Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

Here we go again… Today’s top headline from the financial news outlets: “Strong E-commerce Demand Fuels Bright Outlook for Sustainable Packaging Materials.” 🤯 Reading “news” like this, I can’t help but wonder if the journalists writing it are just slow on the uptake, or if they genuinely believe their readers are sheep living in a vacuum. 😴 By the time you read keywords like “e-commerce demand” and “sustainable materials” in a headline today, the whales of Wall Street have already completed their positioning months, if not a year, ago. What you’re seeing now are the breadcrumbs they’ve left behind, the “official narrative” meticulously crafted to lure you into the market to buy their shares at an inflated price. 🤦

For those of us who trust only the charts, these so-called “positive developments” are not opportunities; they are the most dangerous of warning signs. They signal that a trend has been over-consumed, that retail investors are rushing in with excitement, while the smart money, the colossal capital that truly moves the market, is leaving its footprints on the charts as it quietly exits. They need this “good news” to create market liquidity, allowing them to offload the positions they accumulated at low prices to the “fundamental believers” who are still driving while looking in the rearview mirror. This game is as brutal as it is real, and today, using the packaging industry as our case study, we will reveal the unwritten rules of this game. While others are patting themselves on the back for International Paper’s (IP) “stable dividend” or “industry leadership,” we have already used the capital flow map to identify the true king of this sector and the aging giant on the verge of being left behind.

Before we dive into the charts and expose the truth of capital flow, let’s first play the role of a “fundamental analyst” and examine the script Wall Street wants you to believe. This script is typically filled with grand market projections and seemingly flawless business logic, enough to make any untrained investor’s heart race.

According to the authoritative market research firm Grand View Research, the global packaging market size was estimated at a staggering USD 1.1 trillion in 2024 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% through 2030. The drivers of this massive market are the same tired talking points parroted by the mainstream media: the explosive growth of e-commerce leading to surging demand for corrugated boxes and protective packaging, and concurrently, a global consumer shift towards sustainability. The anti-plastic movement and environmental regulations have made eco-friendly materials like aluminum cans, glass bottles, and recyclable paper products the new darlings of the market.

In this narrative, three main characters are playing out a dramatic “Game of Thrones”:

👑 The King: Ball Corporation (BALL)

⚔️ The Challenger: Crown Holdings (CCK)

🐘 The Old Giant: International Paper (IP)

This script, meticulously crafted by Wall Street, sounds quite reasonable, doesn’t it? Each company has its narrative, its growth drivers, and its risks. A fundamental analyst would take this data and these stories, build complex valuation models, and attempt to calculate a “fair” stock price. They would tell you, based on some metric, that this stock is “undervalued” and that one has “growth potential.”

Now, take a deep breath and completely forget the 1000+ words of “fundamental analysis” you just read. Because none of it is of any practical use for you to actually make money in the market. It is all just noise.

This is the essence of the golden rule: “Fundamentals are the rearview mirror; technical analysis is the map.” Everything you just read—”market size,” “growth forecasts,” “core advantages,” “Achilles’ heels”—are all things that have already happened or are currently happening. They are historical stories, packaged by company management after the earnings are released, and then retold to you by financial journalists and analysts. By the time this information reaches your ears, the smart money, the institutional giants, have already completed their trades based on these expectations. Any decision you make based on this information is, by definition, a step behind. It’s like being forced to drive a car while only looking in the rearview mirror. Do you think you’d reach your destination safely? It’s utterly absurd.

Let’s use another metaphor: Fundamental analysis is like going to a movie where you already know the ending. The entire plot, the characters, the twists—they were all predetermined by the director (Wall Street institutions) and the screenwriter (company management). They bought the best seats in the house (built their positions at low prices) long before the movie was released (before the news broke). And you, the average moviegoer (the retail investor), can only buy a high-priced ticket during the blockbuster’s peak run (when the news is trending), cry and laugh along with the crowd, and then leave in a daze when the movie ends and the lights come on (when the trend reverses). We, the disciples of technical analysis, don’t care about the plot of the movie. We only care about the real-time data from the ticketing system—the price and volume on the chart. We can see which seats are being quietly bought in bulk and which sections of the audience are starting to leave early. We follow the real flow of money, not the fictional movie script.

Let’s conduct a simple “thought experiment.” Imagine that three months ago, you read an in-depth analysis of International Paper (IP), praising its rebirth in the e-commerce era and its attractive dividend yield. You were moved by this “value investing” story and invested your savings. What happened next? You might have experienced a brief pop in the stock price, followed by a long, painful period of sideways movement or even a slow bleed. You open your stock app, stare at that small negative number, and begin to question everything. You reread those “positive” analyst reports, trying to console yourself: “It’s okay, this is a good company, it has a moat, it has stable cash flow.” You’re like a driver constantly looking in the rearview mirror for reassurance, oblivious to the giant pothole that has opened up on the road ahead. Now, let’s look at the chart. You would be shocked to discover that right around the time that “in-depth analysis” was published, IP’s stock price hit a key resistance level, and volume began to spike abnormally, yet the price failed to break out. This is the most classic sign of distribution! The chart, this map of capital, had already issued a warning in the clearest language possible: The smart money is leaving, and they are handing their shares over to you, the person who just read the news. This one signal is worth ten thousand times more than any hundred-page earnings report.

In the brutal, zero-sum game of the financial markets, you must make a choice. Do you want to remain a docile sheep, content to graze on the pre-digested “fundamental” grass fed to you by the mainstream media, only to be sheared of your wool without even realizing it? Or do you want to become a hunter, armed with a map, with your eyes scanning the terrain, learning to read the only true language of the market: price, volume, and chart patterns?

Fundamental analysis gives you a false sense of security. It makes you think you’ve grasped “value,” when in reality, you’re just holding the bag for someone else’s profit. Technical analysis is the only skill that will allow you to survive in this dark forest. It is not a crystal ball; it cannot predict the future with 100% certainty. But it is an incredibly precise, real-time map that clearly marks the flow of capital, the shifts in market sentiment, and the hidden dangers and opportunities. It allows you to stand on the same side as the market’s strongest players, to follow their footprints instead of becoming their prey.

We have seen countless investors get lost in the fog of so-called “value investing” and “fundamental analysis,” wasting enormous amounts of time and money only to end up with nothing. Their problem wasn’t a lack of effort; it was that they were using the wrong tools and reading the wrong map from the very beginning. They were staring at the rearview mirror, yet expecting to win a forward race.

It is time to abandon these outdated dogmas. It is time to stop being the “news reader” who is always the last to know. The real rules of the game have always been written on the chart. Mastering the ability to read this map is the only path to achieving financial freedom and taking control of your own destiny.

Do not hesitate any longer. Visit our website now and start learning how to become a true market hunter. While others are still wandering in circles in the fog of news, you will be holding the map, walking a clear path toward your goal.

Sources:

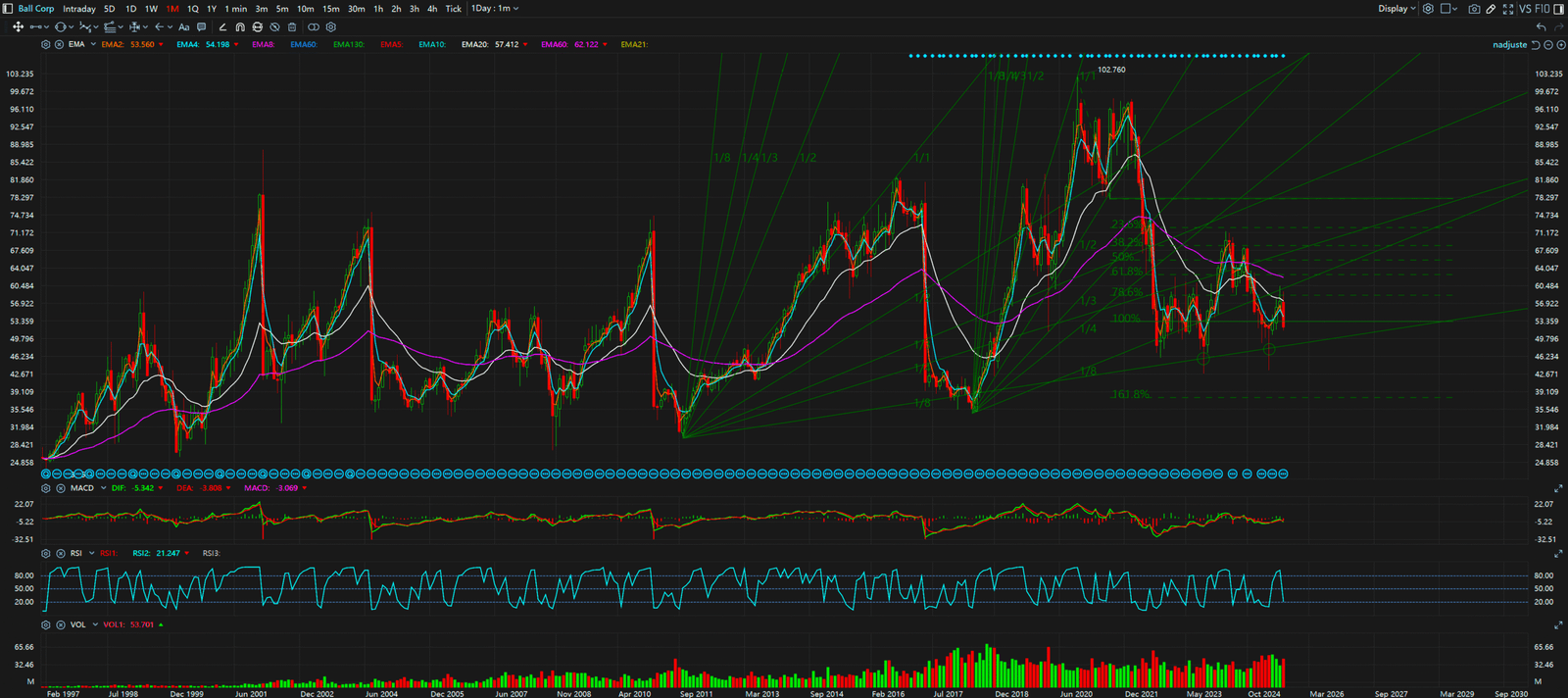

Monthly Timeframe (BALL)

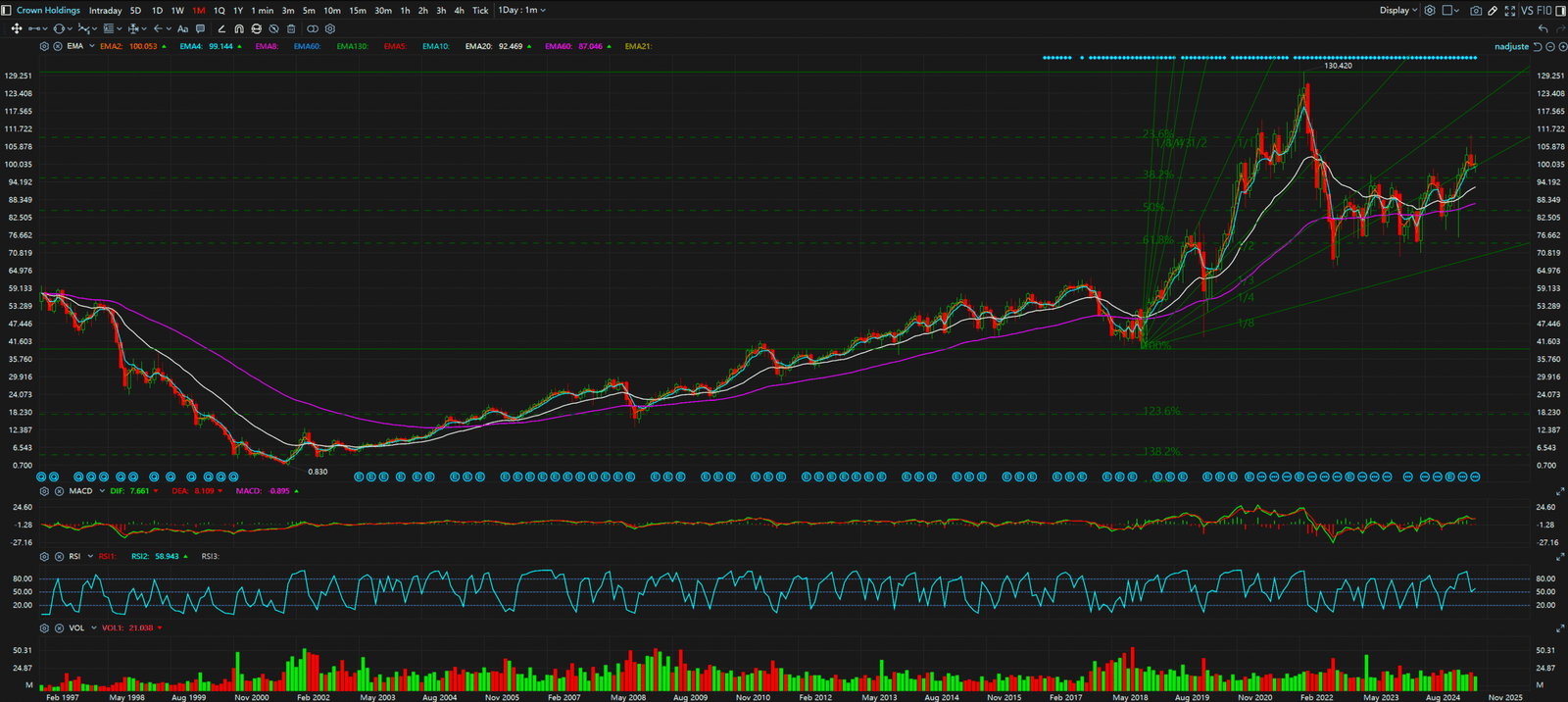

Monthly Timeframe (CCK)

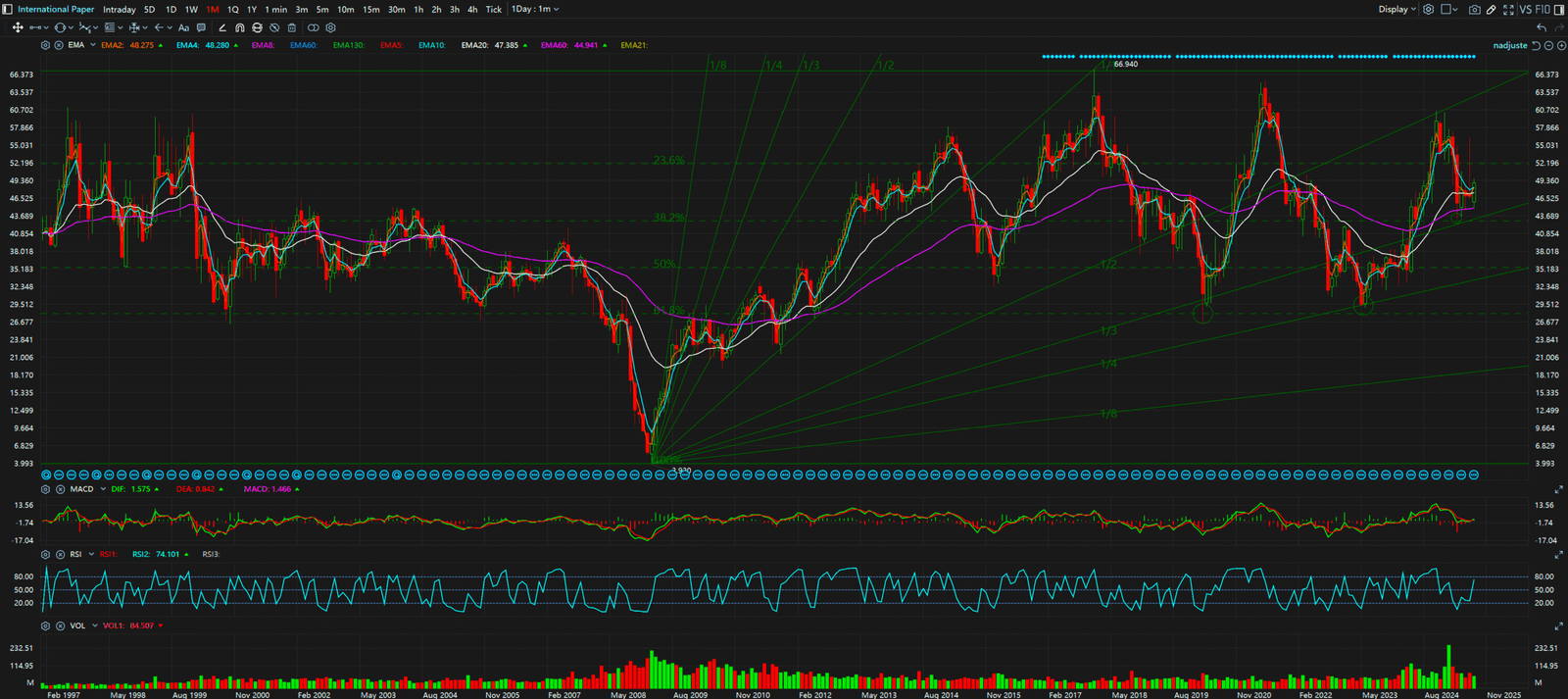

Monthly Timeframe (IP)