Look for the cause. The effect will take care of itself.

William Delbert Gann – 1923

Date: Dec 31, 2025 | Time: 23:45 EST | Source: Institutional Desk

Can you feel it? That suffocating tension in the air.If you think 2026 was just “another year,” you have already lost half the battle.Listen to me: The world doesn’t evolve linearly; it evolves in jumps. We are currently standing in the final window before “Class Calcification” sets in. The Wall Street whales, the Silicon Valley elites— they aren’t gambling. They are moving wealth. They are shifting assets from the “Old World” to the “New Paradigm.”

People say the market is expensive? That’s a joke. When productivity experiences geometric growth due to AI and Nuclear energy, old P/E valuation models become wastepaper. 2026 isn’t about “investing.” It’s about “Storming the Beach.”This article isn’t for retail tourists looking for lunch money. If you are 18 to 35, hungry to shatter your family’s financial ceiling, and obsessed with FIRE (Financial Independence, Retire Early), these 5,000 words are your weapon.

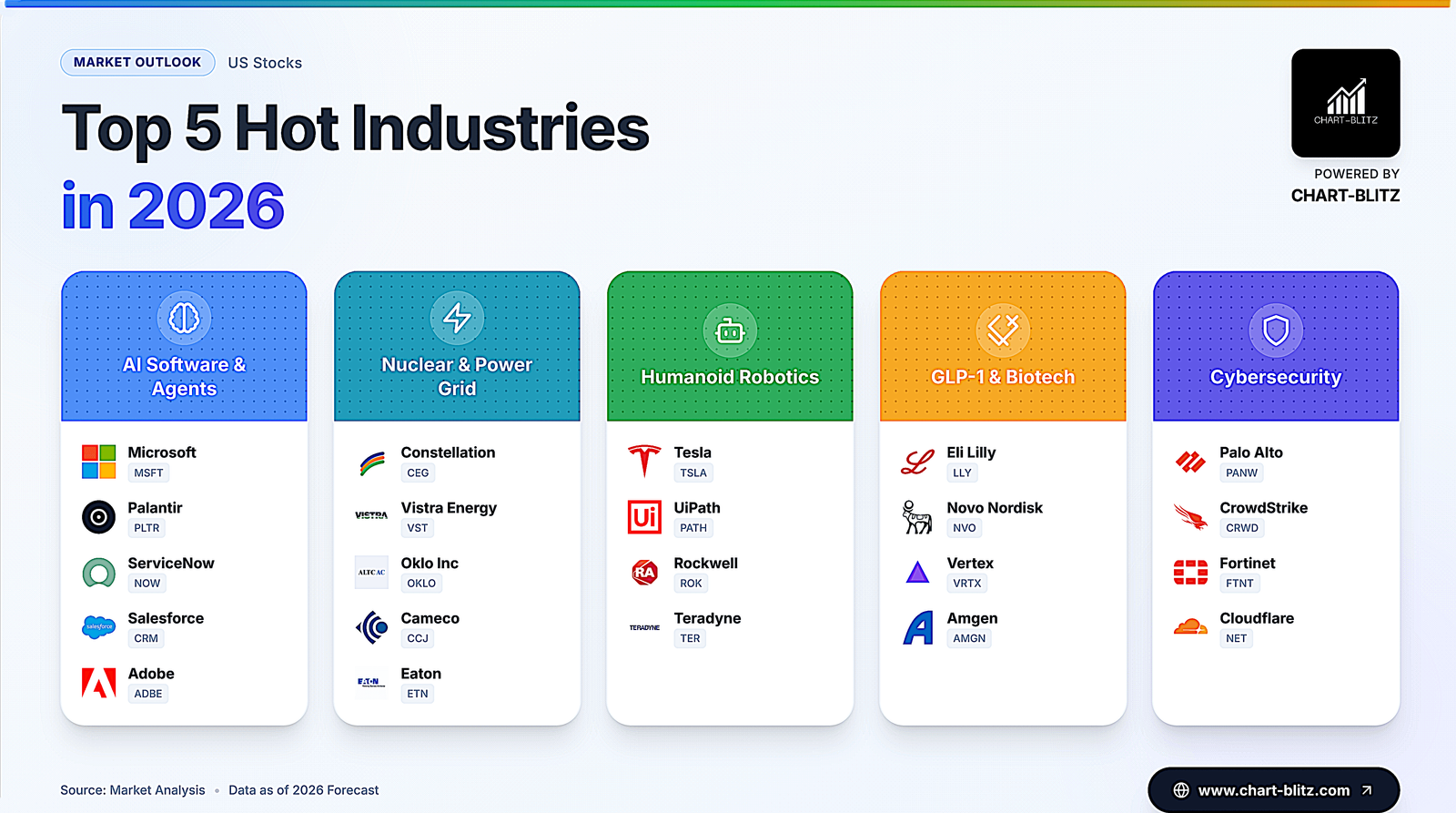

I have dissected 5 Alpha Sectors and 22 Specific Tickers. First, I will give you “Institutional Grade Fundamental Intelligence.” Read this, and you will become the macro expert in your friend group—you will understand the physics of money flow. Then, the Charts. Because fundamentals tell you what to buy, but technicals tell you when to strike. Welcome to the Real World.

The Top Hottest Industry: AI Software & Agents (The Brain)

You need to understand the cycle. 2024-2025 was the “Infrastructure Phase”—all the money went to NVDA to buy the shovels. But 2026 is the “Application Phase.” There is a massive capital rotation happening right now: The CAPEX to OPEX Shift.

- The Macro Logic:

According to Gartner’s Q4 2025 Global IT Spending Forecast ($CITE_1), the AI budget structure of Fortune 500 companies has undergone a metamorphosis. For the past two years, CFOs blindly approved massive GPU hardware purchases—this is CAPEX (Capital Expenditure). It’s heavy, one-time, and depreciating. But in 2026, Boards are demanding ROI. Capital is now flowing into OPEX (Operating Expenditure)—recurring software subscriptions that replace human labor immediately. This leads to a massive release of Operating Leverage for software companies. As Inference Costs plummet, Software Gross Margins are set for a historic expansion. - The Tech Pivot: Agentic AI:

This is the vocabulary you need to dominate conversations: Agentic AI. Old AI was a Chatbot (Input -> Output). 2026 AI is an Agent (Goal -> Autonomy). This changes the B2B pricing model from “Per Seat” to “Outcome-based.” Whoever owns the enterprise Workflow and Proprietary Data possesses the ultimate Data Gravity. Once an enterprise integrates an Agent, the Switching Cost becomes infinite.

You feel smart now, right? You understand the macro. But remember: Logic doesn’t make you rich. Execution does. The market is full of traps. Even the best companies can wreck your portfolio if your timing is garbage. Look at the charts!

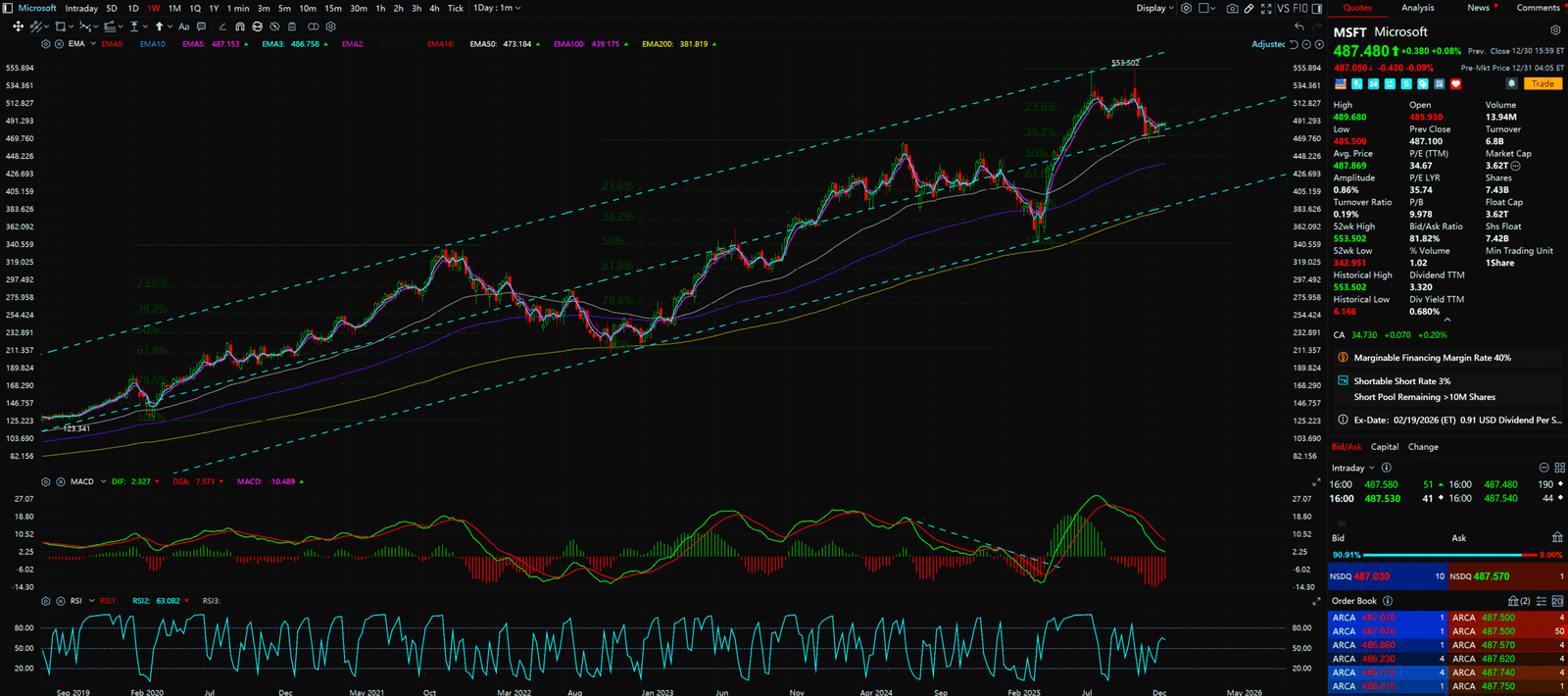

1. MSFT (Microsoft) – The Whale’s Breath

- Pattern: Ascending Channel (Slow Grind)

- MSFT is moving in an extremely standard, moderate ascending channel. The moving averages (EMA 20/50/200) are perfectly aligned. This is textbook Institutional Accumulation. The big boys are suppressing the price with algos to fill their bags without spiking the volatility.

- Action: Buy Zone is at the channel midline or near the EMA 50 (460−470). Stop loss below $440. This is a “sleep well at night” hold.

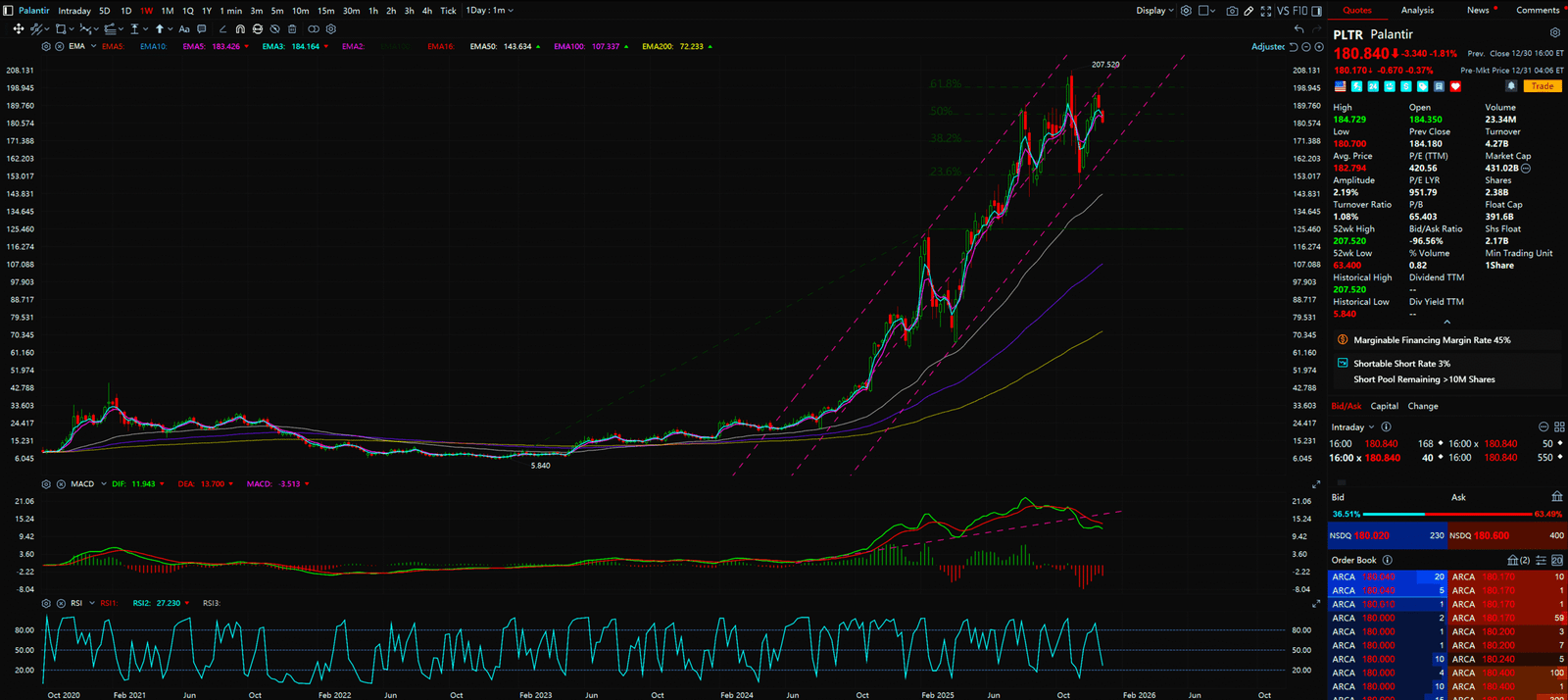

2. PLTR (Palantir) – Cooling the Parabola

- Pattern: High Tight Flag

- PLTR went Parabolic recently. Now, it is consolidating sideways at the highs. This is not a top; this is a Bull Flag. The fact that it refuses to drop proves selling pressure is nonexistent. The float is locked.

- Action: Wait for a breakout above the flag’s upper rail at $208 accompanied by a Volume Spike. Do not front-run. If it backtests the EMA 20 and holds, that is a secondary entry.

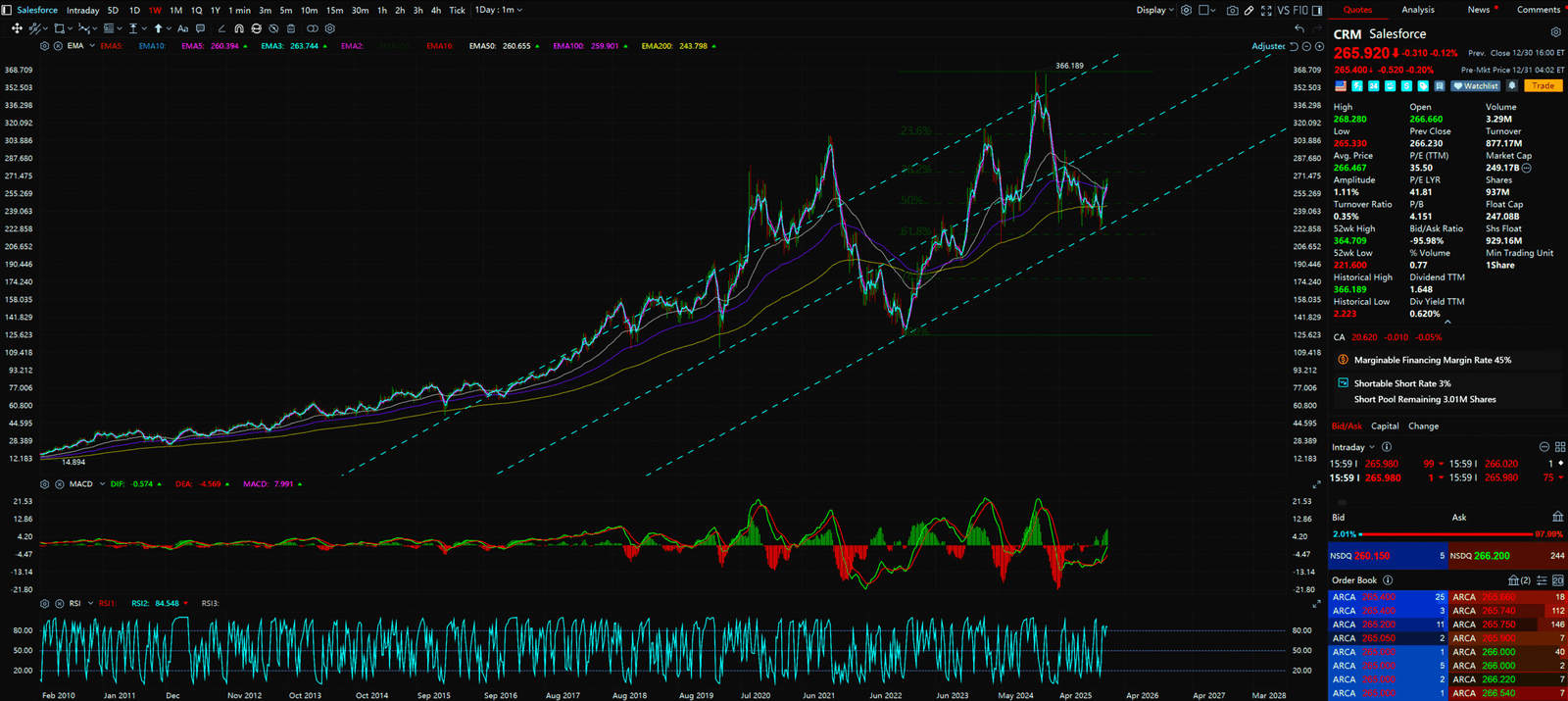

3. CRM (Salesforce) – The Value Rotation

- Pattern: Cup and Handle Breakout (Backtest)

- CRM completed a massive multi-month Cup and Handle and has broken the neckline. It is currently in the Backtest Phase. This is one of the safest entries in technical analysis—Resistance turned Support.

- Action: Enter at market price. Stop loss 3% below the neckline.

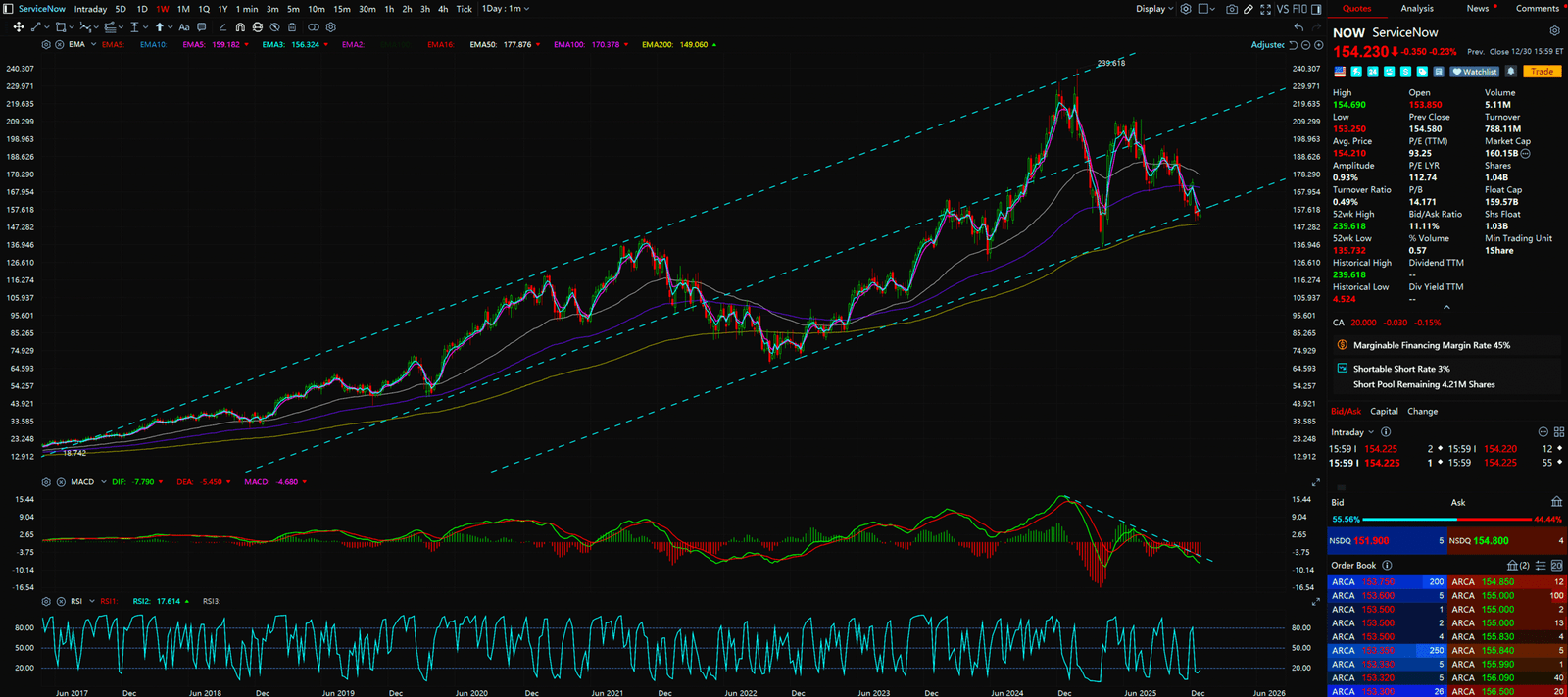

4. NOW (ServiceNow) – Relative Strength King

- Pattern: 45-Degree Trendline

- NOW’s chart is pristine. It rides a 45-degree trendline. Even when the SPY dips, NOW refuses to sell off. This shows massive Relative Strength.

- Action: As long as the long-term trendline holds, every touch is a Dip Buy opportunity.

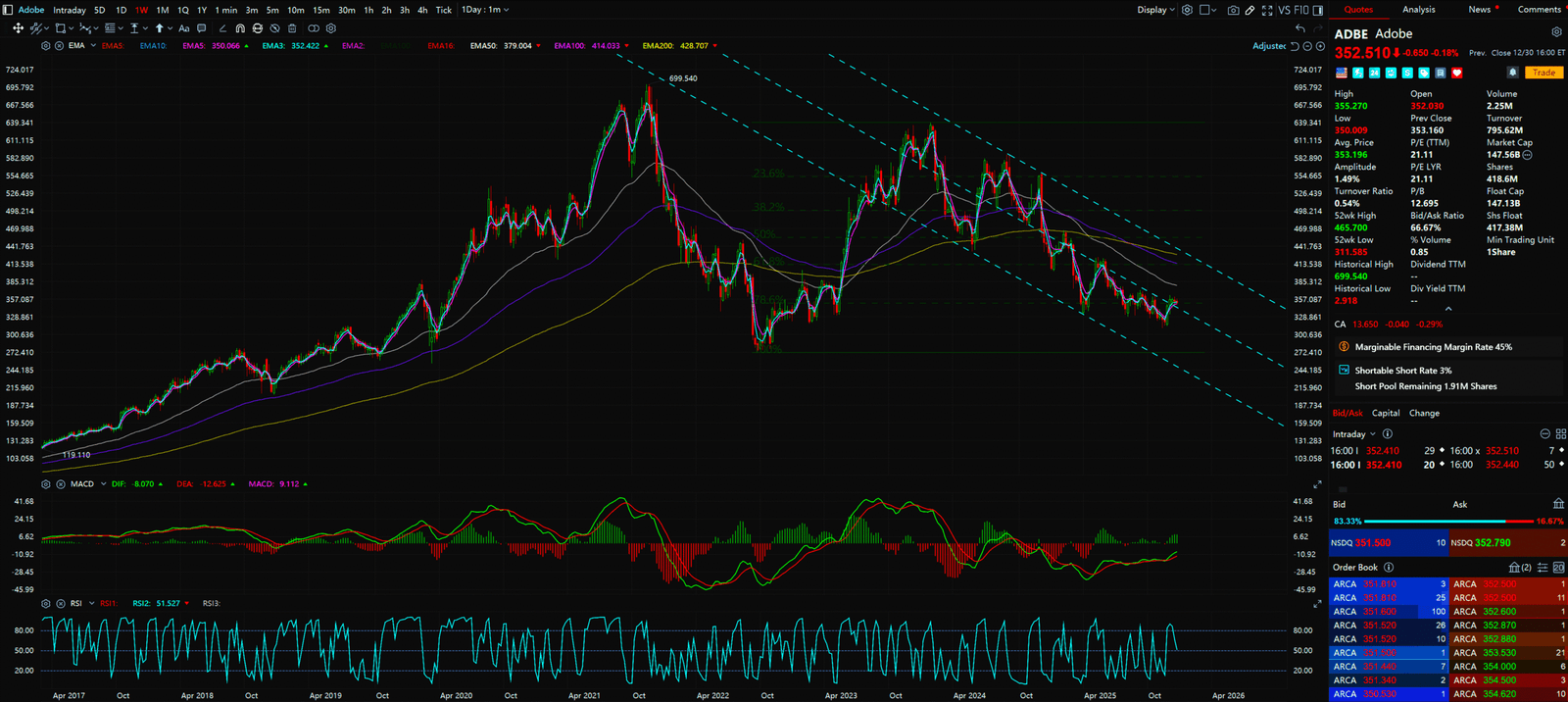

5. ADBE (Adobe) – Creative Monetization

- Pattern: Rounding Bottom / Falling Wedge Breakout

- ADBE was punished due to AI fears, but the chart shows a clear Base Building process. It recently broke out of a Falling Wedge with RSI Divergence. The market is repricing the Firefly model revenue.

- Action: This is a Reversal Play. Confirm support above the EMA 200 and enter. Target the gap fill above.

The Runner-Up Industry: Nuclear & Power Infrastructure (The Lungs)

The physical limit of AI isn’t chips; it is Power. Memorize this formula: Computation = Energy.

- The Energy Deficit:

According to the U.S. Department of Energy (DOE) 2025 report ($CITE_2), Data Center power consumption is projected to hit 9% of total US generation by 2027 (up from 4%). This geometric growth is colliding with an aging US grid (40+ years old), creating a massive Supply/Demand Mismatch. - The Nuclear Moat:

Why Nuclear? Explain this to your friends: Solar and Wind are Intermittent. AI training requires 99.999% uptime—this demands Baseload Power. Nuclear is the only scalable, zero-carbon baseload solution. The Repricing Event: Wall Street is currently re-rating nuclear operators (like Constellation) from “Boring Utilities” (15x PE) to “AI Growth Tech” (30x PE). This Valuation Reset is a once-in-a-decade event. - Grid Supercycle:

Beyond generation, the lead time for transformers and switchgear (Eaton) has extended from 12 months to 36 months. We are in a Grid Supercycle.

The fundamentals are bulletproof, but the charts are “Hot.” For Momentum Stocks, we don’t care about P/E ratios. We care about Trend Strength. Do not fight the trend.

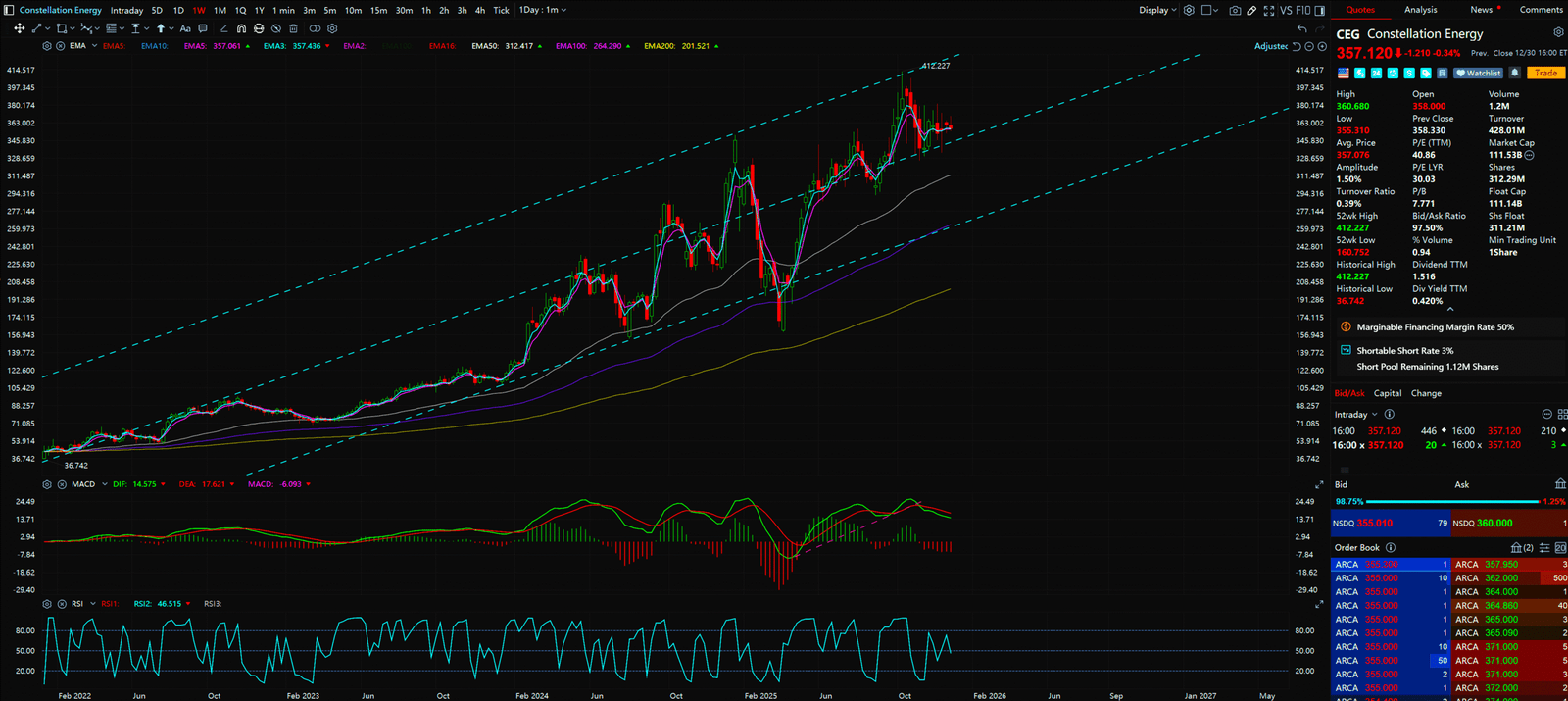

6. CEG (Constellation Energy) – Alpha Leader

- Pattern: Steep Ascending Channel

- CEG has a steep slope, indicating Institutional FOMO. The price hugs the EMA 10 and EMA 20 perfectly.

- Action: Trend Following. Do not try to short the top. Place limit orders near the EMA 20. If it closes below the EMA 50, take profit immediately.

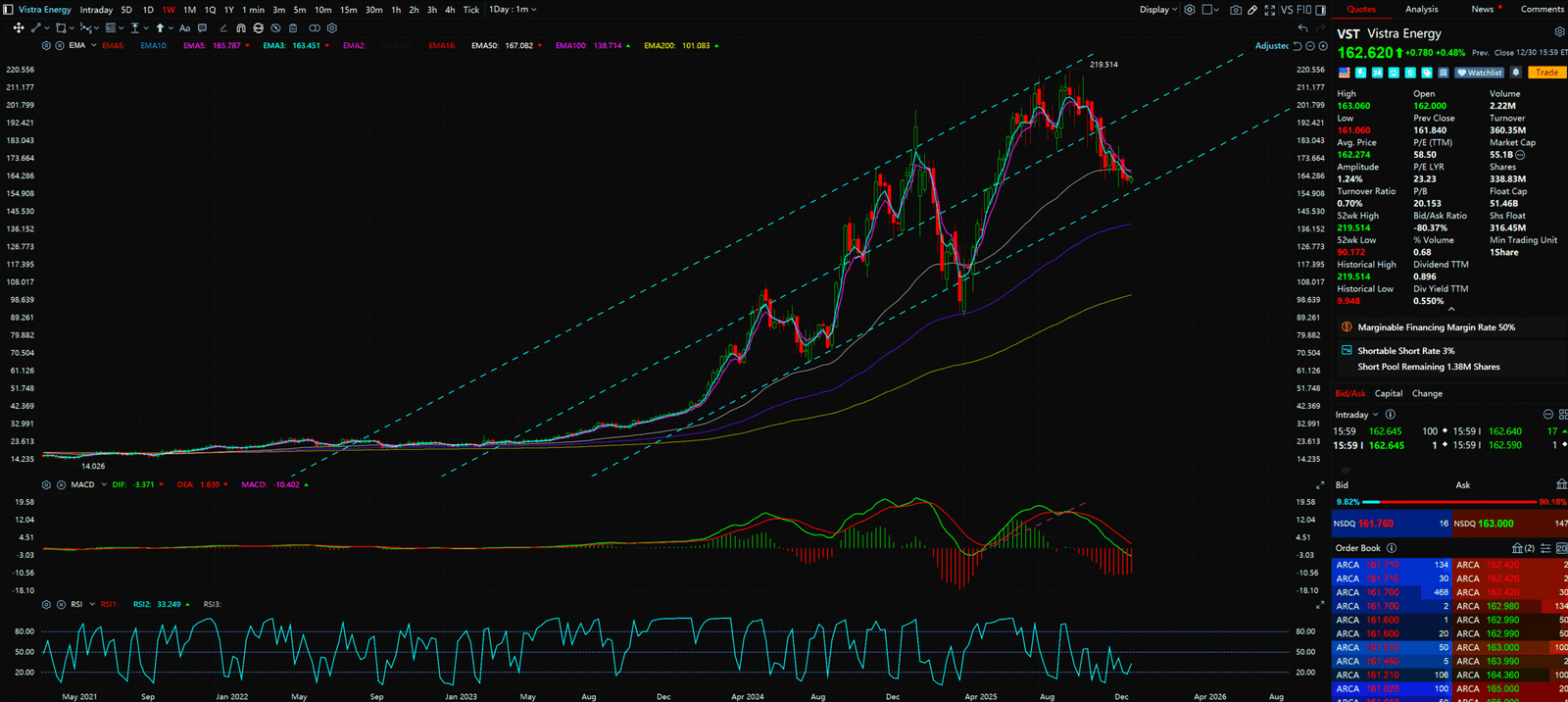

7. VST (Vistra) – Momentum Twin

- Pattern: High Momentum Grind

- Identical structure to CEG. Volume Confirmation is strong. Every Red Candle Pullback is engulfed within 2-3 days.

- Action: Ride the EMA 20. Use a Trailing Stop because when these momentum trades break, they break hard.

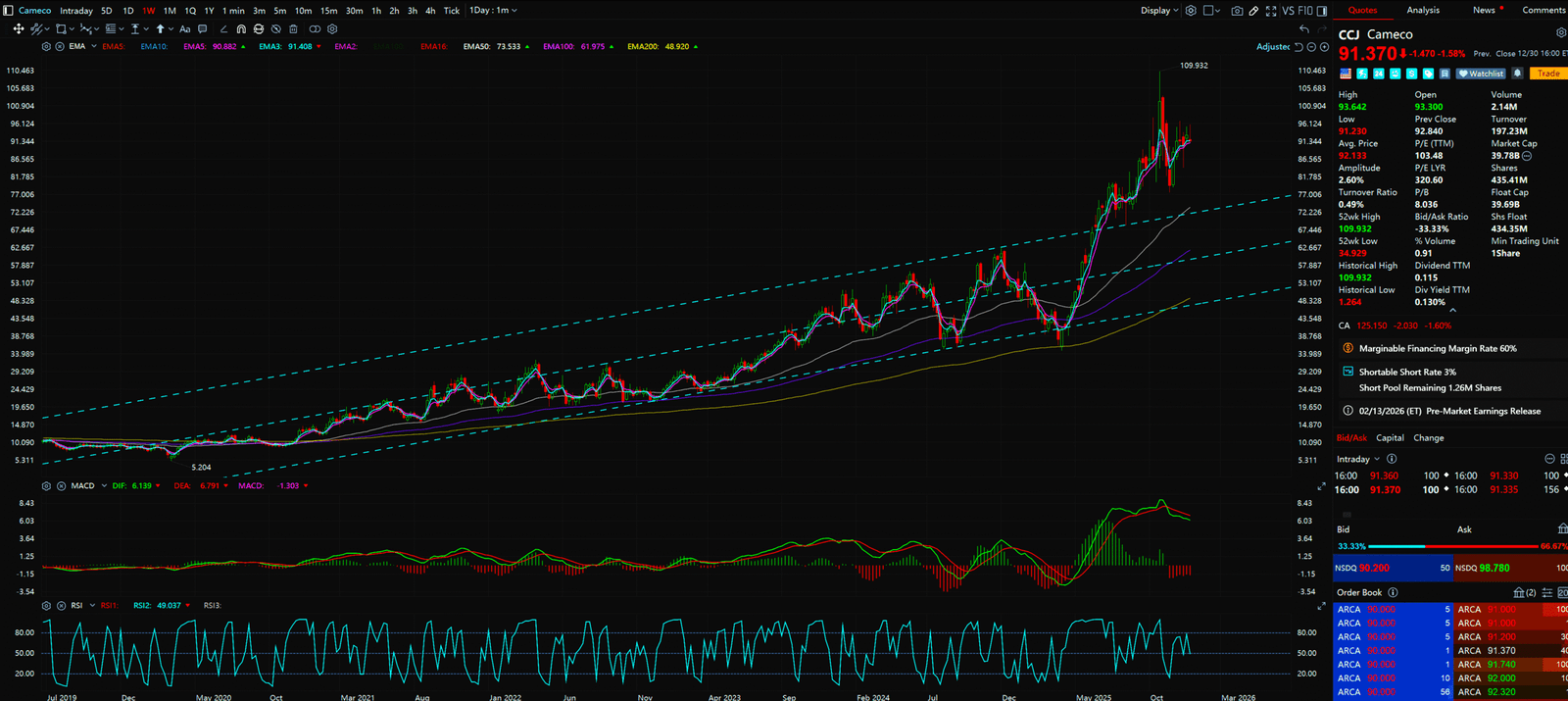

8. CCJ (Cameco) – The Commodity Squeeze

- Pattern: Step-Up Formation

- CCJ (Uranium miner) moves in steps. Rally -> Consolidate -> Rally. It tracks the Uranium Spot Price.

- Action: Currently at the top of a consolidation box. Buy on the breakout of previous highs.

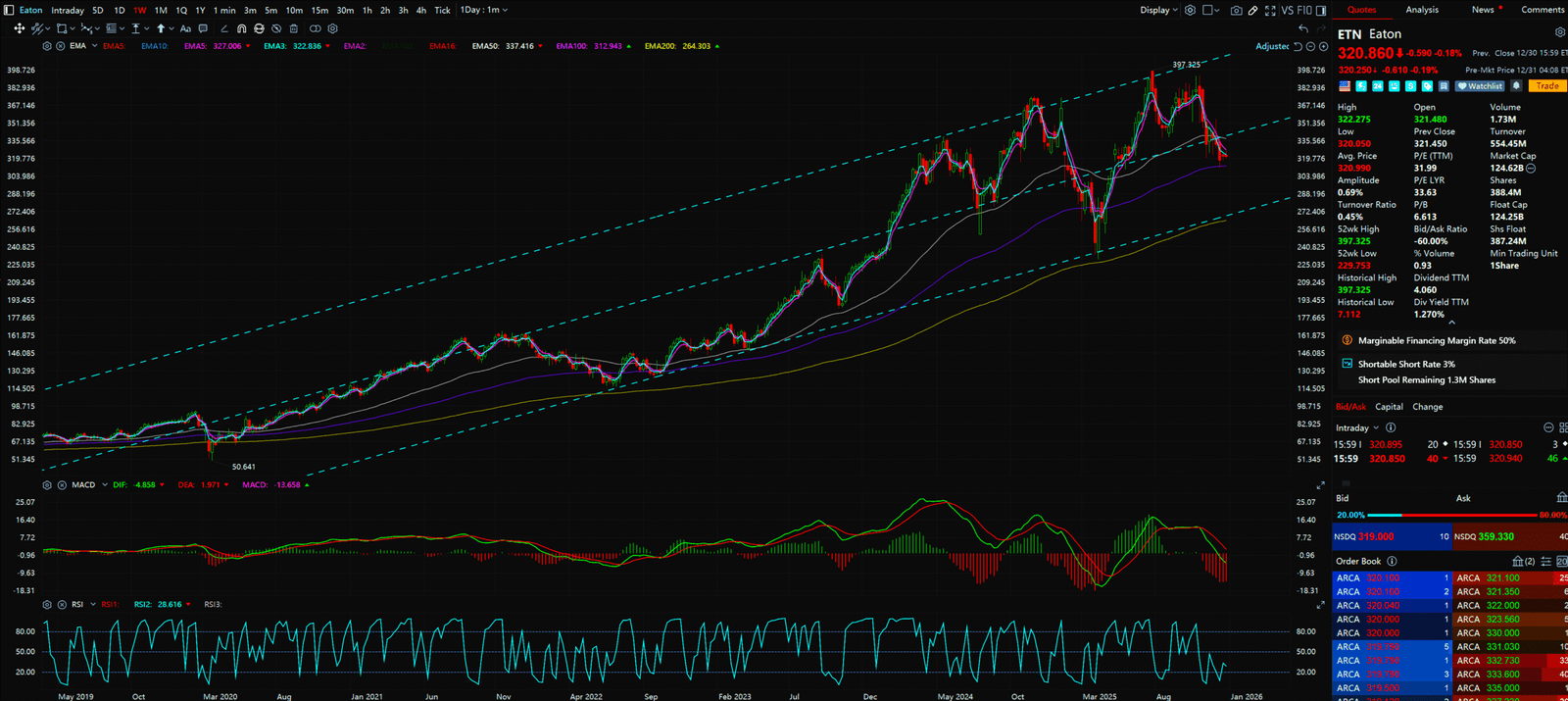

9. ETN (Eaton) – The Compounder

- Pattern: Slow & Steady Uptrend

- Not as steep as CEG, but incredibly stable. Moving averages are fanning out (Bullish alignment).

- Action: Suitable for larger position sizing. Hold as long as it stays above EMA 100.

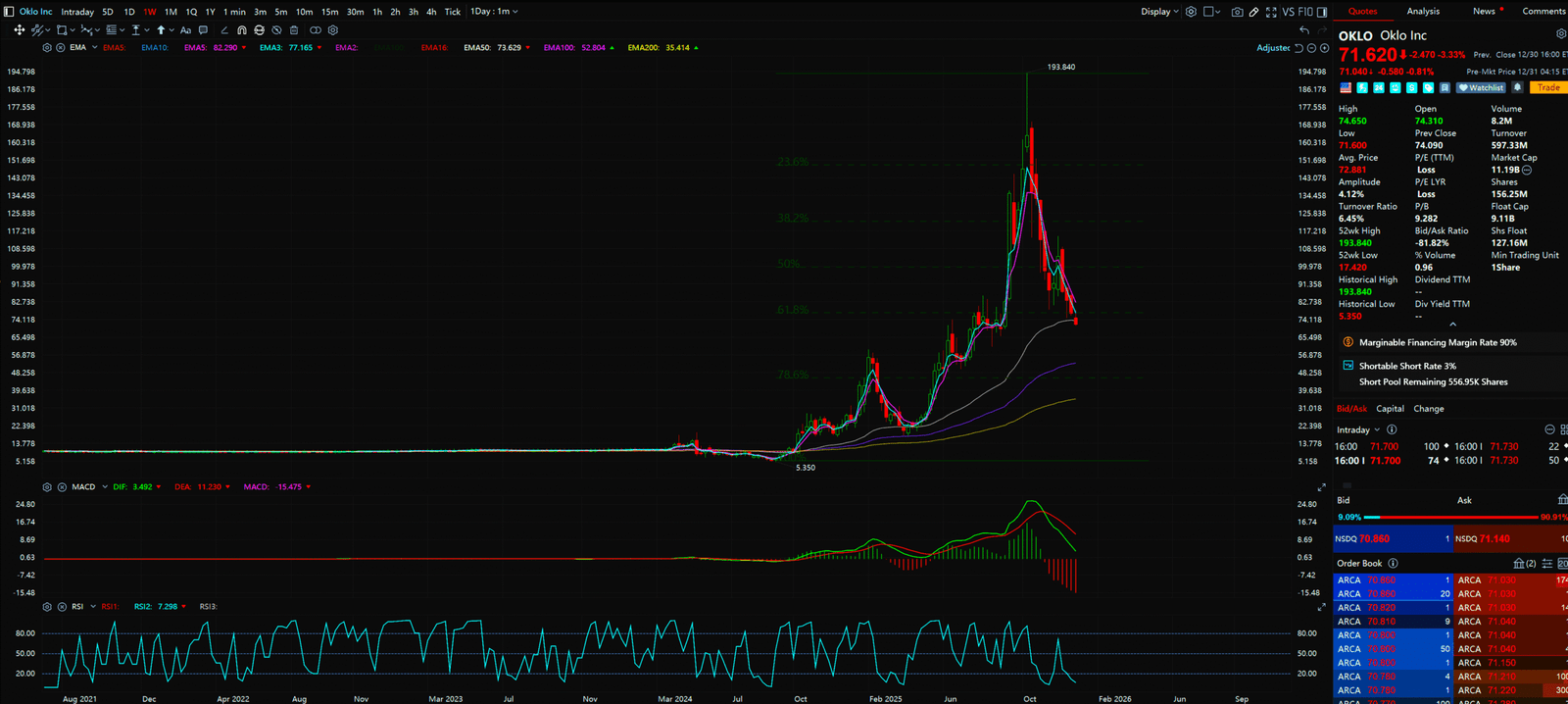

10. OKLO (Oklo Inc.) – The Gambler’s Table

- Pattern: Bottoming Process / W-Pattern

- OKLO is a SPAC. It had the classic “Pump and Dump.” Now, Volume is Drying Up at the lows, forming a W-Bottom. Risk: High Beta Speculation.

- Action: Only enter if it breaks the Neckline at $25. Target is a double. Stop loss must be tight.

The Third Most Popular Industry: Humanoid Robotics (The Hands)

Why Robotics now? Because Demographics are destiny. The developed world faces a structural labor shortage. The core concept here is Unit Labor Cost.

- The $20k Milestone:

A US blue-collar worker costs 60k−80k/year (with benefits). Tesla’s Optimus target BoM (Bill of Materials) is $20k. This implies an ROI < 6 Months. Once the tech is proven, adoption isn’t “innovative,” it’s “survival.” - From Demo to Deployment:

Morgan Stanley predicts that 2026 is the year robots move from YouTube Demos to Factory Floors. This is a race for Real-world AI Data. Whoever has the most robots deployed learns the fastest. - Reshoring:

The US wants to “Re-industrialize,” but there are no humans to do the work. Automation (Rockwell, Teradyne) is the only answer to this secular trend.

This is the most volatile sector. These stocks move like crypto. You will get shaken out if you have weak hands. Volatility is the price you pay for performance.

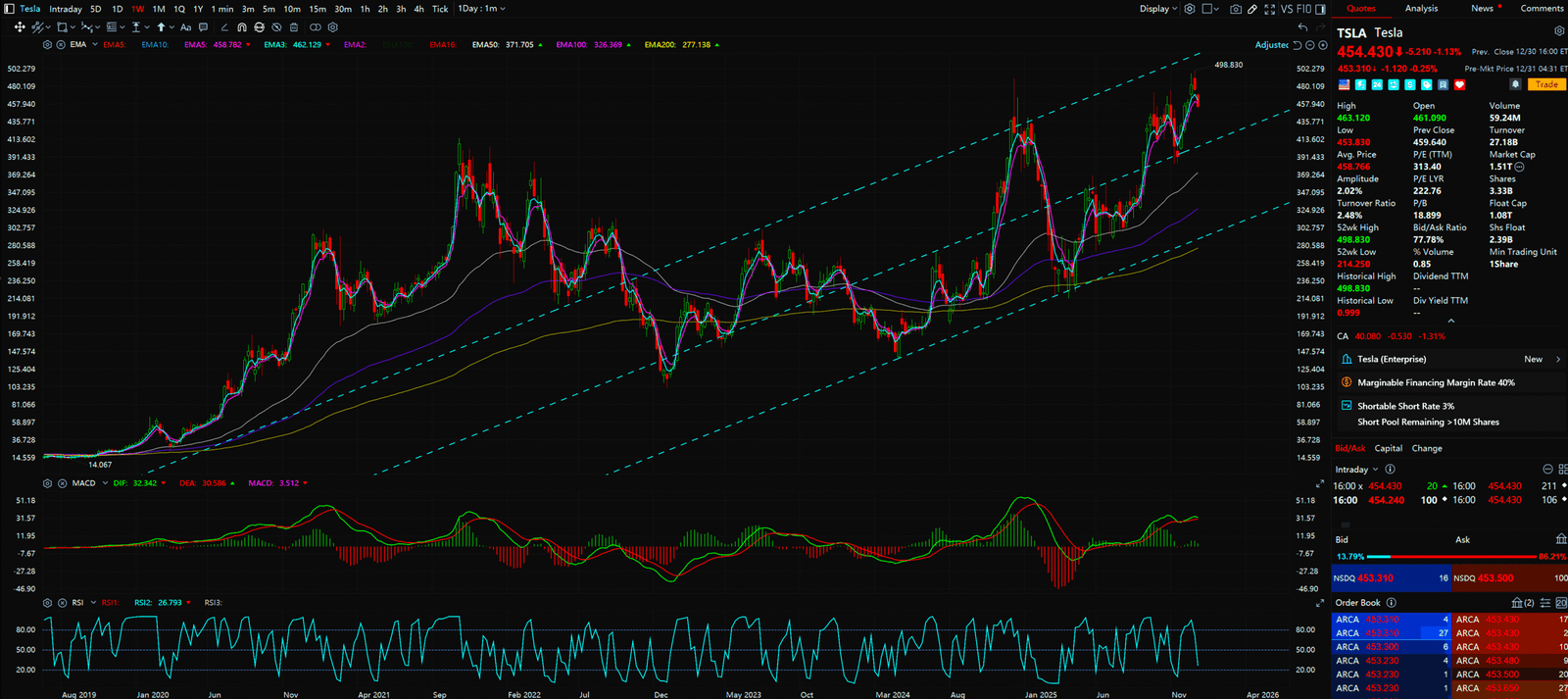

11. TSLA (Tesla) – The King of Volatility

- Pattern: Ascending Broadening Wedge

- TSLA broke the multi-year downtrend and is now in a Broadening Wedge. Higher Highs and Lower Lows indicate massive disagreement between Bulls and Bears.

- Key Level: $400 is massive Structural Support (Resistance turned Support).

- Action: Wait for the pullback to the 380−400 zone. Do not chase. If it breaks $500 with volume, blue skies to $600. Watch for RSI Divergence.

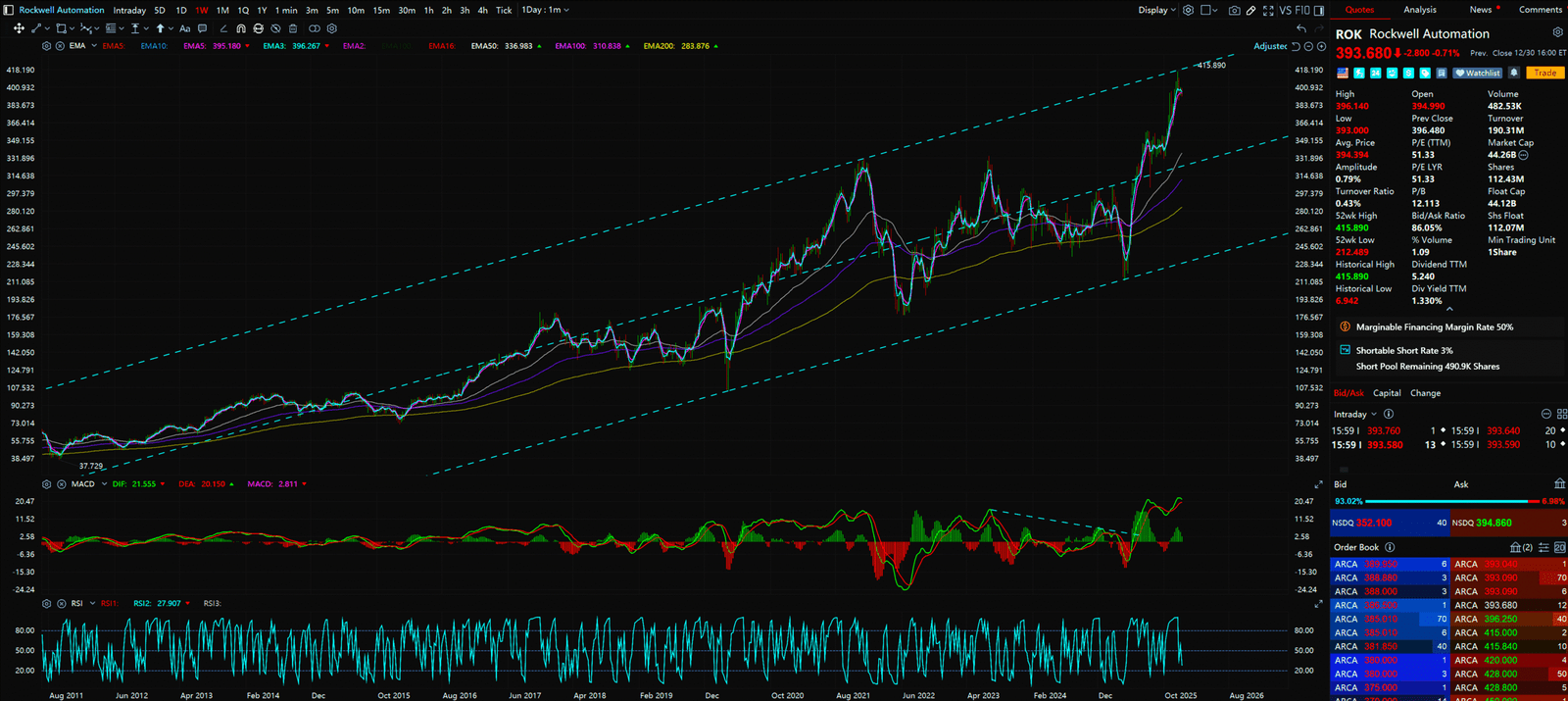

12. ROK (Rockwell Automation) – Legacy Industrial

- Pattern: Slow Recovery Trend

- ROK is slower. It is emerging from a long consolidation.

- Action: Defensive play. Stop loss below EMA 200.

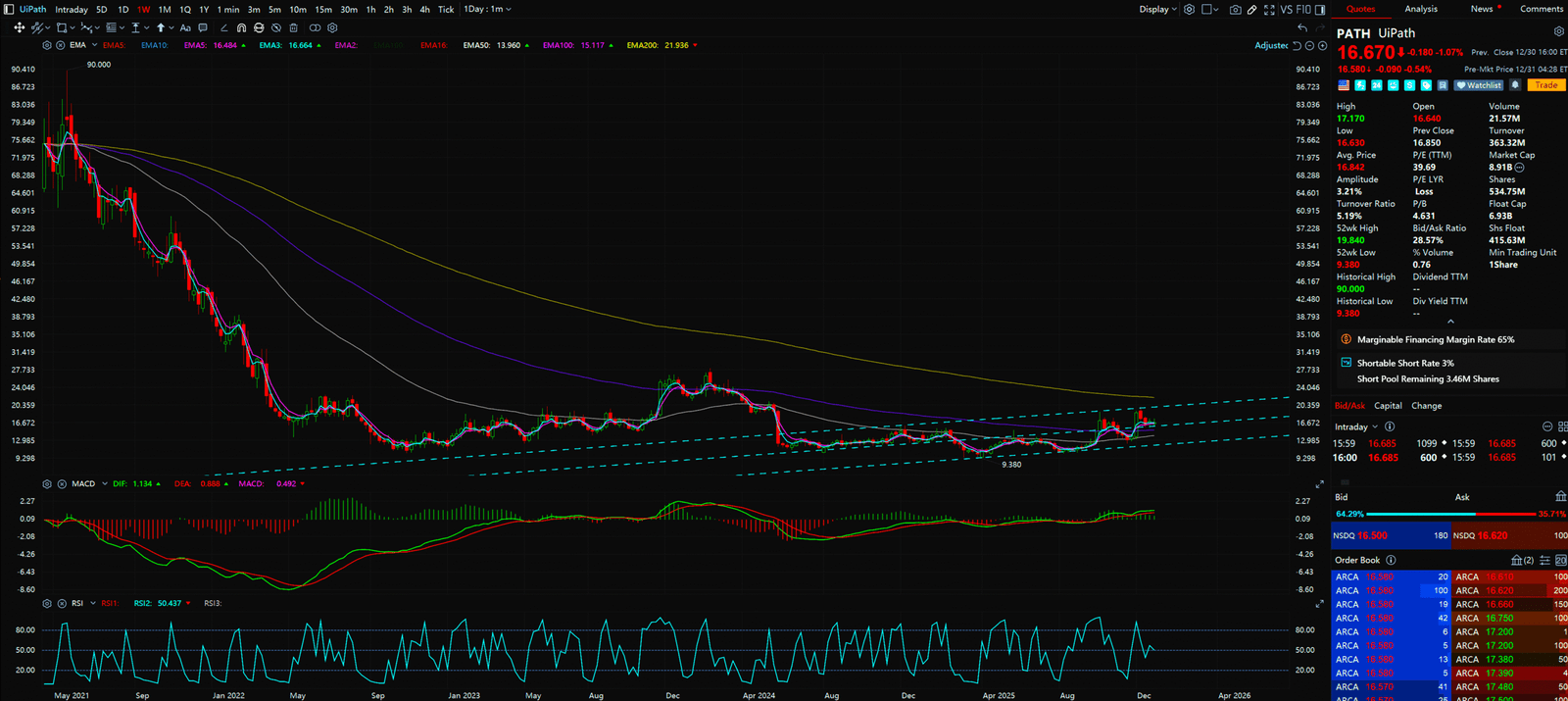

13. PATH (UiPath) – Software Automation

- Pattern: Base Consolidation

- PATH is still horizontal. It is a Laggard.

- Action: This is not a leader. Only touch this if you are a Contrarian trader playing the “Catch Up” trade. Wait for a breakout of long-term resistance.

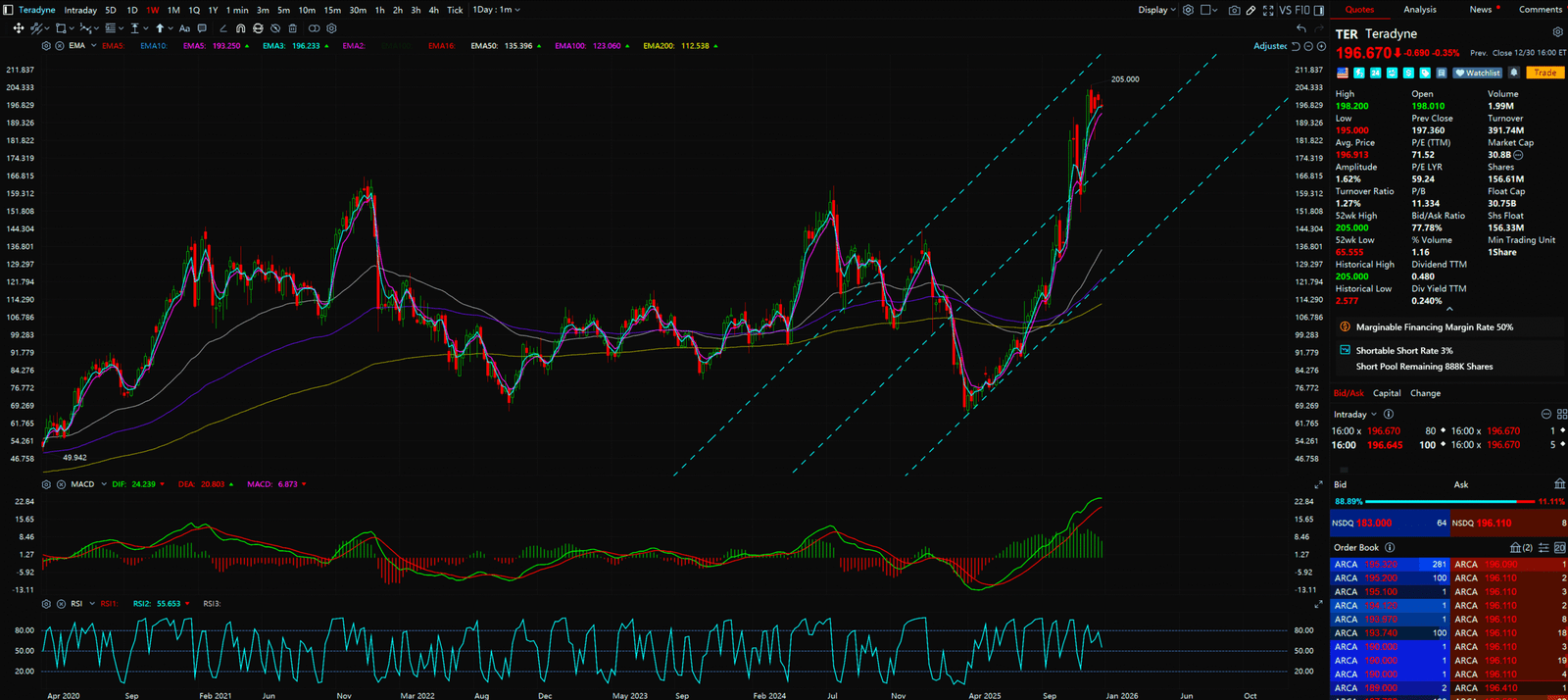

14. TER (Teradyne) – The Pick & Shovel

- Pattern: Descending Triangle Breakout

- TER (Semiconductor testing + Cobots) just broke a consolidation pattern. RSI is strengthening.

- Action: Buy the retest of the breakout level. Closely correlated with the Semi cycle.

The Fourth Contender Industry: Biotech & GLP-1 (The Life)

If you think GLP-1s (Ozempic/Mounjaro) are just weight-loss drugs, you are thinking too small. This is the iPhone Moment of Healthcare.

- TAM Explosion:

Clinical data proves GLP-1 efficacy in Cardiovascular disease, Kidney disease, and Sleep Apnea. This expands the TAM (Total Addressable Market) from “Vanity Weight Loss” to “General Health Management.” The Kicker: Insurers and Medicare are paying up because the Preventative Cost is far lower than treating a heart attack. This is a victory for Health Economics. - Interest Rate Sensitivity:

Biotech is the most rate-sensitive sector. As we enter the 2026 Rate Cut Cycle, financing costs drop. This will ignite an M&A Supercycle, where Big Pharma (with cash) buys small biotechs (with patents). - The Duopoly Moat:

LLY and NVO own 90% of the market. The CapEx required to build sterile fill-finish factories creates a barrier to entry that competitors cannot cross for 3-5 years.

For these secular compounders, the hardest part isn’t buying — it’s Sitting on your Hands. Do not trade in and out.

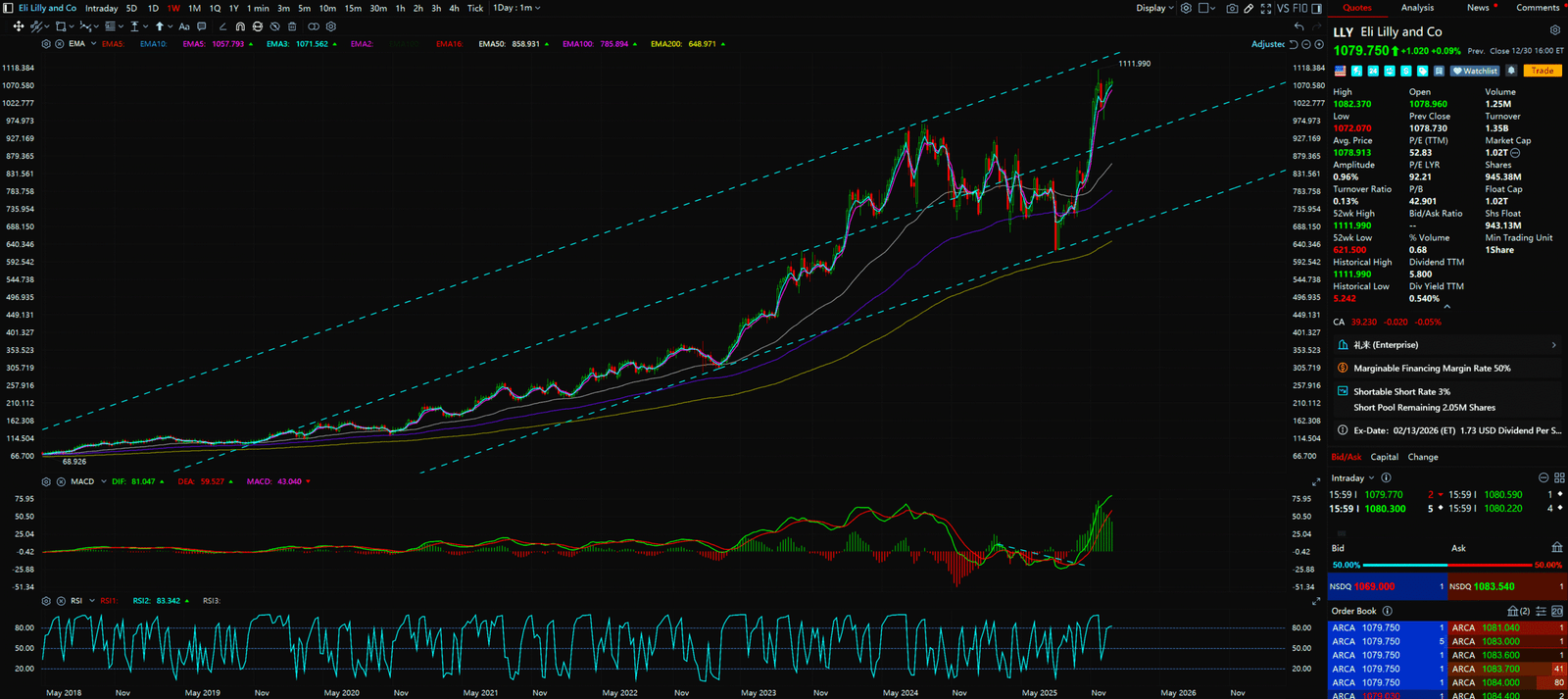

15. LLY (Eli Lilly) – The Perpetual Motion Machine

- Pattern: Perfect Linear Uptrend

- The LLY chart is one of the strongest in the market. A perfect 45-degree slope.

- Action: DCA (Dollar Cost Average). Every touch of the EMA 50 is an automatic buy signal.

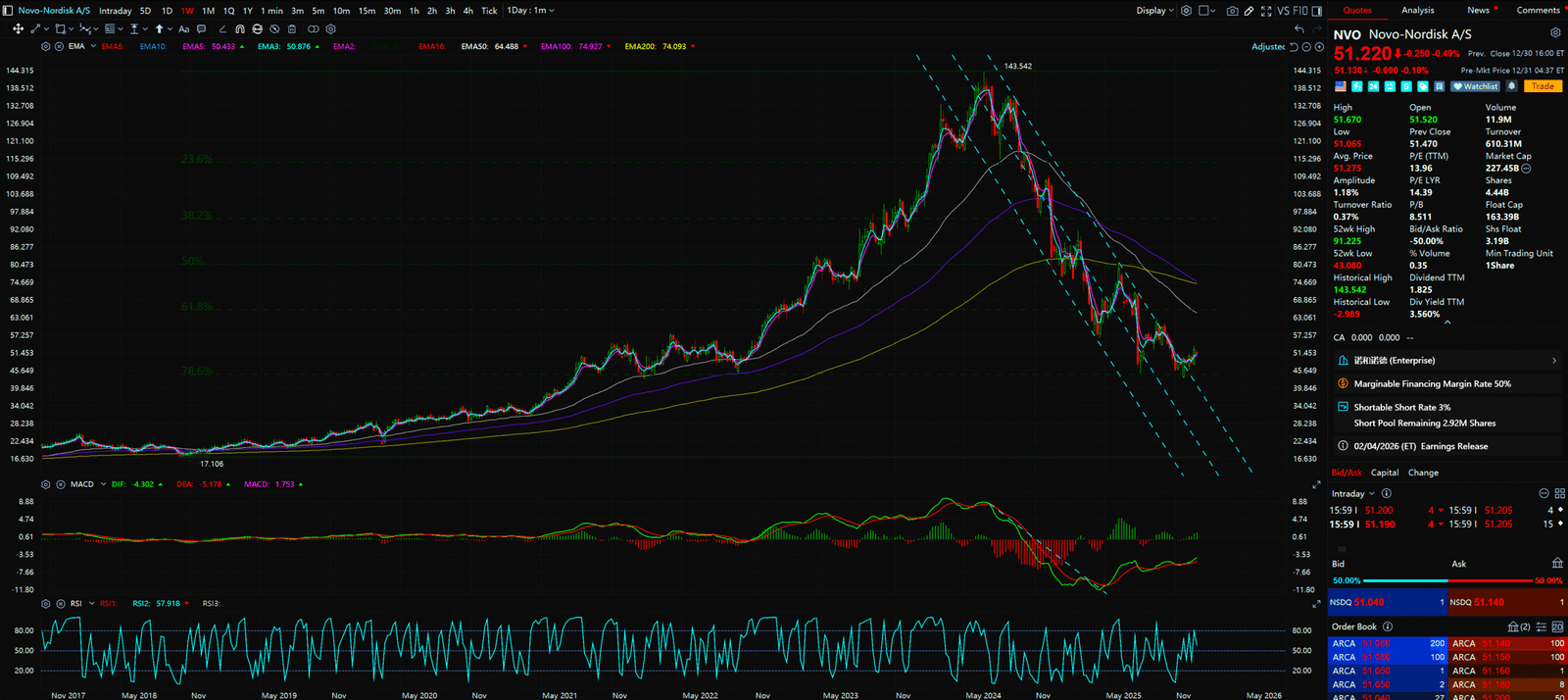

16. NVO (Novo Nordisk) – The Golden Pit

- Pattern: Descending Channel / Bull Flag

- Unlike LLY, NVO has had a deeper correction recently.

- The Opportunity: This is a massive Bull Flag on the weekly chart. It is digesting overbought conditions.

- Action: Sniper Entry when price breaks the upper trendline (115−120).

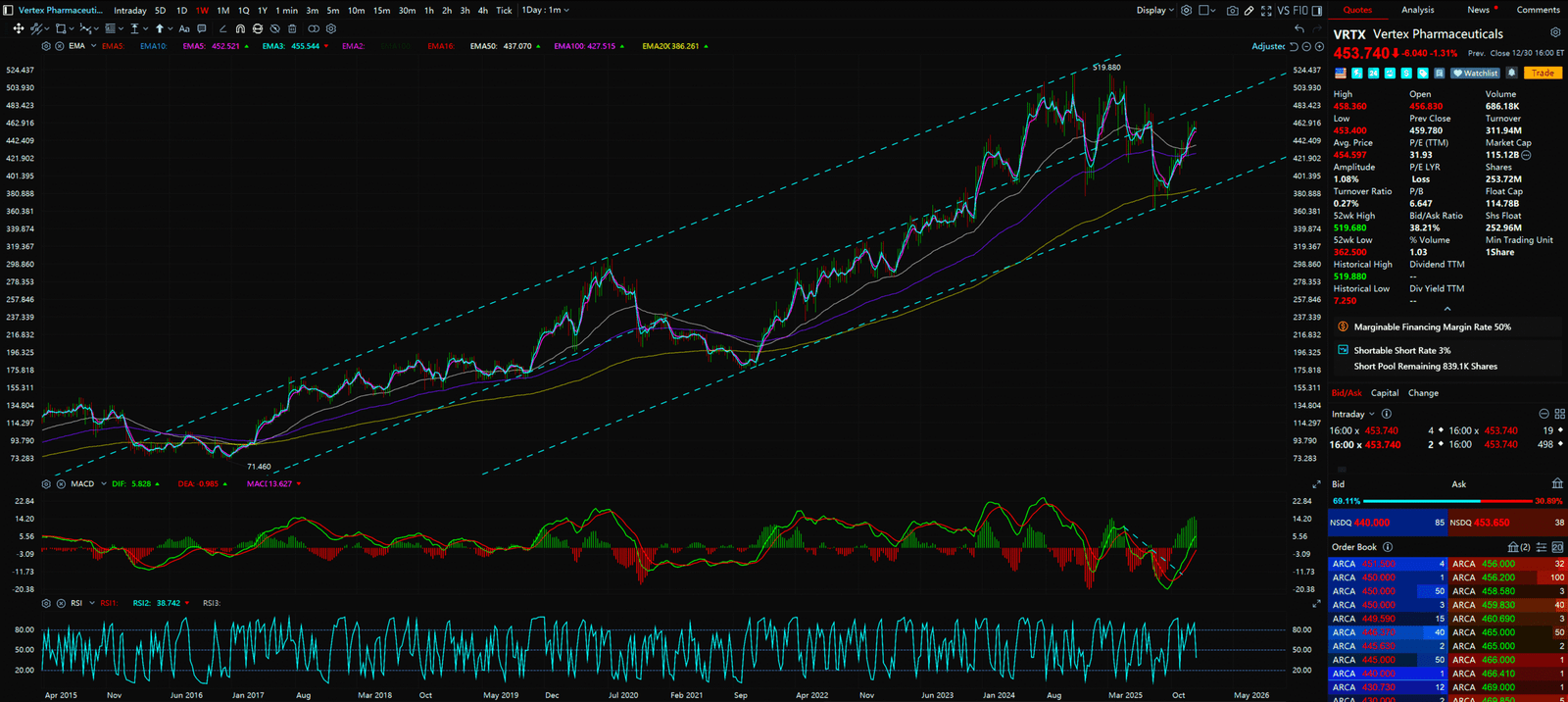

17. VRTX (Vertex) – The Cash Cow

- Pattern: Steady Uptrend with Consolidation

- VRTX moves in “Step-up” boxes. Very low volatility compared to XBI.

- Action: Buy the breakout of the current box.

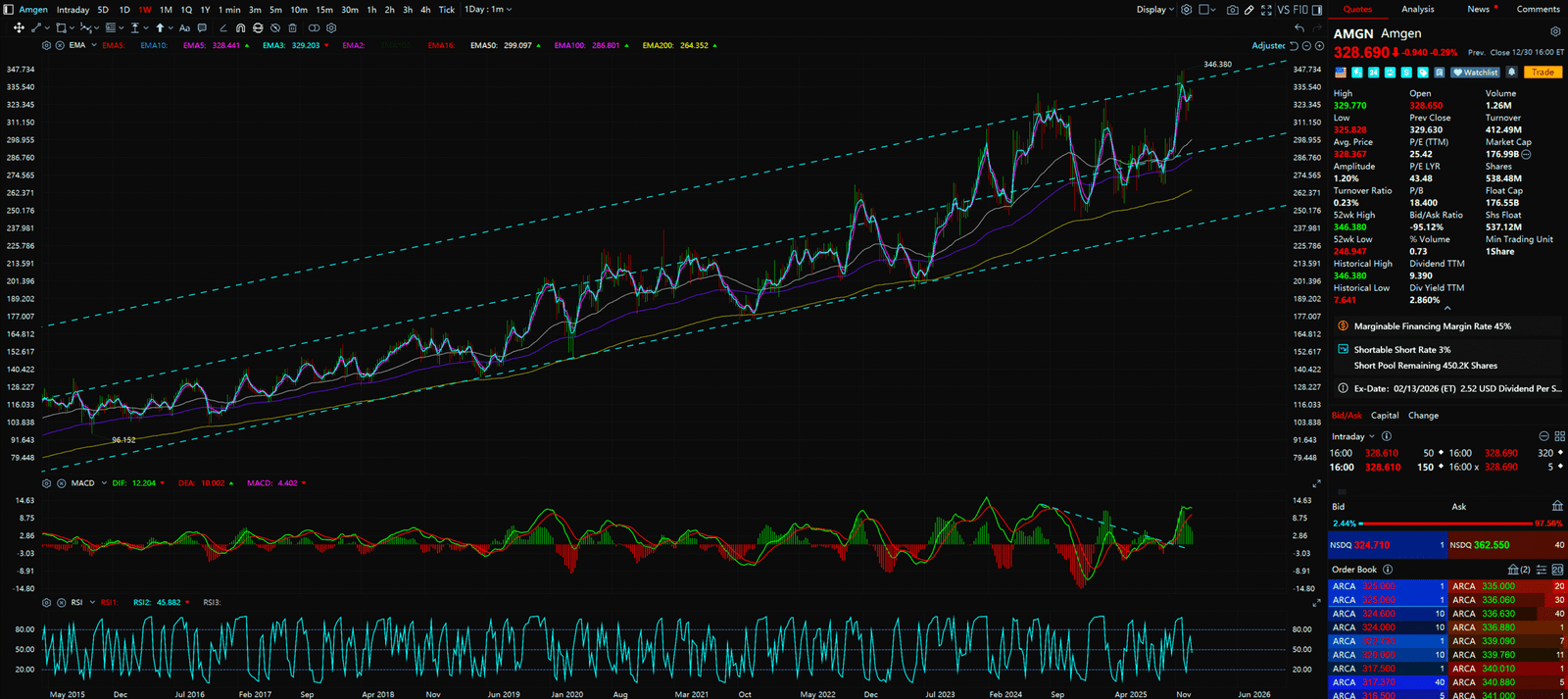

18. AMGN (Amgen) – The Dividend Defender

- Pattern: Base Building

- AMGN is forming a long base. It acts as a bond proxy with upside.

- Action: Use this as a portfolio stabilizer. Buy at the bottom of the range.

Rounding Out the Top 5 Industry: Cybersecurity (The Shield)

This sector is both Defense and Offense. AI has reduced the marginal cost of a cyber attack to zero. This is Asymmetric Warfare.

- Recession-Proof Spending:

Even in a slowdown, a CEO might cut marketing, but they will never cut Cybersecurity. One breach can wipe out 20% of market cap. This is Non-Discretionary Spending. - The “Platformization” Trend:

This is the buzzword of 2026. CFOs hate managing 50 different security vendors. They want Vendor Consolidation. Palo Alto (PANW) and CrowdStrike (CRWD) are swallowing the market by offering a “Single Pane of Glass” platform. It is a Winner-Takes-All dynamic.

Cyber stocks have high Beta. They rip higher and flush lower. You need to be a Sniper. Wait for the pattern completion.

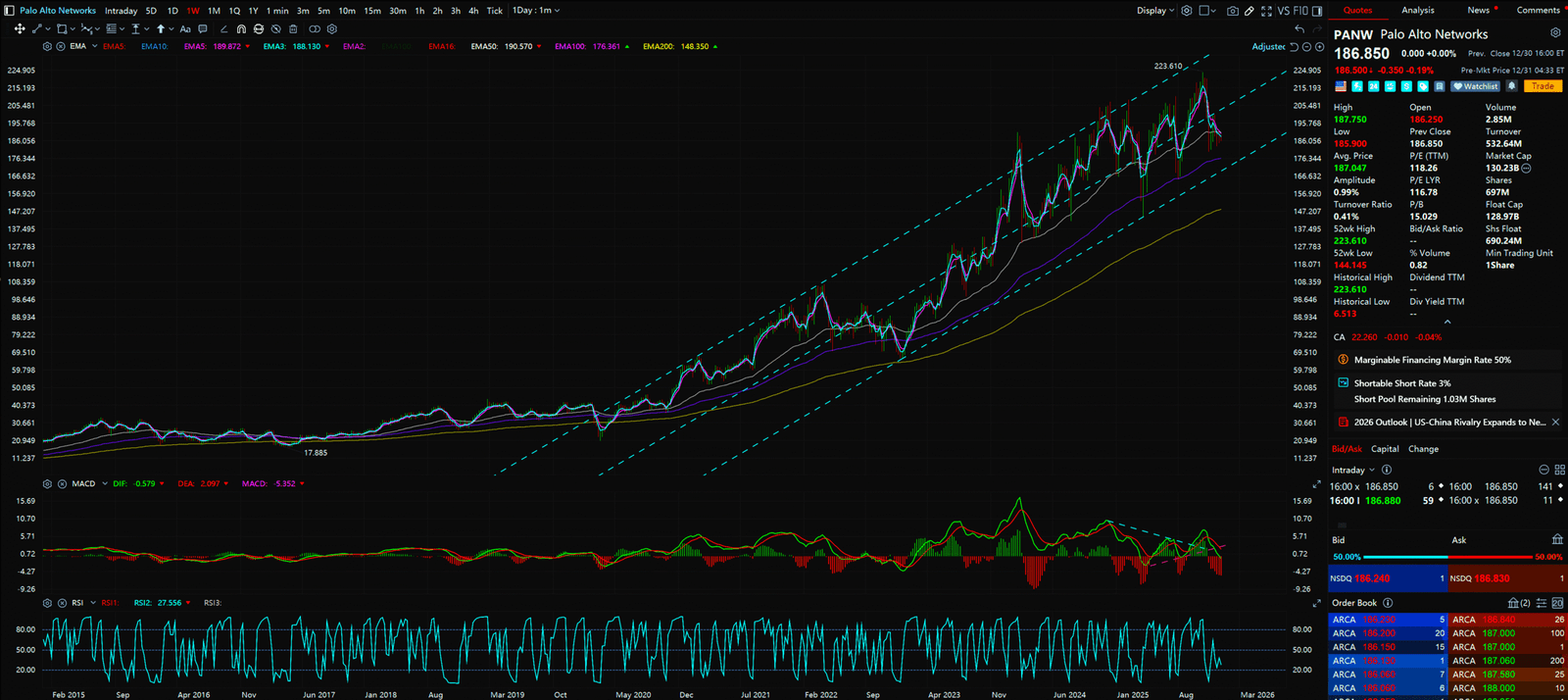

19. PANW (Palo Alto Networks) – Blue Sky Breakout

- Pattern: ATH Breakout (Price Discovery)

- PANW has cleared all resistance. It is in Price Discovery mode.

- Action: Buy the dip to the EMA 20. As long as we don’t see a Blow-off Top (massive vertical spike with volume), stay long.

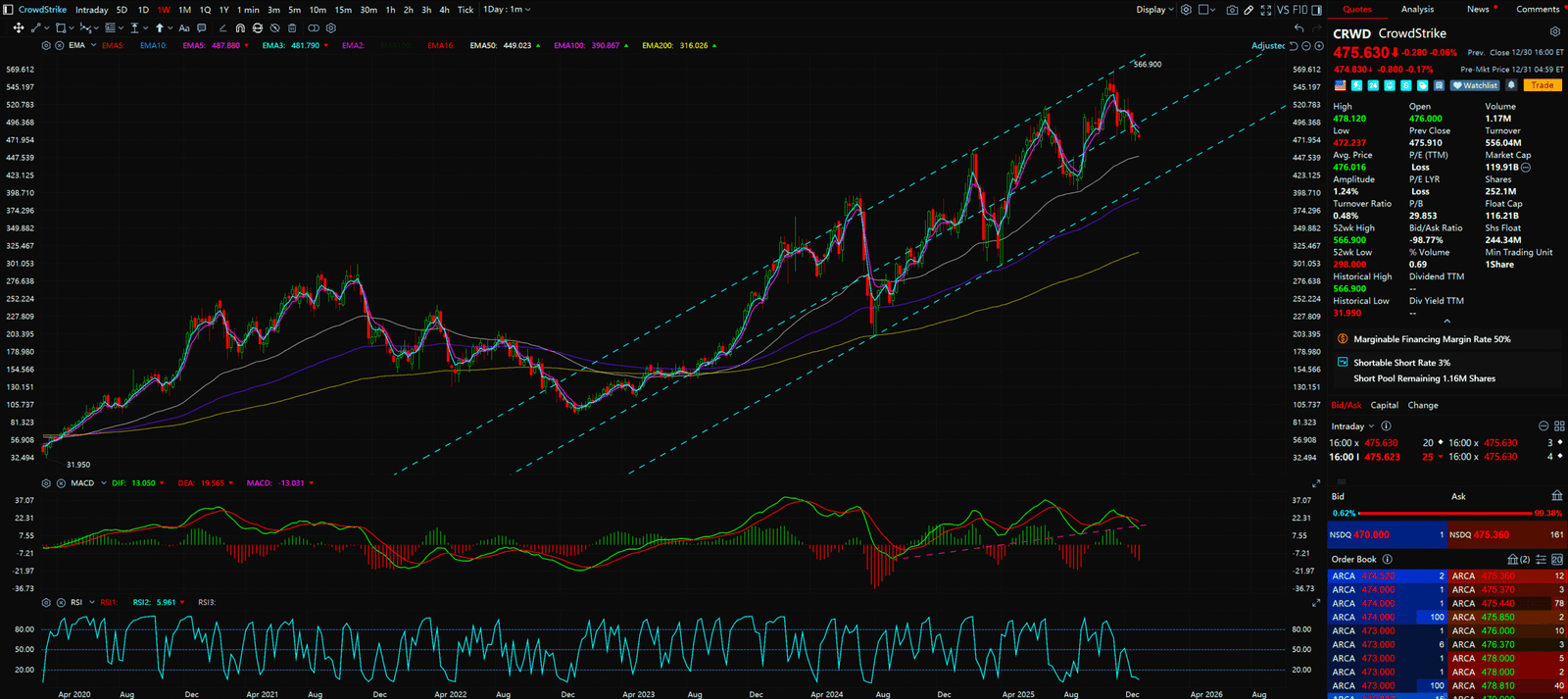

20. CRWD (CrowdStrike) – The King Returns

- Pattern: V-Shape Recovery into Cup & Handle

- After the update disaster, CRWD managed a V-shape recovery. Now forming a Handle at the highs.

- Action: Watch the $400 level. A volume breakout here opens the door to $500.

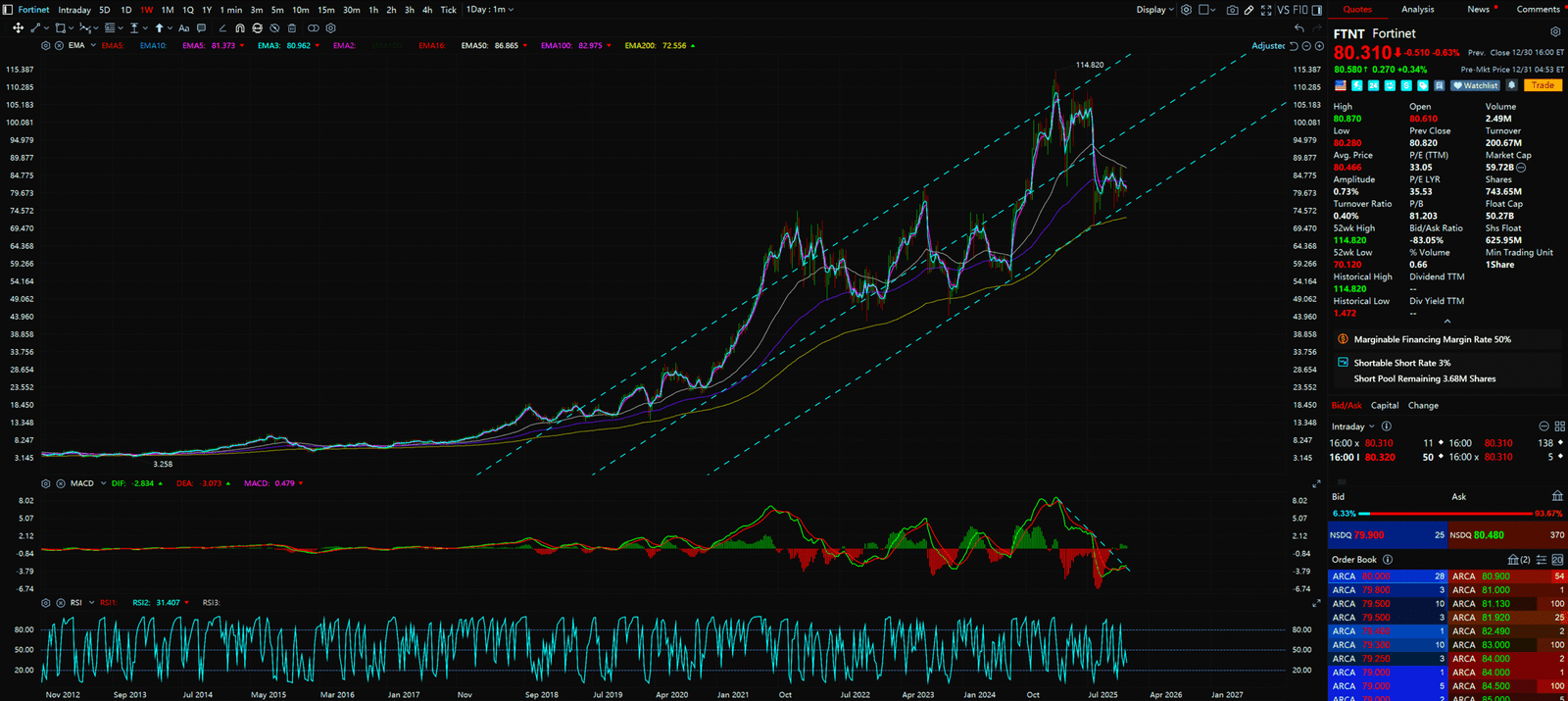

21. FTNT (Fortinet) – The Value Swing

- Pattern: Ascending Channel

- More moderate volatility than PANW. Trades cleanly inside a channel.

- Action: Buy at the lower channel rail, sell at the upper rail. Perfect for Swing Trading.

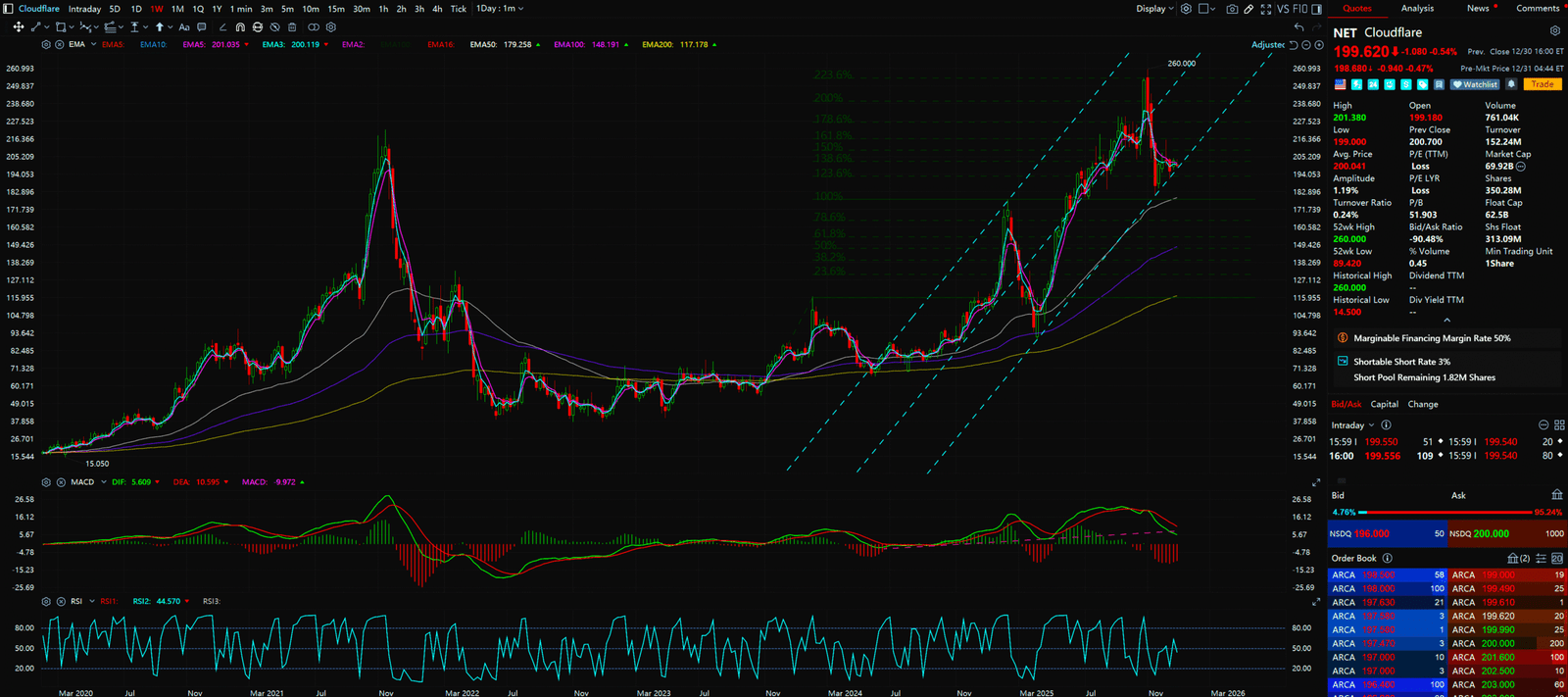

22. NET (Cloudflare) – The Edge Squeeze

- Pattern: Volatility Contraction (Squeeze)

- NET charts show volatility compressing. This usually precedes a violent move.

- Action: Wait for the direction. A break above $100 confirms the bull trend.

Conclusion: The Choice

You have seen the 5 Sectors. You have analyzed the 22 Charts. Your brain is now loaded with institutional data. You can choose to let this be “just another article” and go back to pretending to be an expert at happy hour. Or, you can Execute. The gates of 2026 are opening. The wealth transfer waits for no one. Are you ready?

🔥 Want the Chart-Blitz Team’s list of the “Top 5 Tier 2 US Stocks for 2026”?

👉 Visit Top 5 Tier 2 US Industies for 2026 now to explore our proprietary trading models!

References:

- Gartner, “Worldwide IT Spending Forecast, 4Q25 Update”.

- U.S. Department of Energy, “Data Center Energy Demand Report 2025”.

- Morgan Stanley, “The Robotics Revolution: From Factory to Home”, Research Note Sep 2025.

This content is for educational and entertainment purposes only and does not constitute financial advice. Investing involves risk. The author may hold positions in the securities mentioned. Do Your Own Research (DYOR).