Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear

William Delbert Gann – 1949

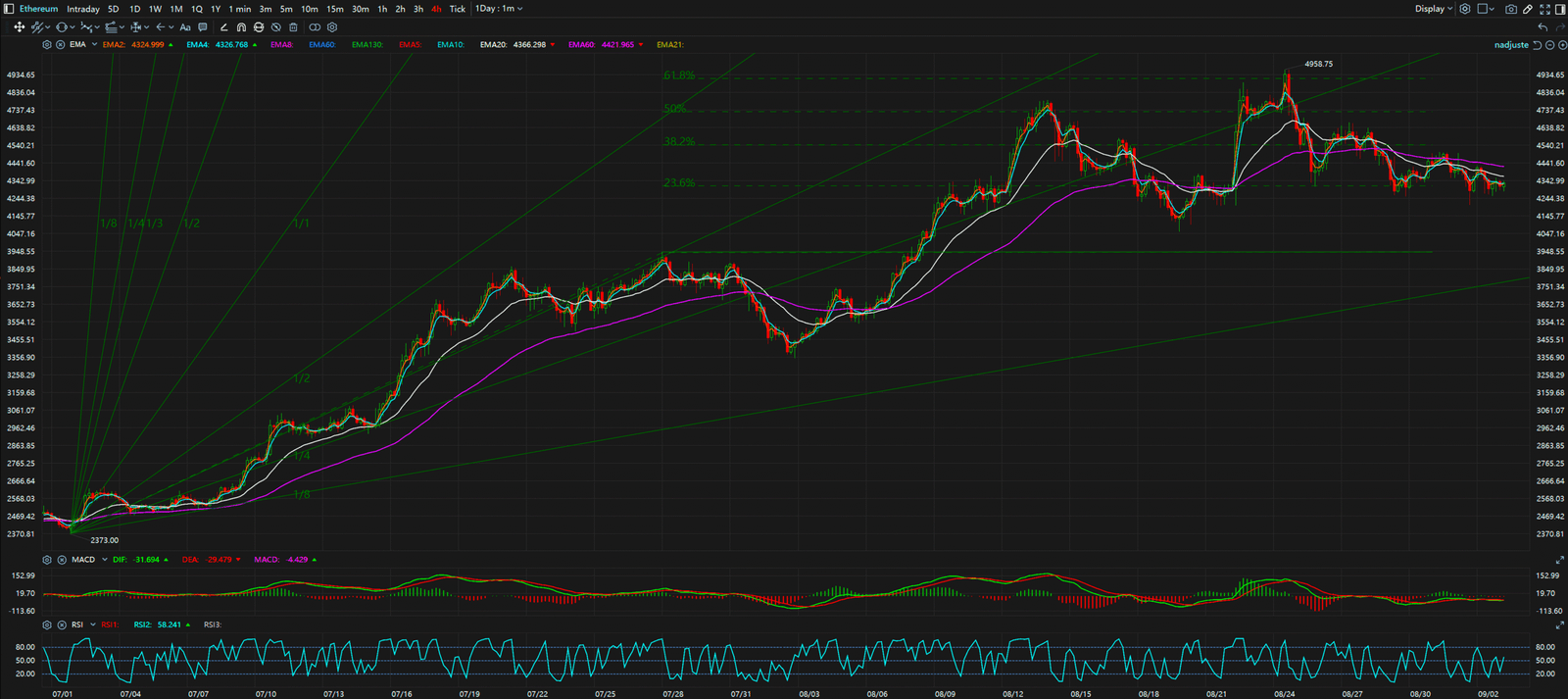

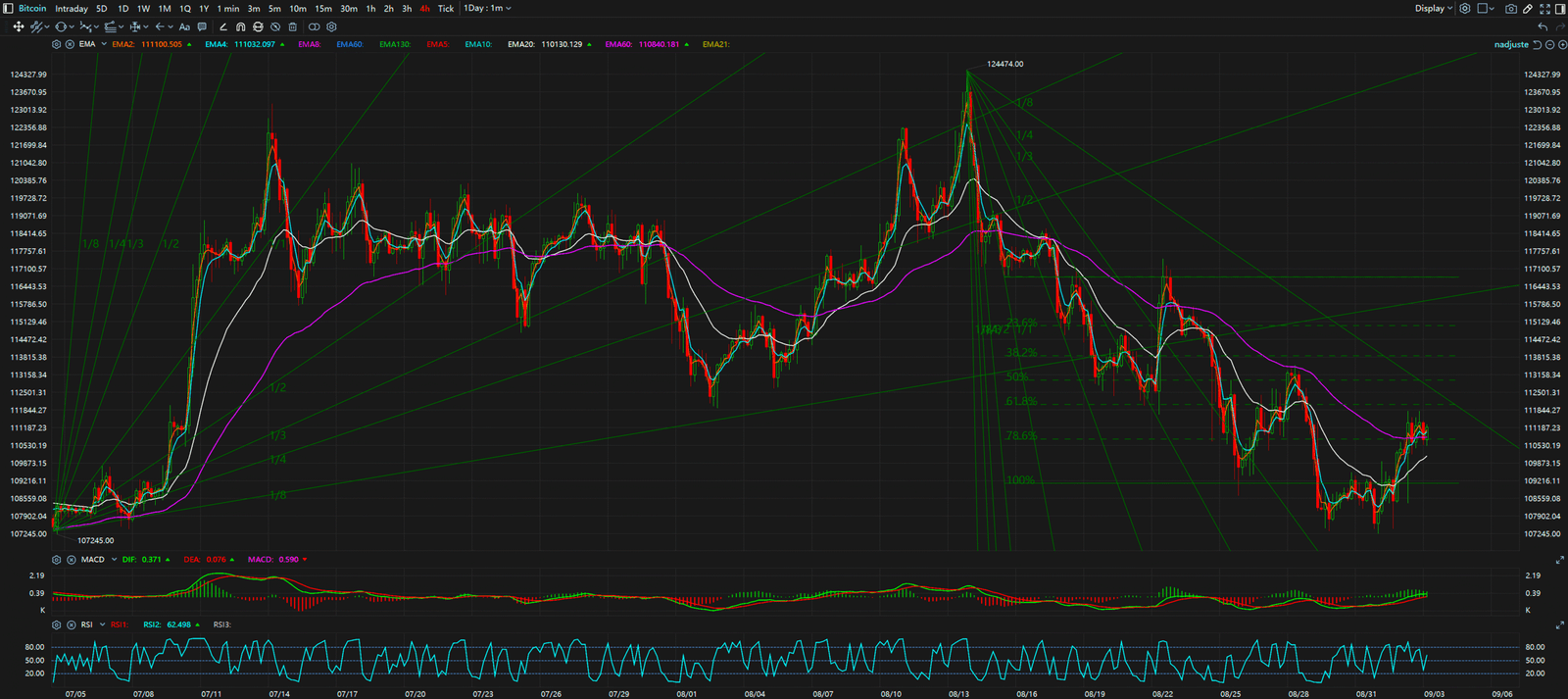

While Bitcoin appears robust, maintaining its ground above a critical price threshold, a significant divergence in Ethereum’s price action suggests the market’s current stability may be deceptive. This growing gap between the market’s two largest assets warrants a deeper look.

The Bull Case / The Obvious Story: Bitcoin is demonstrating considerable strength, holding a stable market structure above the key psychological level of $110,000. Its ability to absorb selling pressure and post a slight 24-hour gain indicates a resilient bull case, leading many to believe the broader market uptrend remains intact.

The Bear Case / The Hidden Signal: However, a look at Ethereum reveals a counter-narrative. The asset has posted a nearly 2% loss over the same 24-hour period. This price action divergence, where the market leader holds firm while a major altcoin falters, is a classic signal of weakening underlying momentum. It suggests that conviction is waning and the market could be vulnerable to a broader correction.

Synthesis & Implication: This conflict between BTC and ETH implies that the market is at a critical decision point. While BTC’s strength provides a floor for now, ETH’s weakness could be a leading indicator of a sentiment shift. Traders should be cautious, as the strength seen in Bitcoin may not be reflective of the entire market’s health.

In summary, the market presents a conflicted picture. Bitcoin’s stability is bullish, but Ethereum’s underperformance is a significant bearish divergence. The key levels to watch are support at $110,000 and resistance at $115,000 for Bitcoin, and support at $4,200 and resistance at $4,500 for Ethereum. A break of these levels could determine the market’s next major move.

For continuous, real-time analysis of these developing market structures, visit www.chart-blitz.com.

True trading advantage comes from decoding these conflicting signals. To learn the professional-grade framework for seeing the market’s real intentions, explore our exclusive models on www.chart-blitz.com.

Sources:

4-Hour Timeframe for Bitcoin

4-Hour Timeframe for Ethereum