Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend

Jesse Livermore – 1923

“Manufacturing is coming back to America!” “Supply chain reshoring is creating local jobs!” These slogans sound inspiring, don’t they? Politicians proclaim them on television, and financial news headlines shout them from the rooftops, heralding a second spring for American industry. And so, the sheep flock to see which companies will benefit from “re-industrialization.” They dive headfirst into the financial statements of companies like Rockwell Automation (ROK), studying their order growth, profit margins, and management’s “guidance” on the outlook. 😴 Do you really think billions of dollars of capital move because of a politician’s speech? Do you truly believe a quarterly earnings report can tell you how factories will operate a year from now? 🤦 This is all a well-staged theatrical performance, and the news and financial reports are just the program notes handed out to the audience. The real script is never printed on them.

First, let’s look at what’s written in these “program notes.”The “Official Story” tells us that industrial automation is the core of the Fourth Industrial Revolution, a market of immense scale. According to data from MarketsandMarkets, the global industrial automation market is projected to grow from $170 billion in 2023 to over $250 billion by 2028. In this revolution, three major forces are at play:

This analysis sounds professional, doesn’t it? But its value is the same as last week’s weather forecast: zero.

After you’ve studied ROK’s product lines and analyzed Siemens’ global footprint, what’s next? Your decision is still based on a collection of things that have already happened. You are looking into a beautifully polished “rear-view mirror.” The image is clear and brilliant, but it’s forever pointed backward.

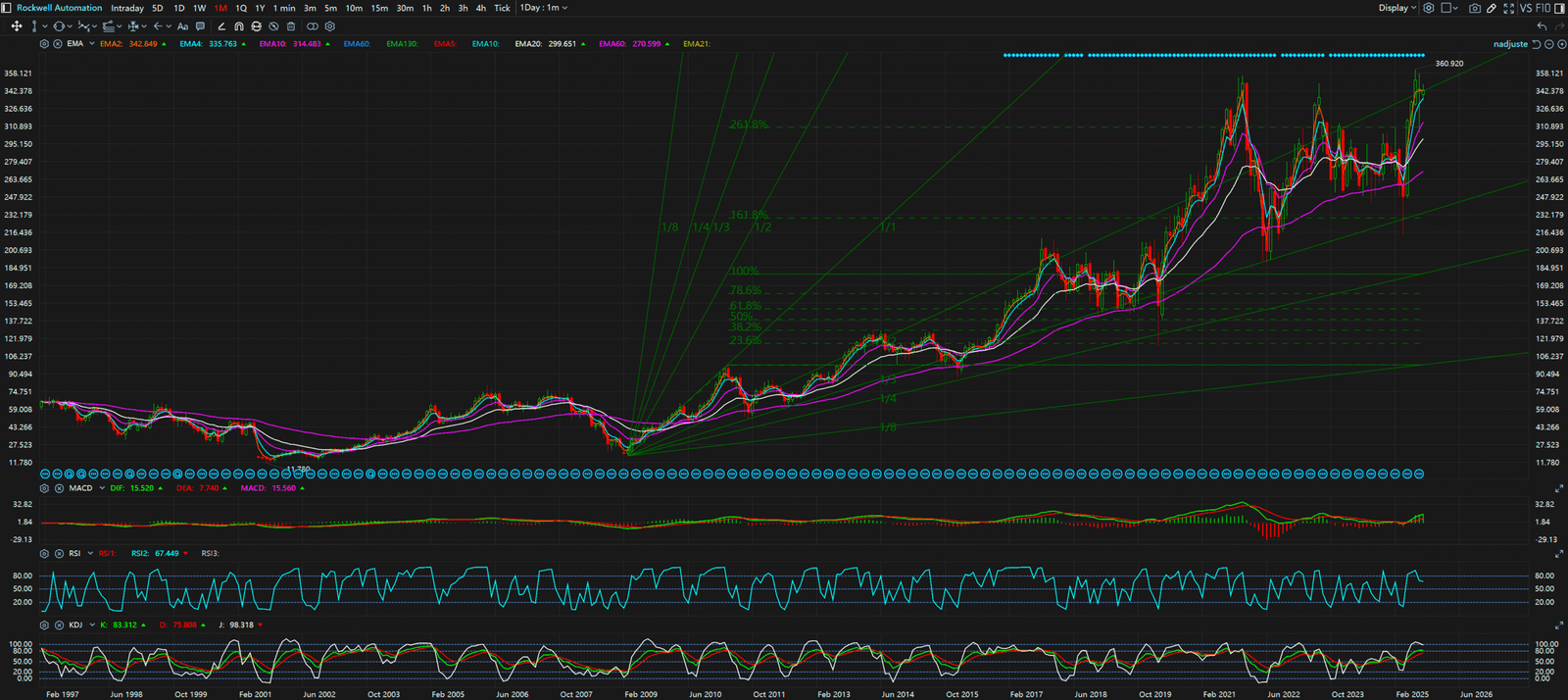

Let’s conduct a thought experiment: On Wednesday, the news breaks that a major U.S. automaker is investing $10 billion in automating its EV factories over the next five years. Analysts immediately publish reports stating that ROK, as the North American market leader, will “significantly benefit,” and its price target is raised. The herd rushes in, and the stock jumps 3%. You think you’ve caught a rocket. But what you don’t know is that six weeks ago, on ROK’s daily chart, the price, after a long period of consolidation, suddenly saw three consecutive days of massive volume on up-moves, cleanly breaking through a key resistance level. These were the “footprints” of capital flow. This signal told us that the “smart money”—perhaps a fund with inside knowledge from the automaker, or a Navigator who saw the whole industry trend—had already made its move. They didn’t buy because of the news; their buying is why the news was released. When you rush in on the headlines, you are only providing the fuel for their profitable exit.

The chart is the only truth. Every candlestick, every volume bar, every touch of a trendline is an “EKG” of market sentiment. It doesn’t lie. Earnings can be “managed,” news can be “guided,” but the real-time flow of billions of dollars cannot be hidden. These footprints form the only “map” that can forecast the future.

There are only two kinds of people in the market: Navigators, who read the map and plan their course, and Sheep, who graze with their heads down, following the herd.

Navigators know the “Official Story” is just noise designed to confuse the masses. Their decisions are based solely on the cold, objective data from the charts—price, volume, and trend. They position themselves before the news breaks and exit when the public celebrates. The sheep do the opposite. They chase headlines, believe analysts, and stake their hard-earned money on lagging, often manipulated, information. Their fate is never in their own hands.

What you’ve seen today is just the tip of the iceberg. To truly master these “rules of the game,” you need a complete methodology. Do you want to continue being a sheep, led to the slaughter? Or do you want to become a Navigator, in control of your own financial destiny?

The choice is yours. Visit our website now to learn how to read the market’s true language and find the only signal that matters amidst the noise. Stop chasing breadcrumbs. It’s time to start drawing your own map.

Source:

Monthly Chart – Rockwell Automation (ROK)

Daily CHart – Rockwell Automation (ROK)