Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

Here we go again. Yesterday, several “authoritative” investment banks upgraded their forecasts for the semiconductor industry, citing “stronger-than-expected” demand for AI chips and an “impending supercycle” in the memory market. 🤯 Instantly, financial news apps lit up with push notifications, all screaming headlines like “Semiconductor Stocks on the Move! Top Analyst Picks!” Retail investor forums erupted in a chorus of excitement, with everyone suddenly acting like seasoned experts, debating which company has the most “reasonable” P/E ratio or the most “promising” technology. It’s laughable, and frankly, pathetic. While you’re getting hyped up over this meticulously crafted “Official Story” from Wall Street, the real players—the “Navigators”—have already read the next chapter of the script on the charts. This news? It’s nothing more than the last handful of breadcrumbs scattered for the sheep before the shearing begins. 😴

Alright, let’s put on the “fundamental investor” hat for a moment and perform the perfunctory ritual of analyzing why Lam Research (LRCX) and its playground, the semiconductor equipment industry, are supposedly such a “compelling” investment.

The Macro Narrative: The “Can’t-Lose” Gold Rush

According to the standard playbook, semiconductors are the “new oil,” and equipment makers like Lam Research are the ones “selling the drills and shovels.” The argument is seductive: no matter which country or company wins the race in AI, electric vehicles, 5G, or cloud computing, they all need chips. And to produce those chips, they must buy equipment from Lam Research, Applied Materials (AMAT), ASML, and their peers. The “Official Story” tells you that investing in LRCX isn’t a bet on a single company; it’s a bet on the future of human technology. Market research firms project the global semiconductor equipment market to surpass $200 billion by 2030, growing at a “robust” CAGR of over 9%. Sounds like a sure thing, doesn’t it? Just buy and hold, and let the good times roll. 🤦

The Three Titans: A Battle of Gods, A Trap for Mortals

In this oligarchic market, each major player has its officially assigned role:

Achilles’ Heel: Customer Concentration. LRCX derives a huge portion of its revenue from a handful of major memory manufacturers like Samsung, Micron, and SK Hynix. This means that when the memory market enters a downturn or a key customer slashes capital expenditures, Lam’s earnings take a disproportionately massive hit. Its fate is inextricably tied to the volatile boom-and-bust cycle of the memory industry.

Okay, we’ve laid it all out. Compelling, right? You feel like you’ve got a handle on the industry’s very soul.

But does any of this actually matter?

All this talk of “macro trends,” “economic moats,” and “Achilles’ heels” is based on past data and public information. It’s a beautifully polished “rear-view mirror.” It gives you a crystal-clear view of the wall you just crashed into, but it tells you absolutely nothing about the hairpin turn just ahead. Wall Street analysts are master craftsmen who specialize in decorating these rear-view mirrors. They write 10,000-word reports and build complex financial models for one purpose only: to create a plausible explanation for a price move that has already happened.

Consider this “thought experiment”: On Monday, the news breaks that a key LRCX customer is slashing capital spending due to high inventory. The fundamentalists see this, panic, and sell. The stock tanks 8%. On Wednesday, LRCX stock suddenly sees massive volume at the lows and stages a V-shaped reversal, closing up 6%. It’s not until Friday that “market chatter” emerges about a massive long-term procurement deal signed between LRCX and a sovereign wealth fund betting on AI infrastructure. See the pattern? The news (the breadcrumbs) is always the last to arrive. By the time the bad news is out, the bottom might already be in. By the time the good news is announced, the smart money might be using the ensuing rally to sell their positions. In this chaos, only one thing tells the truth: the chart. That long-tailed candle on Wednesday, printed on enormous volume, was the “footprint” of capital. It told you, in the most honest language possible, that big money was stepping in. That signal was two days ahead of the news and a million times more accurate than any analyst report.

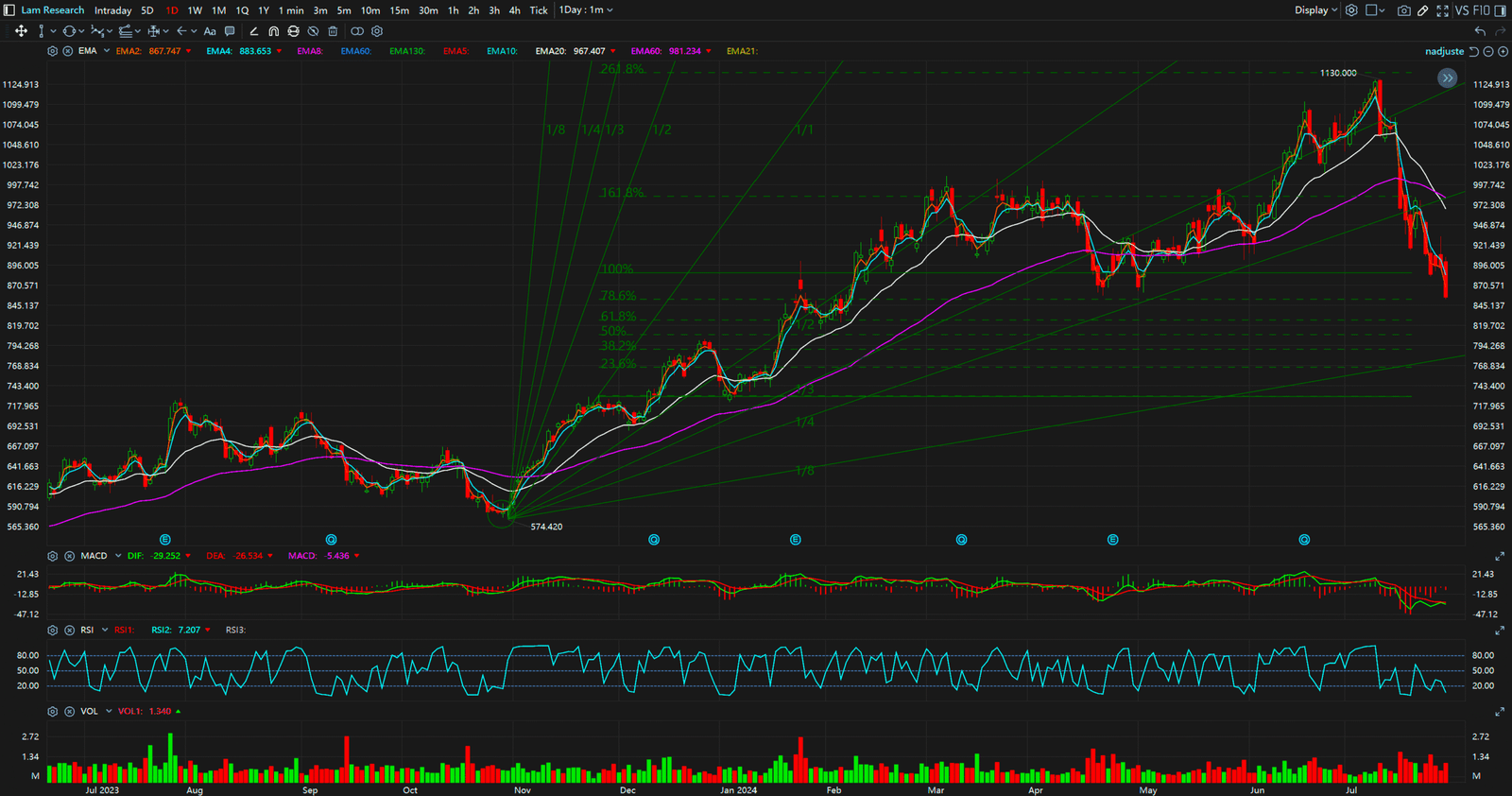

The Brutal Truth on the Charts: The Script for LRCX

Forget the earnings reports. Forget the analysts. Now, we open the only map of truth—the chart—to dissect the price action of LRCX over the last 18 months. You are about to see a meticulously executed script of accumulation, markup, and distribution.

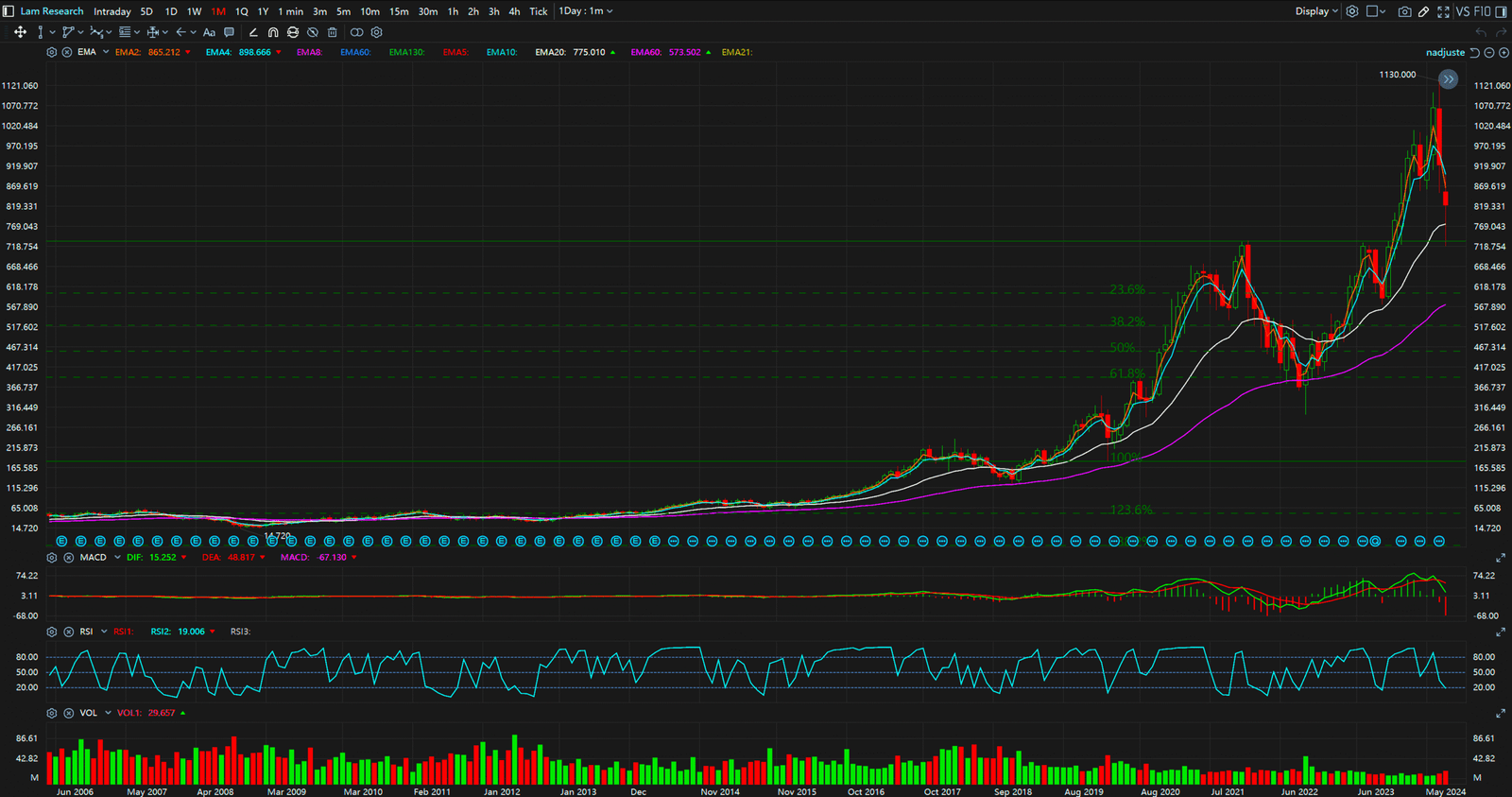

Act I: The Macro Script (Monthly Chart) – Establishing the Long-Term Trajectory

First, pull up the monthly chart. What we see is a long-term ascending trendline (Point A) originating from the 2020 lows and extending to the present. This line is the “lifeline” of LRCX. During the 2022 bear market, even after a gut-wrenching 50%+ correction, the price found its ultimate support right around this trendline before launching its next major bull run. This is not a coincidence. This is the consensus of macro capital—as long as LRCX’s price remains above this line, the long-term script is “up.” Any dip towards this line is interpreted as a “loading opportunity,” not an “apocalypse.” This is the fundamental difference between a Navigator’s macro perspective and a sheep’s, who wets their pants over daily fluctuations.

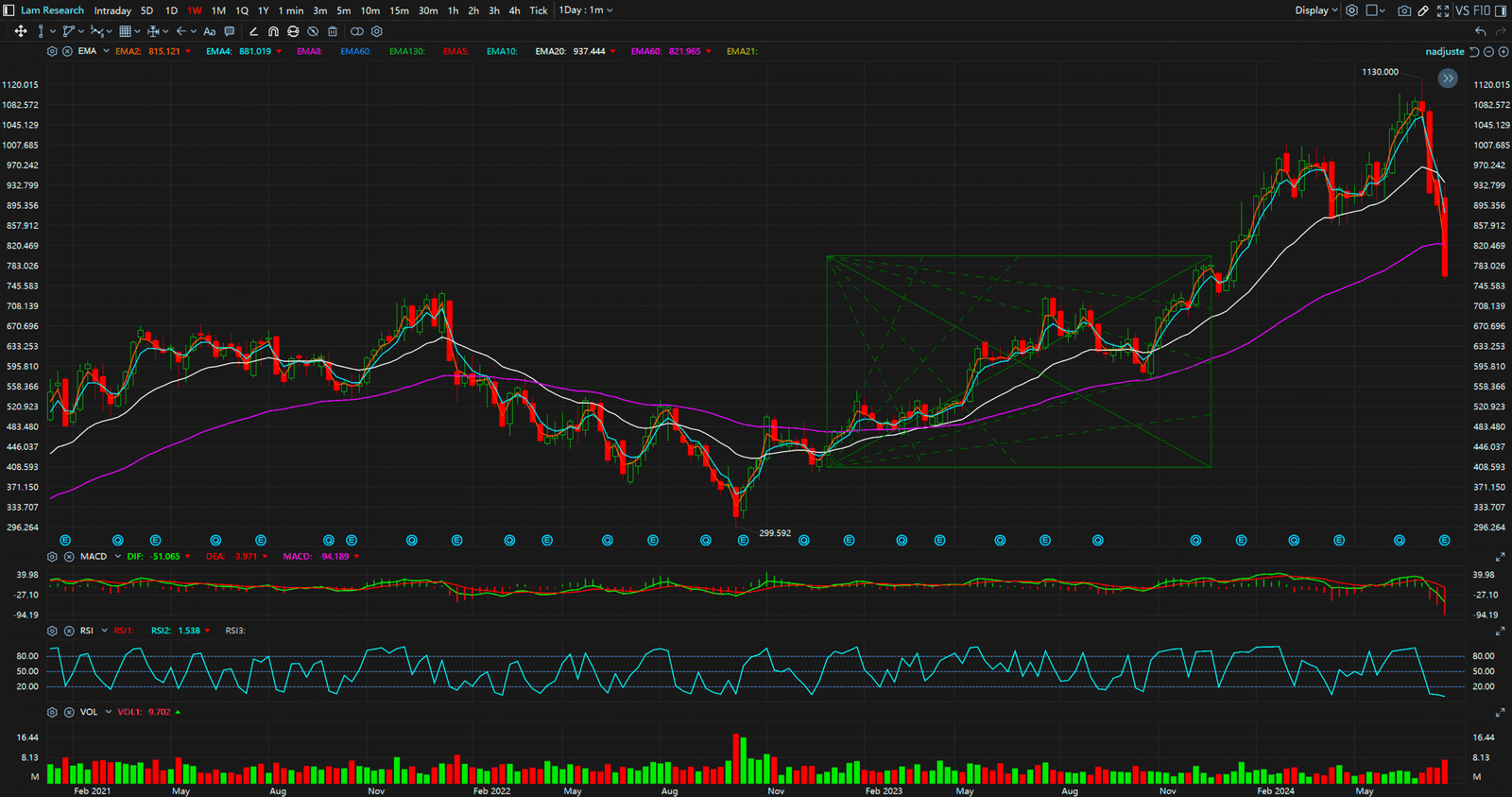

Act II: The Strategic Setup (Weekly Chart) – The Accumulation Zone & Relative Strength

Next, we zoom into the weekly chart, where the plot thickens. Notice that for most of 2023, LRCX’s price was contained within a massive rectangular range (Zone B). A fundamentalist would call this a “holding pattern pending better earnings” due to the memory market slump. In our world, this is a textbook “accumulation range.”

Act III: The Tactical Execution (Daily Chart) – Weaponizing News to Engineer Fear and Greed

The daily chart is the battlefield where capital executes its tactics. We can find countless examples of news being used to fleece the retail crowd.

The Future Script: Key Battleground Levels

Synthesizing this analysis, the script for LRCX is crystal clear. The long-term uptrend remains intact, but the stock has entered a short-term distribution or high-level consolidation phase. The next critical moves will revolve around the following price zones:

The Navigator’s strategy is simple: we watch for the “footprints” of capital re-entering at the core support zone. We watch for the “churn” of distribution at the overhead resistance. We don’t guess tops or bottoms. We simply follow the real-time flow of money. This method of analysis is the only map that matters. Everything else is just noise.

After seeing the footprints of capital, do you still care about the next earnings forecast? Do you still listen to an analyst’s “price target”?

This market has never been a level playing field. It’s a zero-sum game, with the map-reading “Navigators” on one side and the news-reading “sheep” on the other. While the sheep are busy debating which patch of grass (fundamentals) looks greener, the Navigators have already used their map (the chart) to locate the next water source. The “Official Story” from Wall Street is the opium designed to keep you docile and content, ready for the shearing.

Wake up. Stop being a passive recipient of information. Your financial destiny should not be dictated by a press release, an earnings report, or a so-called “expert” analyst. True power comes from your ability to read the market for yourself. Want to learn the “real rules of the game”?

Want to evolve from a sheep, destined for slaughter, into a Navigator who controls their own destiny? Visit our website now and learn to read the only source of truth in the market—the chart. It is the only survival skill you will ever need in the brutal arena of finance.

Sources:

Monthly Timeframe (Lam Research)

Weekly Timeframe (Lam Research)

Daily Timeframe (Lam Research)