Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend

Jesse Livermore – 1923

Elon Musk, the planet’s master market manipulator, has spoken. A single, casual sentence—”We’re going to make our own AI chip”—and Wall Street convulsed as if struck by lightning. 🤯 Analysts scrambled to publish reports, and media headlines exploded. “Tesla’s Betrayal, TSMC’s Dynasty in Peril?” “Whale Client Lost, TSMC’s Moat Breached?” Retail investors, gripped by fear, stared at their portfolios as if the apocalypse had arrived. 😴 This is the script Wall Street writes best: create panic, amplify noise, and then, in the midst of your confusion, harvest your wealth. 🤦

Here is the “official story” Wall Street wants you to believe: the power dynamics of the semiconductor industry are being rewritten by the ambition of one man. This story has all the dramatic elements:

Macro Market Context: The world is at the boiling point of an AI arms race, and the demand for advanced chips is a bottomless pit. According to Precedence Research, the global AI chip market is projected to hit $372 billion by 2032, growing at a CAGR of nearly 40%. In this golden race, whoever controls the most advanced chips controls the future.

The Three Key Players:

👑 The Leader: TSMC (Taiwan Semiconductor Manufacturing Company)

⚔️ The Challenger: Samsung Foundry

🐘 The Incumbent (The Elephant Trying to Turn): Intel Foundry Services

And now, Elon Musk’s “AI6” is the giant rock thrown into this pond, creating waves of panic. The official story’s conclusion is simple: one of TSMC’s largest clients might be leaving, challengers see an opening, and the king’s throne is shaky. Therefore, you should be scared. You should sell.

But does any of this actually matter? Which affects your emotions more: a single sentence from Musk or a detailed corporate earnings report? The answer is obvious. This news, this “story,” is a tool designed to manipulate public sentiment. It’s the rear-view mirror. It’s the breadcrumbs. Elon Musk says he’ll build his own chip, which sounds terrifying, but let’s think deeper:

This kind of fundamental analysis is like debating the aerodynamics of a rocket while completely ignoring the flow of its fuel (capital).

A Thought Experiment: Imagine that after Musk’s announcement, TSMC’s stock price panics and drops. The sheep are rushing for the exit. But at the same time, on the chart, you see the price fall to a key long-term support level. Volume spikes abnormally, but the price stops falling, forming a long lower shadow (a “wick”). What is this signal? These are the “footprints” of the Navigators—the real institutional money—seeing a bargain and starting to sweep up shares. They don’t care what the news says; they only trust the truth of supply and demand reflected in price and volume. While you are staring at the headline with trembling hands, the Navigators are already deploying their capital. Days later, when the market digests the “bad news” and realizes it was a false alarm, the price recovers. The sheep will come back to chase the stock higher. And the Navigators, having bought at the bottom, will be waiting to sell to them.

The chart is the only truth in this market. It has no emotion, no bias. It is a naked record of the votes cast with real money by every participant. Trendlines, support, resistance—this is the map we use to navigate the future. Forget the ridiculously complex financial models and the flowery language of analysts. Their purpose is to make you feel that investing is too complicated and that you need them. But the real rules of the game are all written on the chart.

In this market of information asymmetry, you have only two choices: be a Sheep, chasing news and “expert” opinions, or be a Navigator, who knows how to read the map and chart their own course. The fate of the Sheep is to buy in at the peak of euphoria and sell in a panic at the bottom, ultimately becoming lunch for the big players. Navigators, on the other hand, don’t listen to stories; they trust data. They don’t watch the news; they watch the charts. They know that all “official stories” are carefully packaged narratives designed to herd the sheep. The only truth is the trail of capital flow.

Learning technical analysis isn’t about chasing some mythical magic for predicting the future. It’s about gaining a survival edge in this brutal game. It gives you a framework for independent thought, a lens to filter out market noise, and a map to guide you through the storm.

Do you want to continue being a manipulated sheep, or do you want to take back control of your financial destiny and become a navigator? The choice is yours. Visit our website and start learning the real rules of the game. Stop chasing breadcrumbs; it’s time to become a map reader.

Sources:

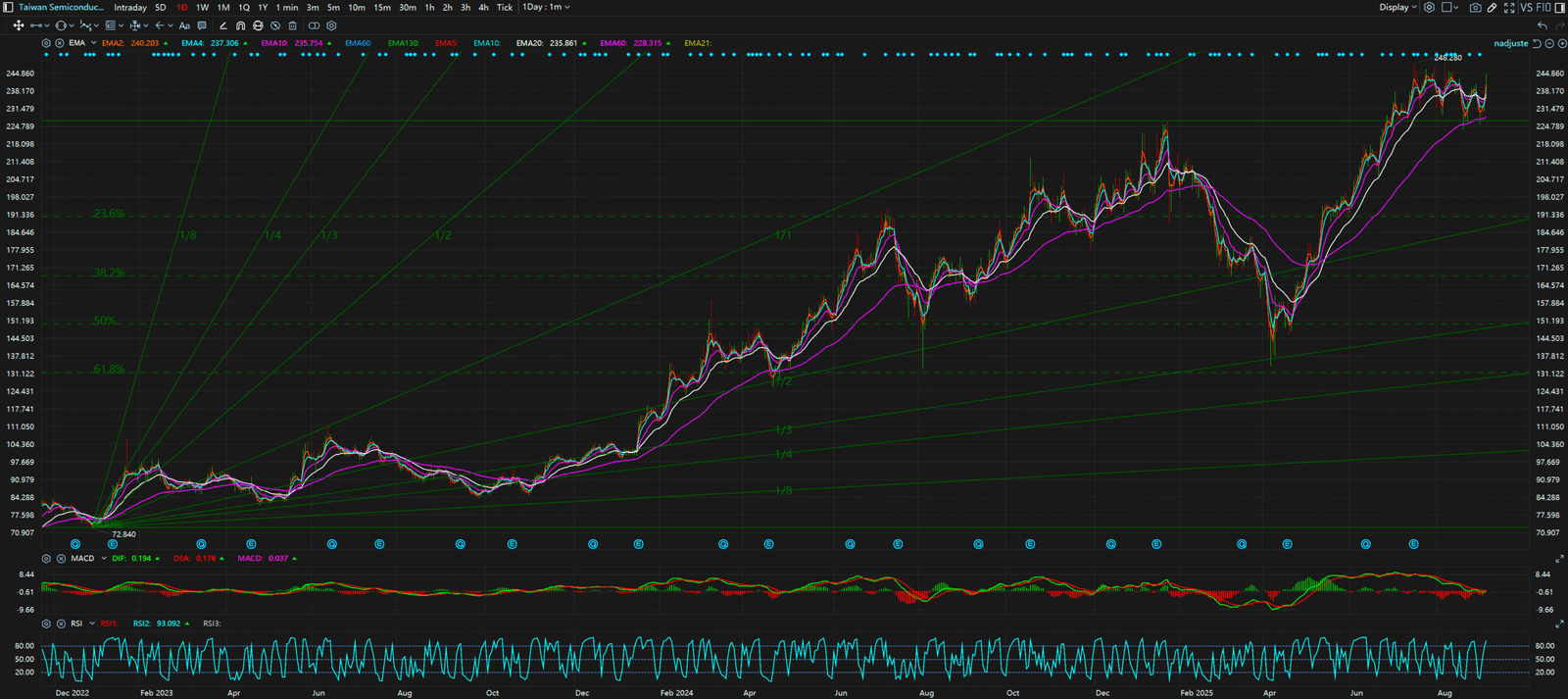

Daily Timeframe – TSM

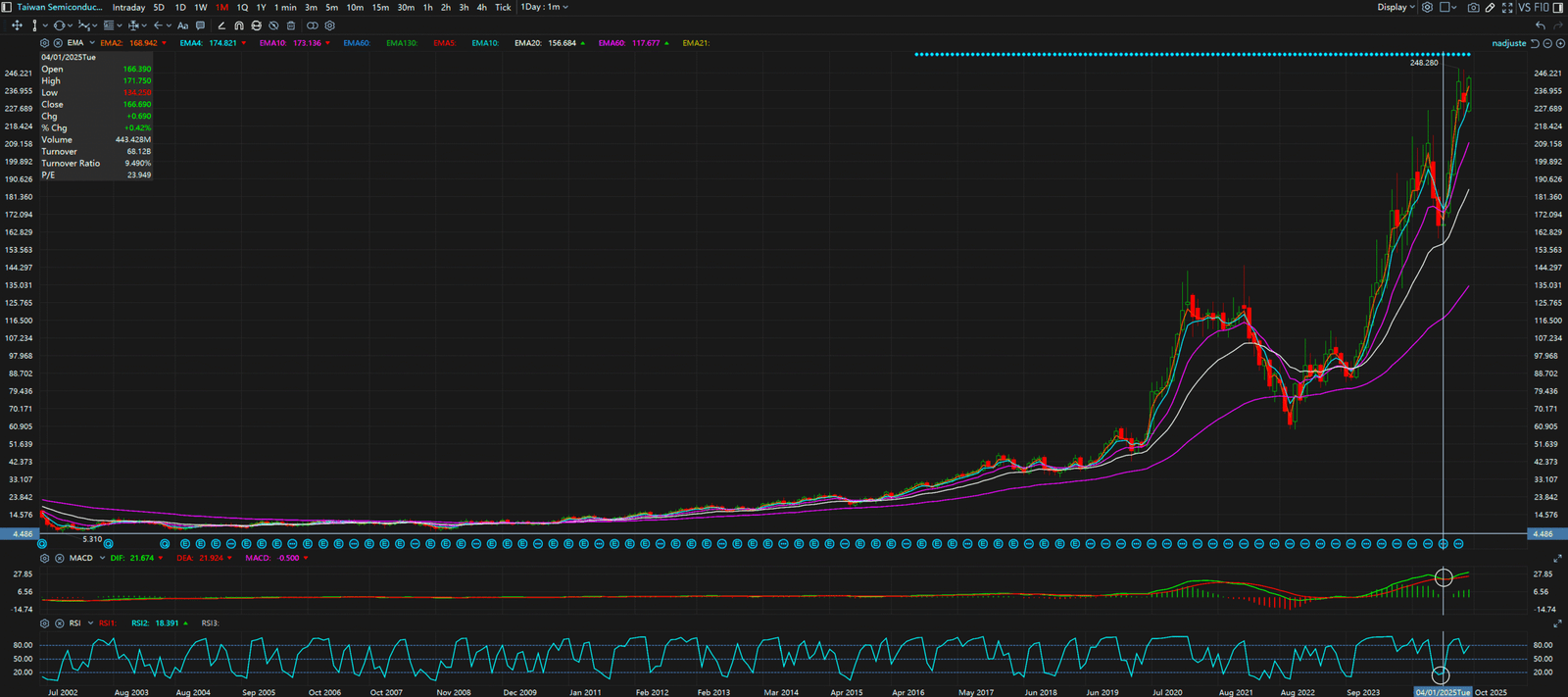

Monthly Timeframe – TSM