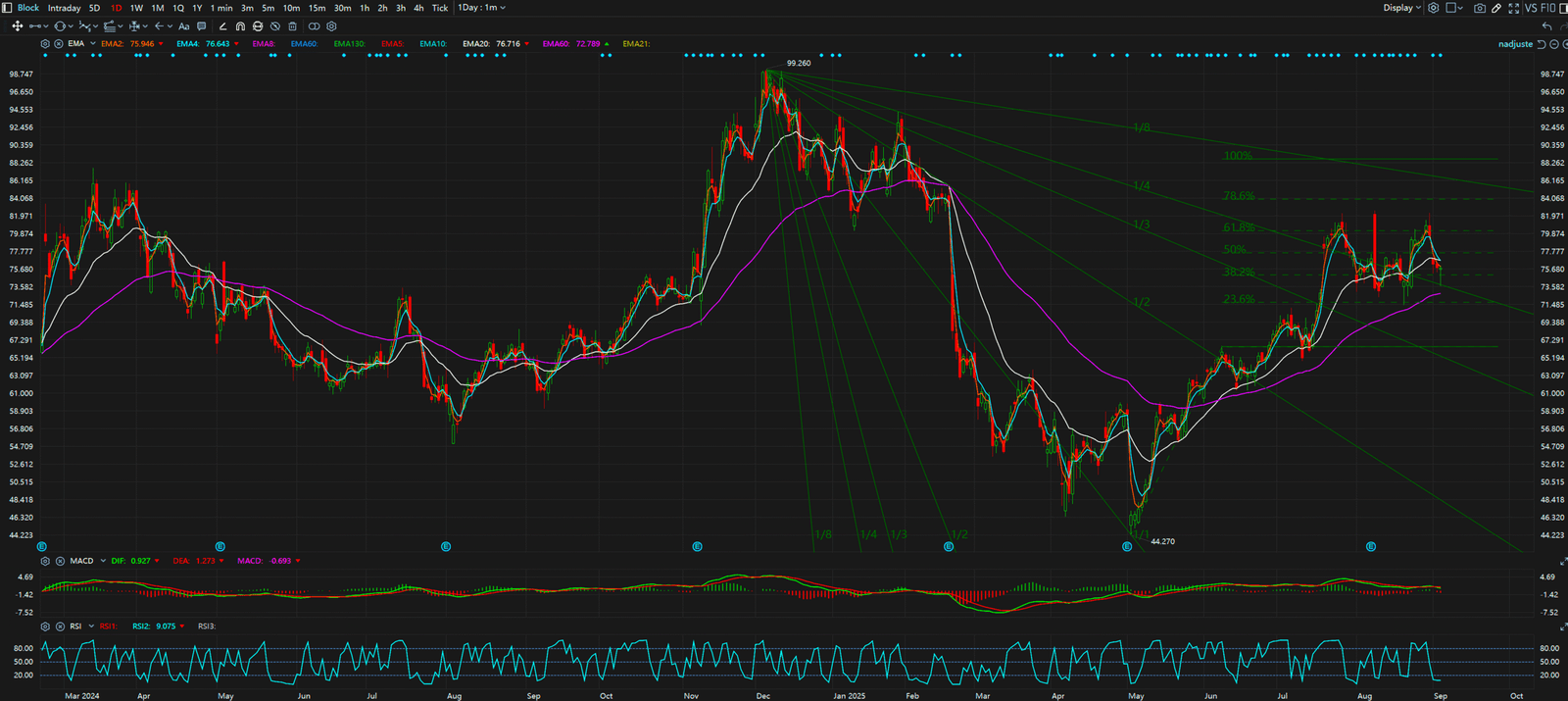

If PYPL is a frog being slowly boiled, then Block (formerly Square) is a heart-attack test. Its stock is famous for its violent swings, attracting countless speculators seeking high returns. The commentary from fundamental analysts is full of contradictions: they praise the incredible growth of its Cash App and its “forward-thinking” bets on Bitcoin, while simultaneously expressing concern over its unstable profitability and aggressive investment strategies.

This kind of ambiguous analysis is useless to a trader. It only leaves you paralyzed in a state of “want to buy, but afraid it will fall.” Now, let’s use the scalpel of technical analysis to cut open SQ’s unpredictable heart and see what’s really inside.

1. The Life-and-Death Flip of Support and Resistance: In the world of technical analysis, nothing reveals the shift in market psychology more powerfully than a “support-resistance flip.” A once-solid support level, tested multiple times, becomes a formidable resistance ceiling for future rallies once it has been decisively broken.

Let’s focus on the $85-90 price zone on SQ’s chart. For most of 2022, this area acted as a life raft, repeatedly saving the stock from the abyss. Every time the price fell to this level, a flood of buying would emerge, and fundamental investors would cheer, “See, this is a solid bottom!”

However, this all came to an abrupt end in late 2022. As the macroeconomic environment tightened and market risk appetite plummeted, SQ’s price decisively shattered this “lifeline” with a massive bearish candle. From that moment on, the rules of the game changed completely.

In the subsequent years, 2023 and 2024, SQ attempted to rally back to this zone several times. But do you see what happened? Each time, as the price approached $85, it was as if it hit a thick glass ceiling, followed by an even deeper decline. The former “life raft” had now become an “iron coffin lid,” suppressing all hope.

Why? Because the investors who bought above $90 and failed to cut their losses when the support broke have had their psychology shift from “greed” to “prayer.” Their only wish is for the price to get back to their entry point so they can escape the nightmare. Therefore, any rally towards the $85-90 zone triggers their break-even selling, which in turn kills the rally.

Fundamental analysis cannot explain this phenomenon. It will only tell you about the company’s latest acquisition or Jack Dorsey’s latest bold statement on Bitcoin. But the $85 line on the chart coldly tells you: the power structure of the market has been inverted, and the bears have conquered this high ground.

2. The 200-Day Moving Average: The Bull-Bear Demarcation Line For a high-beta growth stock like SQ, the 200-day moving average (200-day MA) is like its vital signs monitor. This line is simple, intuitive, yet incredibly powerful.

Look at SQ’s chart. During the great bull market of 2020-2021, the price was flying high above the 200-day MA. But in late 2021, the price fell off a cliff, breaking below the line. Since then, this line has transformed from “support” to “suppression.” Over the past two-plus years, nearly every major rally in SQ has ended upon touching or briefly piercing the 200-day MA.

This line is like the palm of Buddha’s hand; no matter how much the Monkey King (the stock price) struggles, it cannot escape. It has defined SQ’s bear market structure with almost mechanical precision. While fundamental analysts are still debating its “long-term value,” this simple line has already provided the clearest answer: as long as the price cannot decisively reclaim and stay above a rising 200-day MA, any rally must be treated as mere noise in a bear market.

3. The Volatility Contraction Pattern (VCP) Trap: The VCP, a concept popularized by legendary trader Mark Minervini, is a powerful tool for identifying potential breakout points. It describes a period of consolidation where volatility and volume gradually decrease, often a sign that Smart Money is quietly accumulating shares.

However, this tool can also be used in reverse to identify “fakeout” traps. In early 2024, SQ’s price formed what looked like a beautiful VCP in the $60-80 range. Volatility tightened over several weeks, and many technical traders were rubbing their hands, ready for the upward breakout.

But a true professional would ask one critical question: Where is the volume?

In a healthy VCP accumulation, the subsequent upward breakout MUST be accompanied by a significant expansion in volume. This confirms the commitment of big money. But in SQ’s breakout attempt, the volume was unusually anemic. Although the price briefly spiked above $85, it felt weak and labored, like a rocket with no fuel.

This was a classic “bull trap.” It is often designed to lure in the last batch of retail chasers, allowing institutions to complete their final distribution. Unsurprisingly, after a brief moment of euphoria, the price quickly reversed and fell below the low of the entire consolidation range, triggering a new leg down.

Did the fundamentals change during that time? No. The company’s story was the same story. But the details of the volume on the chart gave away the fraudulent nature of the breakout in advance. This is the microscopic power of technical analysis; it allows you to see the subtle, internal market dynamics that a fundamental analyst will never observe.

SoFi Technologies, the company that started with student loans and dreams of becoming a “one-stop-shop for digital finance,” is one of the most popular “meme stocks” among retail investors in recent years. Its CEO, Anthony Noto, is a master of painting a grand vision. Every earnings call feels like an inspiring speech, filled with exciting terms like “member growth,” “product synergy,” and “profitability inflection point.”

Fundamental believers are completely sold on this story. They believe that as long as SoFi’s user base continues to grow and its profit margins improve after obtaining a bank charter, a soaring stock price is just a matter of time. They cheer each other on in online forums, mocking aissenters as “dinosaurs who don’t understand the new era.”

Tragically, the market doesn’t care how beautiful the story is. Let’s turn off Noto’s speech and open SOFI’s heartbreaking daily and weekly charts.

1. The “Destiny” Since Going Public: A Series of Lower Highs Since its debut in 2021, SOFI’s stock chart has one very prominent feature: a series of lower highs.

This simple set of numbers paints an irrefutable picture of a downtrend. It tells us that every time market sentiment reached a fever pitch, every time “good news” was released, the end result was the force of sellers overwhelming the buyers, pushing the price to a lower peak than the last.

It’s like a mountaineer who, after every arduous climb, slips back down due to lack of oxygen to a point lower than where he started. No matter how much his guide (the CEO) encourages him, no matter how excellent his equipment (the fundamentals) appears to be, the fact that he is slowly descending the mountain cannot be changed.

A fundamental analyst will spend countless hours analyzing SoFi’s loan quality, net interest margin, and non-interest income. But all of this complex analysis cannot overturn this simple, brutal observation on the chart: the big money in the market is using every rally to systematically unload their SOFI shares.

2. The Curse of the “Gap” Theory: On a candlestick chart, a “Gap” holds special significance. It represents an extreme, overnight shift in market sentiment. Downward “Breakaway Gaps” and “Continuation Gaps” are particularly ominous; they are like milestones on the road of a bear market.

Reviewing SOFI’s chart, you’ll find it is littered with downward gaps. The most fatal of all was the massive gap that appeared in May 2022, right around the $8 level. At the time, the company released a seemingly decent earnings report but simultaneously lowered its full-year guidance. The market’s reaction was catastrophic. The stock gapped down at the open and has never filled that gap since.

According to technical analysis theory, while “gaps always get filled” is a common saying, a more accurate statement is that the gap itself constitutes powerful resistance or support. That huge gap near $8 is like a permanent crack in the ceiling of SOFI’s stock price. For a long time to come, whenever the price attempts to rally back to that area, it reawakens the market’s painful memory of that “betrayal,” triggering a wave of selling.

In the several rallies of 2023 and 2024, the price repeatedly faltered and turned back after approaching or briefly touching this gap zone. The fundamental believer cannot understand this: “Why? Isn’t the user growth fantastic?” The answer is that the chart has a memory. The market’s collective trauma is not easily erased by a new earnings report.

3. The True Intent of Consolidation: Distribution or Accumulation? From the second half of 2023 into 2024, SOFI’s price has been in a prolonged period of sideways consolidation, mostly between $6 and $10. Fundamental investors call this “basing” or “building a bottom.” They see it as the calm after the storm, a time for gathering strength for the next leg up.

This is a fatal misunderstanding. A sideways range can be either “Accumulation” or “Distribution.” How do you tell the difference? The key is to observe the characteristics of the price action within the range and the corresponding volume response.

The legendary technical analyst Richard Wyckoff provides us with the perfect framework. A healthy accumulation range is characterized by:

Now, compare this to SOFI’s action. What do we see?

All of this points to one conclusion: the primary purpose of this multi-month consolidation is likely not “Accumulation,” but “Re-distribution.” Institutional players are using SoFi’s appealing growth story to leisurely transfer their remaining shares, at a relatively favorable price, into the hands of fantasy-filled retail investors.

What happens after this distribution process is complete? The answer is self-evident. Once the underlying support is removed, the price will seek its next, lower point of equilibrium.

We have just dissected three companies: PYPL, a fallen angel wrapped in a cloak of “value”; SQ, a sick patient repeatedly rejected by a critical resistance level; and SOFI, a “meme stock” whose distribution reality is masked by a grand narrative.

Their fundamental stories are all different. One talks of “value reversion,” another of a “Bitcoin future,” and the third of “user growth.” But their charts, in unison, compose a symphony of selling, distribution, and collapsing confidence.

This symphony has three core movements:

Your Choice – The Rearview Mirror or the Map?

Now, the choice is yours.

You can continue to live in the illusion of fundamentals. You can keep reading the “research reports” meticulously crafted by company PR departments and investment bank analysts. You can keep cheering for a few percentage points of revenue growth after an earnings release while ignoring the steady decline of the stock price. You can continue to be the driver who stares at the rearview mirror, completely unprepared for the sharp turn and the cliff just ahead.

Or, you can make a radical change.

You can choose to trust your eyes, not your ears. You can choose to trust the indelible tracks left by the market—price and volume—instead of the stories that can be edited and embellished at any moment. You can choose to pick up the only accurate market map, technical analysis, and learn to identify the traps, find the path, and take control of your own trading destiny.

Forget the clichés about “long-term holding.” In the wrong structure and trend, “long-term holding” is just a euphemism for “long-term suffering.” True wisdom is knowing when to enter and when to exit, and the only source for that signal is the chart itself.

The next time you hear someone excitedly discussing a company’s “disruptive potential” or “undervalued assets,” just smile, and then silently open its stock chart. Because you know that the market’s truth is never hidden in an Excel spreadsheet or a press release. It is carved into the rise and fall of every single candlestick, waiting for those who truly know how to read it.

This is the difference between science and voodoo. This is the difference between the professional and the amateur. This is the difference between the winner and the loser.

Welcome to the real world of technical analysis.

參考資料:

Daily Timeframe – Paypal (PYPL)

Daily Timeframe – Block (SQ)

Daily Timeframe (SOFI)