The stock market is never obvious. It is designed to fool most of the people, most of the time.

Jesse Livermore – 1923

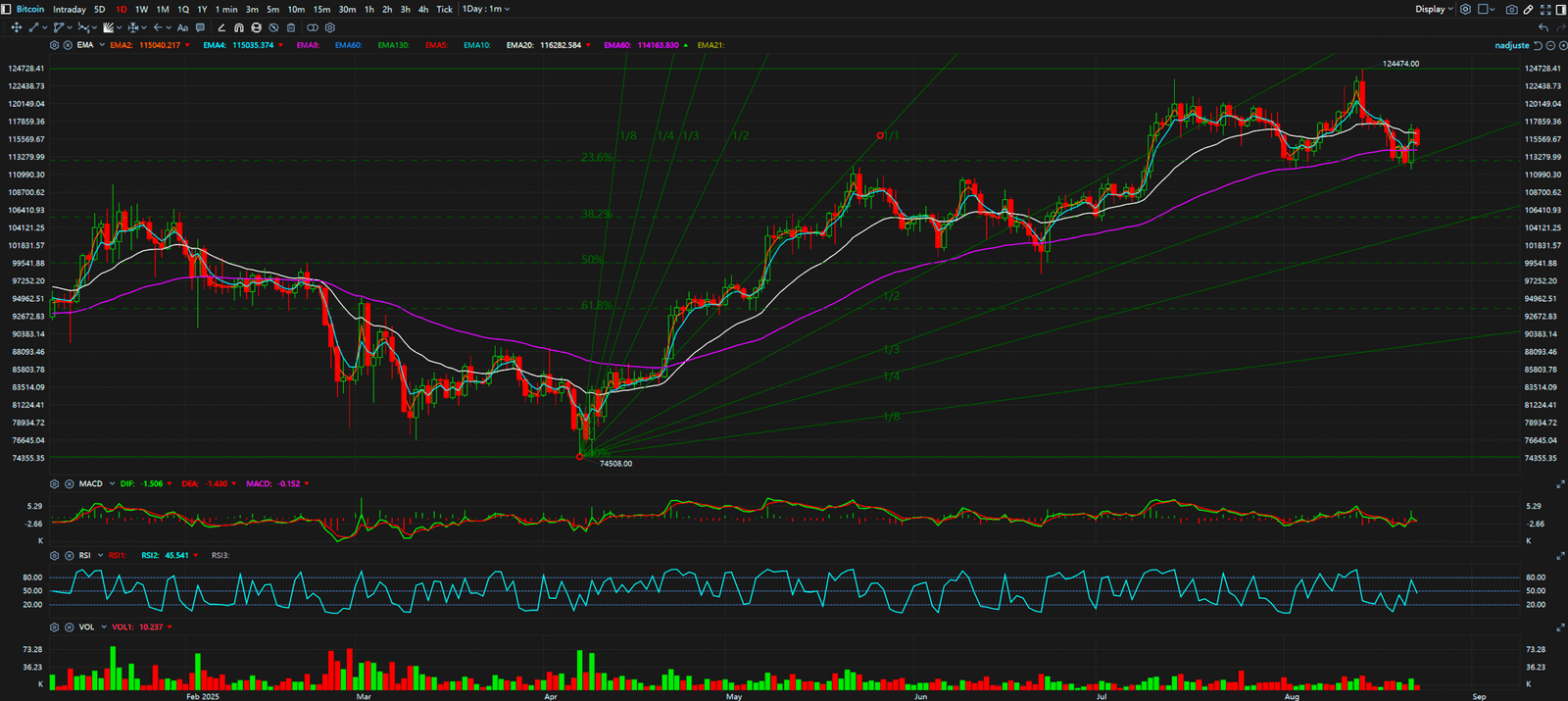

Bitcoin is currently locked in a tense standoff, holding steady around the $113,000 mark. While on the surface, this stability might seem like a sign of strength, a deeper look at on-chain data and the macroeconomic landscape reveals a sharp conflict. A significant Bitcoin whale has resurfaced after seven years of dormancy, signaling potential accumulation by smart money. However, this bullish sign is contrasted by the market’s anxiety over the upcoming Jackson Hole symposium, where a hawkish stance from the Federal Reserve is widely anticipated. This sets up a classic battle between internal bullish conviction and external bearish pressure.

Top Stories at a Glance

The Bull Case: The Silent Whale’s Statement The crypto world was stirred by the news of a long-dormant Bitcoin whale moving a substantial amount of BTC. This kind of activity, especially after such a long period of inactivity, is often interpreted as a sign of accumulation by sophisticated investors who are bullish on the long-term prospects of Bitcoin. This “smart money” is seemingly unperturbed by the short-term noise and is using this period of consolidation to build up their positions. This on-chain activity provides a strong undercurrent of bullish sentiment, suggesting that those with deep pockets are confident in Bitcoin’s future.

The Bear Case: The Shadow of the Fed In stark contrast to the bullish on-chain signals, the macroeconomic environment is casting a long shadow over the crypto market. All eyes are on the upcoming Jackson Hole symposium, where the Federal Reserve is expected to maintain a hawkish tone. Any indication of continued aggressive monetary policy to combat inflation could strengthen the dollar and put downward pressure on risk assets like cryptocurrencies. The fear is that another rate hike or hawkish forward guidance could be the catalyst that breaks the current stalemate to the downside.

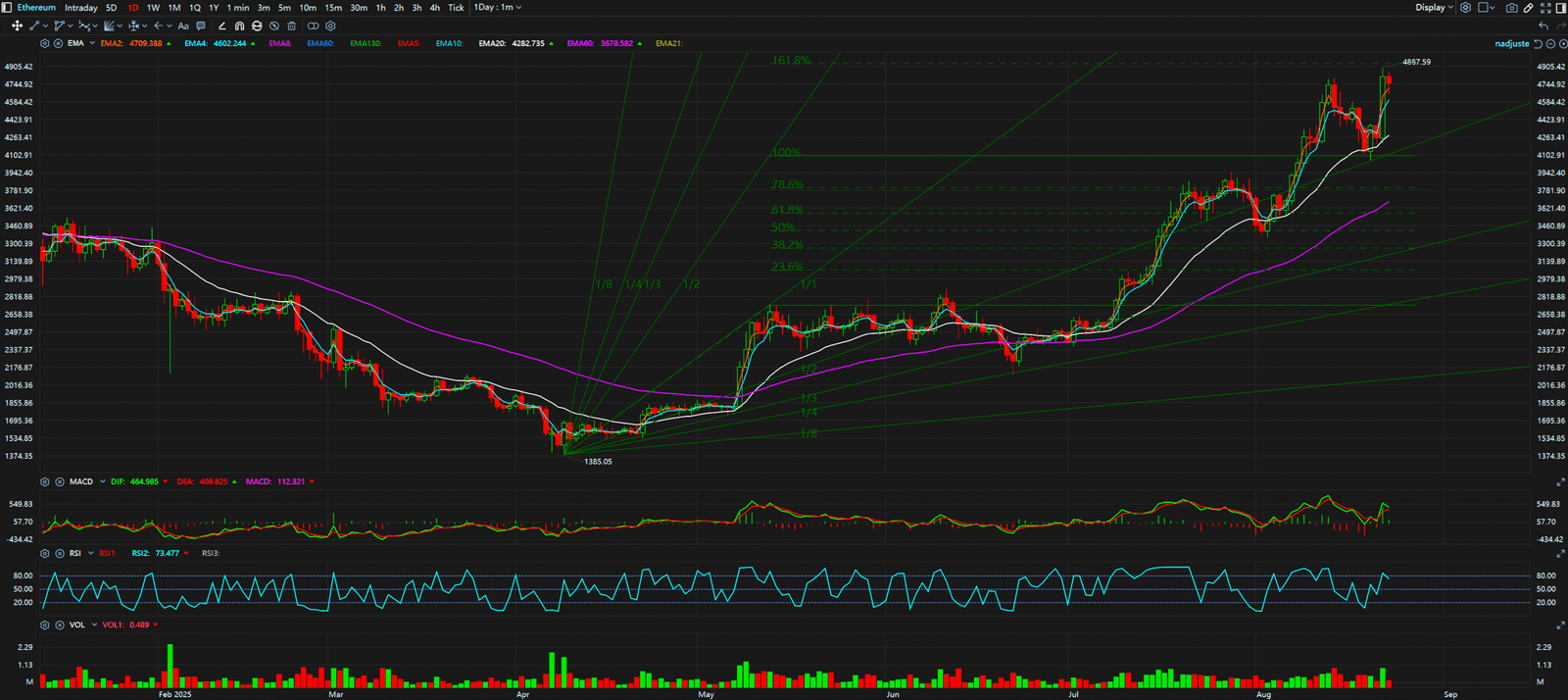

Ethereum’s Role in the Current Climate Ethereum, the second-largest cryptocurrency, is also in a precarious position. While it has its own set of fundamental drivers, such as the ongoing development of its ecosystem, it is not immune to the broader market sentiment. ETH is currently trading in a tight range, mirroring Bitcoin’s price action. A hawkish Fed would likely impact ETH as well, but its strong ecosystem and the growth of DeFi and NFTs could provide some level of support. A decisive move in Bitcoin will likely dictate the short-term direction for ETH and the rest of the altcoin market.

Key Takeaways

The current market is a coiled spring, ready to move decisively in one direction. The conflict between bullish on-chain data and a bearish macroeconomic outlook has created a period of high tension and uncertainty. The key levels to watch for Bitcoin are the immediate support at $110,000 and the resistance at $115,000. A break below support could trigger a sell-off, while a break above resistance could signal a continuation of the uptrend.

For a deeper dive into the technical analysis and to see how these conflicting signals are playing out on the charts, visit www.chart-blitz.com.

True trading advantage comes from interpreting these conflicting signals. To learn how to apply a professional-grade analytical framework to decode the market’s real intentions, visit www.chart-blitz.com to explore our exclusive chart breakdowns and models.

Sources:

- https://www.coindesk.com

- https://finance.yahoo.com/topic/crypto

- https://www.cnbc.com/cryptoworld

- https://www.theblock.co

Unlocking Technical Analysis: Power Moves with Diagrams

Daily Timeframe for Bitcoin

Daily Timeframe for Ethereum