Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

Here we go again. Yesterday’s financial headlines screamed, “Amazon AWS Quarterly Growth Slows, Sparking Market Concerns,” and immediately, a parade of so-called “experts” began pontificating on television about market saturation, intensified competition, and shrinking corporate IT budgets… It’s enough to make you fall asleep 😴. Retail investors are watching a pre-scripted stage play, with actors emoting on cue, while the audience follows along—getting tense, fearful, and then hastily making buy or sell decisions. It’s the same show, different day. Aren’t you tired of it? 🤦 The most absurd part is that by the time this “news” reaches you, the real institutional players may have already positioned themselves days, or even weeks, ago, based on the subtle clues on the price chart. What you’re reading is nothing more than the breadcrumbs they left for you after they’ve finished their feast. 🤯

Wall Street’s greatest talent is storytelling. The “official story” they want you to believe usually goes something like this:

The cloud computing market is, without a doubt, the most critical technology race of the next decade. According to Gartner, worldwide end-user spending on public cloud services is forecast to grow from $591.8 billion in 2023 to $724.6 billion in 2024, a staggering 22.4% increase. By 2027, this figure is projected to surpass the $1 trillion mark. This is a golden playground, and it’s making all the tech giants drool.

On this battlefield, there are three main players:

👑 The King: Amazon Web Services (AWS)

⚔️ The Challenger: Microsoft Azure

🐘 The Old Giant: Google Cloud Platform (GCP)

This is the story Wall Street wants you to follow: a dramatic, three-kingdom saga full of twists and turns, requiring you to constantly track news and analyze earnings reports to make “informed” investment decisions.

But does any of this actually matter?

You spend dozens of hours studying the information above, feeling like you’ve become an industry expert. But think about it: what part of this “information” isn’t already public? What part hasn’t already been digested, analyzed, and priced in by Wall Street analysts? By the time you feel confident about the cloud market after reading a Gartner report, institutional players might have already been quietly distributing their shares in an overbought zone on the chart. By the time you panic-sell after reading news of AWS’s slowing growth, smart money might have already started accumulating shares at a key support level on the chart.

This fundamental analysis is like driving a car while only looking at the rear-view mirror. The scenery in the mirror is lovely, but it will never tell you whether to turn left or right at the next intersection. The chart, however, is your windshield, complete with a GPS. It doesn’t show you past “stories”; it shows you the present “facts” of capital flow—where the pressure is, where the support lies, when to accelerate, and when to brake. It’s all there in plain sight.

Let’s conduct a “thought experiment”:

Who is the real winner? The news is for the masses. The chart is for the enlightened. The “breadcrumbs” thrown by Wall Street are meant to distract you, allowing them to execute their pre-written “script” without being noticed.

In the brutal hunting ground of the financial markets, you have only two choices: be a sheep that reads the news, listens to stories, and gets led to the slaughter; or be a hunter who reads the map, tracks the footprints, and seizes control.

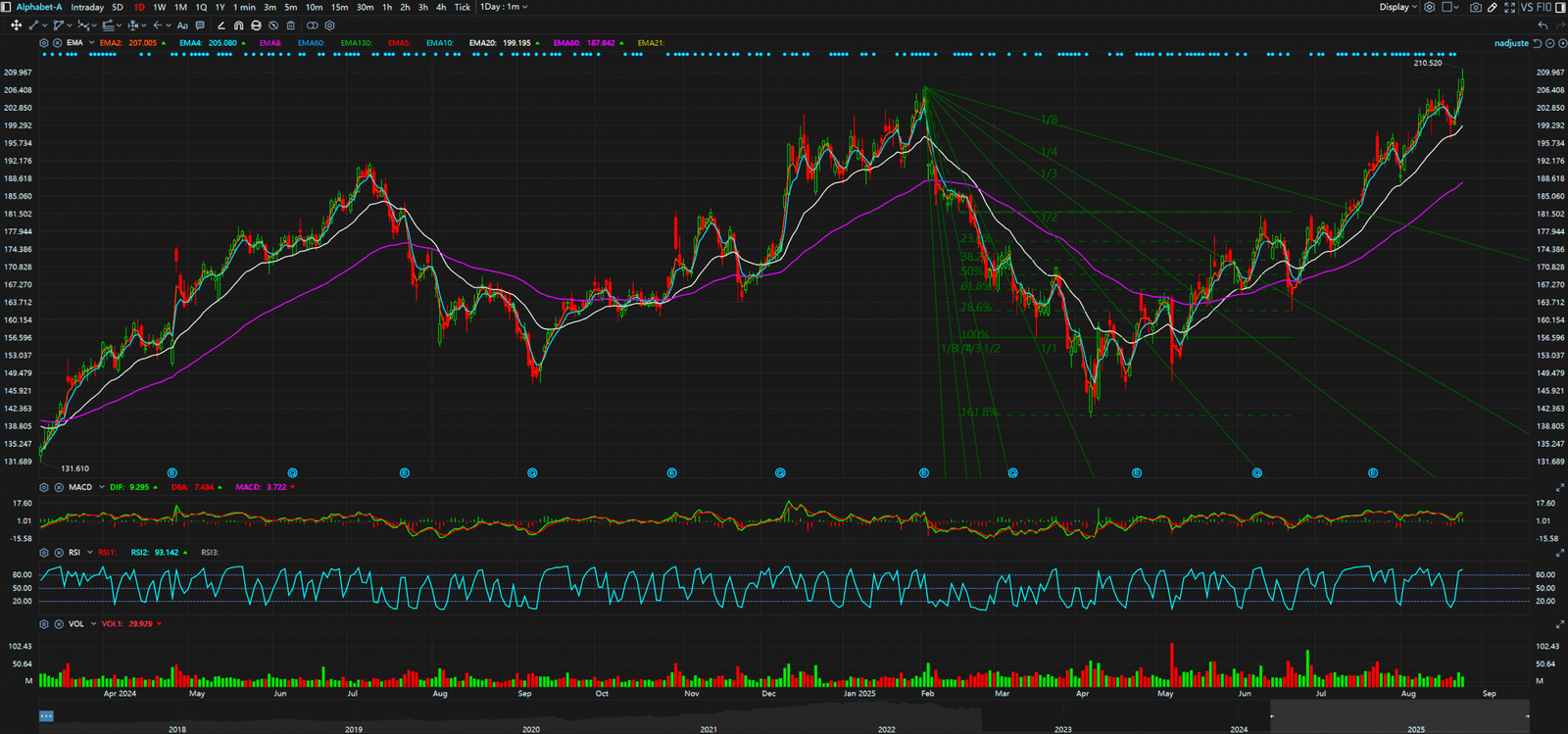

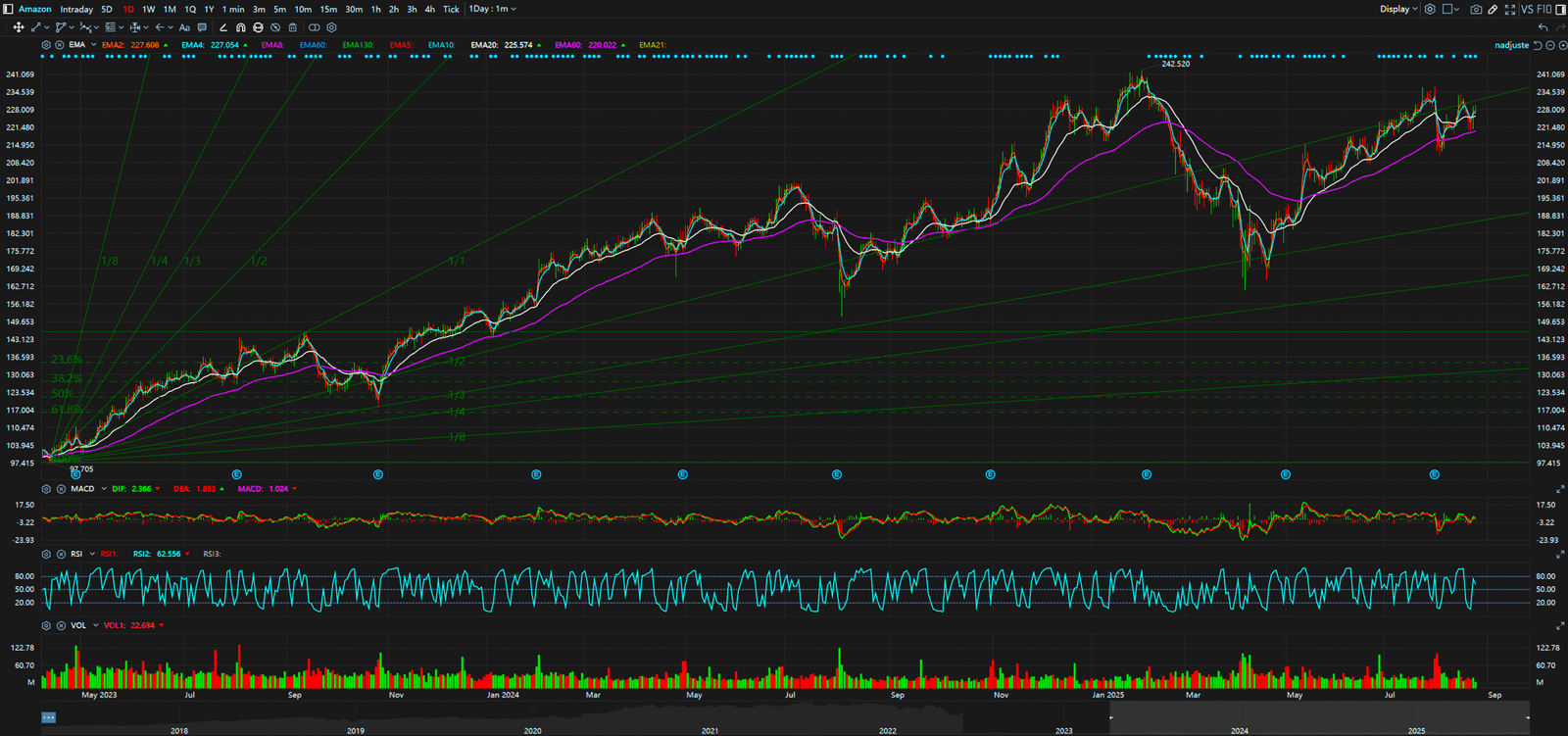

Forget the noise of fundamentals, macroeconomics, and expert forecasts. The only truth is etched in the candlesticks and volume bars. Those are the footprints left by real money, the unfiltered EKG of market sentiment. You don’t need to know if AWS’s growth is 12% or 15%; you only need to know if the uptrend on the chart is still intact. You don’t need to care how much market share Azure has stolen; you only need to care if the stock price has broken a critical support level.

Enough is enough. Stop being a docile sheep. It’s time to wake up and learn the real rules of the game. Instead of letting Wall Street’s “stories” dictate the fate of your hard-earned money, take control of your own destiny. Visit our website now to learn how to read the only map that matters—the chart—and become a true market hunter.

Sources:

Daily Timeframe (Amazon)

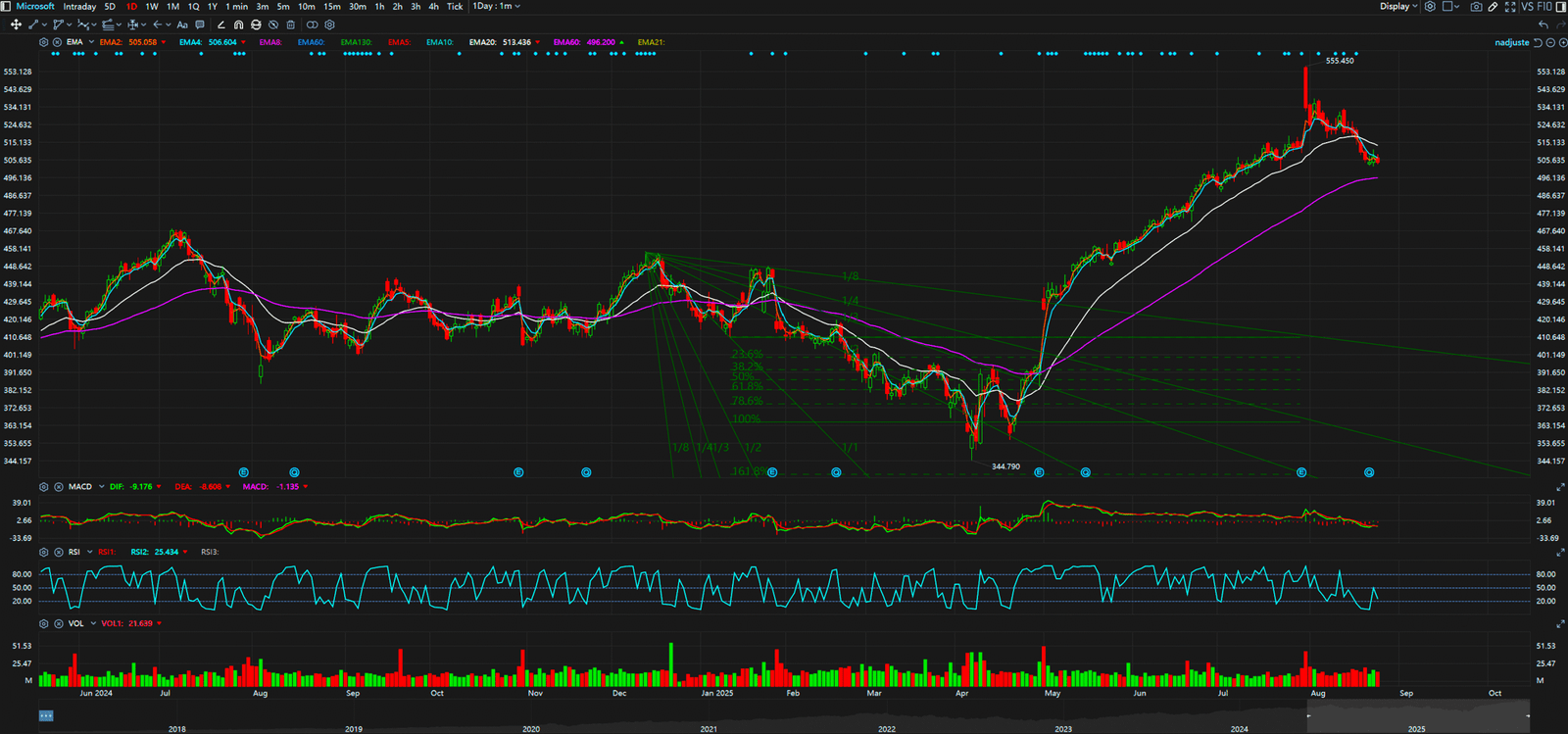

Daily Timeframe (Microsoft)

Daily Timeframe (Google)