Alright, all you “Trend is Your Friend” believers, Crypto breakout trackers, and folks who want the rawest way to catch trend ignition points! Today, we’re dissecting a super classic, dead-simple yet incredibly practical channel indicator – the Donchian Channels! It doesn’t play fancy statistical games like Bollinger Bands or get complicated like some Keltner Channel versions. It just tells you straight up: Yo, where’s the highest high and lowest low over the last N periods? Using it for breakout strategies? Absolutely OG status!

What the heck are Donchian Channels? How Raw Are They?

Donchian Channels were developed by the legendary trader often called the “Father of Trend Following,” Richard Donchian, back in the mid-20th century. His design philosophy was brutally simple but highly effective:

- The Core: Just plot the Highest High and Lowest Low over the past N periods.

- It usually consists of three lines:

- Upper Band: The Highest High over the past N periods.

- Lower Band: The Lowest Low over the past N periods.

- Middle Band (Optional): (Upper Band + Lower Band) / 2. This line is less critical than the upper/lower bands.

「Donchian Channels Structure: Capturing the N-Period High/Low Range」

How raw is it?

- Pure Price Action: Based entirely on actual highest highs and lowest lows, no smoothing, no statistical assumptions.

- Direct Reaction: As soon as a new high/low is made within the lookback period, the corresponding band immediately adjusts.

- Visually Clear: Clearly shows the price range of the recent past.

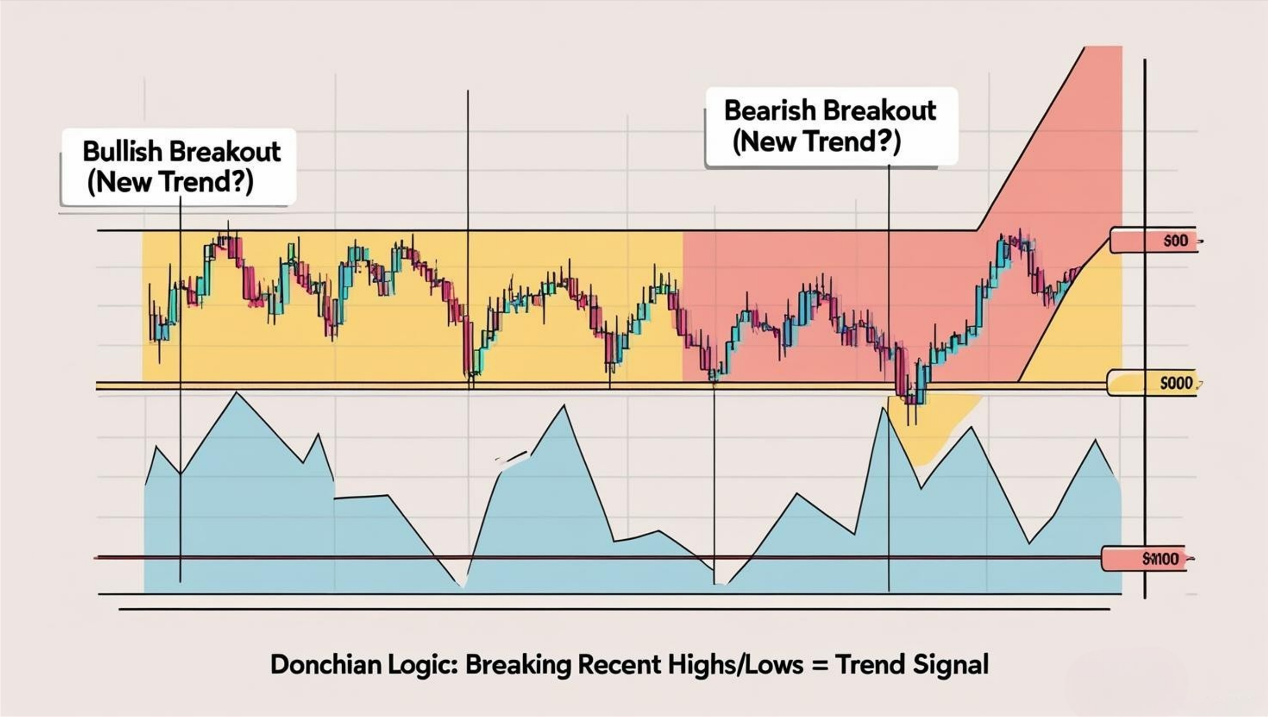

Donchian Channels’ Origin Story & Design: Breakouts Are King!

Richard Donchian was a pioneer of trend-following strategies. His core trading philosophy was: Catch the trend, follow the trend, until the trend reverses. He needed a simple, reliable way to identify trend initiation (breakouts) and potential exit points.

- Design Philosophy:

- Breakout = New Trend Signal: He believed that when price could break above the highest high of the recent past (N periods), it was a strong signal of a potential new uptrend starting. Conversely, a break below the lowest low signaled a potential new downtrend. This formed the basis of the classic “Donchian Breakout System.”

- Channel = Potential Stop/Reversal: The opposite band (e.g., the lower band when long) could serve as a potential stop-loss reference or a warning that the trend might be reversing.

- The Core Idea: Breaking the Recent Range = Display of Force! Being able to push price beyond the recent highs/lows demonstrated sufficient buying/selling pressure to fuel a new direction.

「Donchian Logic: Breaking Recent Highs/Lows = Trend Signal」

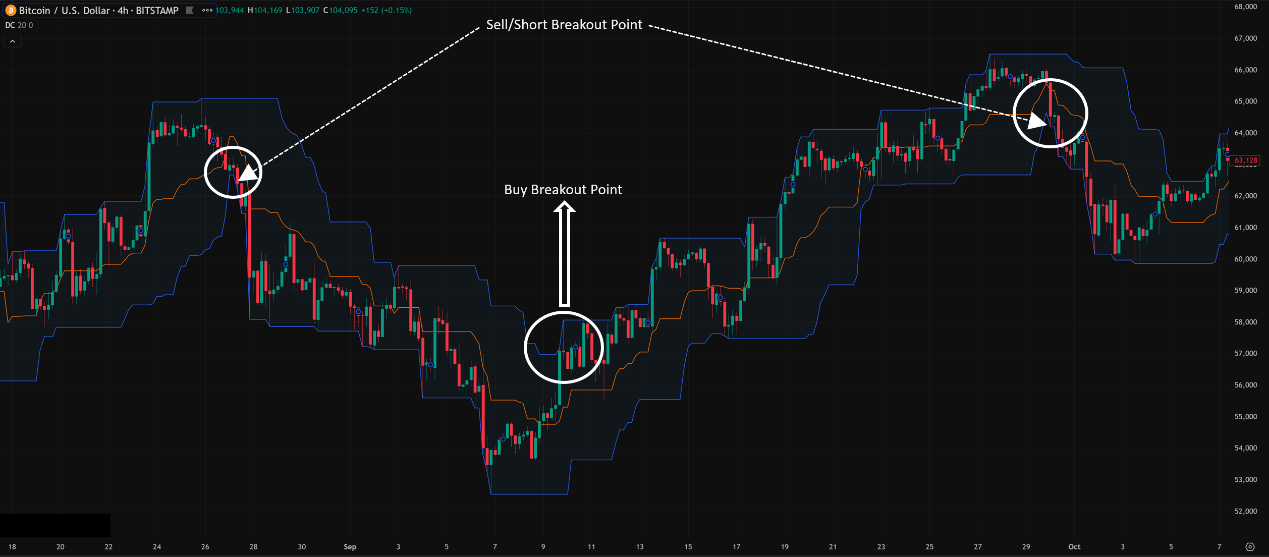

Donchian Channels Basic Plays (Beginner’s Breakout 101):

The core, classic use of Donchian Channels is the breakout strategy!

- Classic Donchian Breakout System:

-

- Buy Signal: When price breaks above the Upper Band (makes a new N-period high) → Buy.

- Sell/Short Signal: When price breaks below the Lower Band (makes a new N-period low) → Sell or Go Short.

- Stop Loss / Exit:

- For Longs: Exit (or reverse to short) when price breaks below the Lower Band.

- For Shorts: Exit (or reverse to long) when price breaks above the Upper Band.

- This is a very pure trend-following system! Its goal is to catch major trends, ignoring short-term noise.

「Classic Donchian Breakout System: Entry/Exit Rules」

2. Channels as Dynamic S/R? (Less Common, Different Concept):

-

- Don’t treat Donchian Channels like BBands for counter-trend S/R plays! Because they are based on actual highs/lows, price touching a band usually signifies trend strength, not a reversal point.

- Only in very clear, long-term ranging markets might the upper/lower bands offer some range trading reference, but that’s not their primary designed purpose.

Donchian Channels Advanced Plays (Pro Level – Trend Hunters):

- Combining with Trend Filtering (Crucial!):

-

- The pure Donchian breakout system generates lots of whipsaws (false breakouts) in ranging markets!

- Solution: Add a long-term trend filter! E.g., use a long-period Moving Average (like 100/200 SMA or EMA).

- Rule: ONLY consider buy signals from Upper Band breakouts when price is above the long-term MA.

- Rule: ONLY consider sell/short signals from Lower Band breakdowns when price is below the long-term MA.

- Effect: Filters out a huge number of false breakouts against the major trend, significantly improving win rate!

「Donchian + Long-Term MA = Trend Filtered Breakouts」

2. Using the Middle Band (Pullback Reference):

-

- In a strong uptrend (price consistently above middle band), brief pullbacks towards the middle band might offer trend-following add-on opportunities if support holds.

- In a strong downtrend (price consistently below middle band), brief rallies towards the middle band might offer trend-following add-to-short opportunities if resistance holds.

- Note: The middle band is just the average of the bands, its S/R strength isn’t as robust as a Kijun-sen (Ichimoku) or a reliable MA. Use as reference only.

3. Channel Width Changes (Similar to BBW, Different Meaning):

-

- Observe the distance between the upper and lower bands:

- Channel Widening: Usually signifies increasing volatility, potentially accompanying trend acceleration.

- Channel Narrowing: Usually signifies decreasing volatility, market entering consolidation. While not a Squeeze, it might still precede a future breakout. However, the predictive power of a narrowing Donchian isn’t as strong as a BB Squeeze because it doesn’t incorporate standard deviation.

- Observe the distance between the upper and lower bands:

Donchian Channels Parameter/Timeframe Breakdown (Which N Catches the Trend?):

Core Parameter: Period (N)

- The core parameter for Donchian Channels is N! It determines how far back you’re looking for the highest high and lowest low.

- Default Parameter: The most common, classic default is 20!

- Why 20? 20 trading days roughly equals one month (4 weeks * 5 days/week). So, Donchian(20) captures “monthly high/low breakouts.” This is a common reference period for many medium-term trend strategies.

- Impact of Changing N:

- Shorter N (e.g., 10):

- Channel is narrower, reacts faster to short-term highs/lows. Breakout signals are more frequent.

- Use Case: Short-term traders might use this to try and catch trends earlier.

- Risk: Tons of false breakout signals! Will get chopped up badly in ranges.

- Longer N (e.g., 50, 55, 100):

- Channel is wider, reacts slower, requires breaking highs/lows over a much longer period for a signal.

- Use Case: Long-term trend traders might use this to filter out almost all short-term noise, aiming to capture only major, sustained trends. The classic “Turtle Trading” system used similar long-term channel breakout concepts.

- Risk: Extreme lag, entry points will be very late, potentially missing much of the trend. Stop distances can also be large.

- Shorter N (e.g., 10):

Parameter Settings Analysis & “Hottest” Combo Discussion:

- Is Period (20) Best? It’s the most standard, widely used setting, offering a good balance point, especially for capturing mid-term trend breakouts on Daily charts.

- Any More “Unique” / “Hottest” Combos?

- Combo 1 (Short-Term Speed): Donchian(10)

- Many short-term Day Traders or Swing Traders use 10 periods hoping for earlier entries.

- Usage: Primarily on H1 / H4 charts for intraday or multi-day breakouts. MUST be combined with strong trend filtering (e.g., long-term MA) and risk management!

- Effect: Faster entry, but many more false signals. Needs a higher win rate or reward/risk ratio to compensate.

- Combo 2 (Long-Term Turtle): Donchian(50) / Donchian(55)

- Inspired by the classic Turtle Trading rules (though their exact implementation differed slightly). Captures very long-term trends.

- Usage: Mainly on Daily / Weekly charts. Breakout signals are rare but often signify a very strong, potentially long-lasting trend. Requires immense patience and ability to withstand larger drawdowns.

- Effect: Win rate might be low (many breakouts fail), but the profit from catching one major trend can be huge.

- Combo 3 (Classic Variation – 4-Week Rule Adaptation): Donchian(20) for Entry, Donchian(10) for Exit

- An improvement suggested by Richard Donchian himself. Enter on a 20-period breakout, but exit (or reverse) on a shorter 10-period breakout in the opposite direction. Aims to lock in profits quicker and reduce drawdowns.

- Combo 1 (Short-Term Speed): Donchian(10)

- Conclusion: The “hottest,” most effective combo depends on your goal:

- Standard Mid-Term Breakouts (Daily/H4): Use the default 20!

2. Faster Entry (Accepting More Whipsaws) (H1/H4): Try 10 (Filter Mandatory!)

3. Catching Massive Trends (Daily/Weekly): Try 50/55 (Patience Required!)

4. Optimizing Exits: Explore the 20 Entry / 10 Exit strategy.

-

- The Key: Understand the time implication of different N values!

Timeframe Analysis:

- All Timeframes Applicable! But N value and strategy must match!

- Ultra Short-Term (M1, M5, M15):

- Use ultra-short N (e.g., 5-10). Breakouts will be extremely frequent, very noisy. Usually only suitable as breakout confirmation combined with other conditions for scalping.

- Intraday / Short Swing (H1, H4):

- Common usage zone! Use N=10 or 20. Trend filtering is essential! Catch the start of intraday or multi-day trends.

- Swing / Long-Term (Daily, Weekly):

- Classic application scenario! Use N=20 (standard) or N=50/55 (long-term). Signals fewer but more reliable, capture major trends.

「Donchian Timeframes: Longer = More Meaningful Breakouts」

Summary: Which Unique Parameter Combo + Timeframe is Hottest & Most Effective? How to Use It?

- Parameters: 20 is the classic balance point. 10 (shorter) / 50-55 (longer) / 20-in-10-out are common variations.

- Timeframe: Daily/H4/H1 are common zones. Weekly for long-term. M15 or lower very noisy.

- Hottest / Most Effective Usage = Trend Filtering + Breakout Execution + Risk Management:

- Core Strategy: Trend-Following Breakouts! Use a long-term MA (e.g., 100/200) to filter direction, only take Donchian breakouts aligned with the major trend.

- Match N to Your Goal: Use N appropriate for the trend duration you want to capture (20 for mid-short, 10 for shorter, 50+ for long).

- Strict Stop Loss / Reversal! Cut losses quickly if a breakout fails, or follow the reversal signal based on the opposite band break. The Donchian system inherently includes a reversal mechanism.

- Don’t Use it to Pick Tops/Bottoms! It follows trends, doesn’t predict reversals.

- Understand It Loses in Ranges! That’s the nature of trend-following systems – multiple small losses are traded for occasional large wins.

Donchian Channels: The Purest Trend Breakout “Boundary Lines”

With its extreme simplicity and pure price-action basis, Donchian Channels became a cornerstone of trend-following trading. Its pros:

- Simple and Intuitive, easy to understand and execute.

- Objective, based entirely on actual highs/lows, no subjective judgment.

- Effectively Captures Trend Breakout Points.

- Built-in Stop Loss / Reversal Mechanism.

Cons:

- Performs Poorly in Ranging Markets, generating many false breakouts (Filtering is MANDATORY!).

- Lagging, especially with longer N periods.

- Entry Points Might Not Be Optimal (price has already moved away by the time breakout occurs).

「Donchian Channels: The Natural Boundaries of Trend」

Donchian Channels are a timeless, classic weapon. For traders wanting to learn pure trend following or build objective breakout systems, they are an excellent starting point and core tool.

Next Steps:

- Add Donchian Channels (use default 20) to your H4 and Daily charts.

- Observe how price interacts with the upper/lower bands, especially at breakout moments.

- Add a long-term MA (e.g., 100 or 200 SMA) as a trend filter and see how many false breakouts it helps avoid.

- Try different N values (e.g., 10 vs. 20 vs. 55) to feel the change in channel width and breakout frequency.

- Backtest! Test breakout strategies with different N values, combined with trend filtering, and analyze historical performance.

Hope you become trend masters and catch every breakout wave!🏄♂️📈📉💨