Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend

Jesse Livermore – 1923

Here we go again. The financial media is once more flooded with the same tired clichés: “AI Revolution,” “Data Explosion.” Analysts, acting as if they’ve discovered fire, are breathlessly describing the “unprecedented” demand for data centers. They’re anointing Equinix (EQIX) as the “arms dealer of the AI era.” And retail investors, reading these headlines, feel that familiar tingle—the feeling they’ve just been handed the keys to the kingdom. 🤯 Are you getting ready to rush into the market, to finance Wall Street’s next big payday with your hard-earned capital? 😴 Wake up, sheep. By the time this “good news” reaches your screen, the real players are likely already planning their exit. 🤦

First, let’s dissect the narrative they’re feeding you. They construct a flawless growth story using a mountain of macroeconomic data and industry reports. According to Synergy Research Group, the global data center market is projected to expand at a CAGR of over 10% for the next five years, exceeding a $300 billion valuation by 2028. The drivers? AI model training, cloud computing, the Internet of Things (IoT), 5G—all demanding colossal amounts of data storage and processing power. This is the so-called “golden runway.”

On this runway, there are three main players:

After hearing all this “fundamental analysis,” do you feel like an expert? Do you feel you’ve grasped the entire industry landscape? That’s exactly how Wall Street wants you to feel. They hand you a stack of data, reports, and expert opinions—it’s like being on a high-speed train and someone hands you a detailed blueprint of the locomotive. The blueprint is beautiful, it’s intricate, but does it help you decide where to get off? Not at all. Because everything they are giving you is a view in the “rear-view mirror.”

This official story is, by definition, lagging information. When you read the news that Equinix signed a massive new contract and the stock pops, do you have any idea that the institutional players, who knew weeks in advance, positioned themselves months ago when the chart showed anomalous volume and a price breakout? Your “buy point” is very likely their “distribution point.” You think you’re buying growth; in reality, you’re just taking the baton in a relay race to the bottom.

Let’s run a thought experiment:

Who wins? The answer is self-evident.

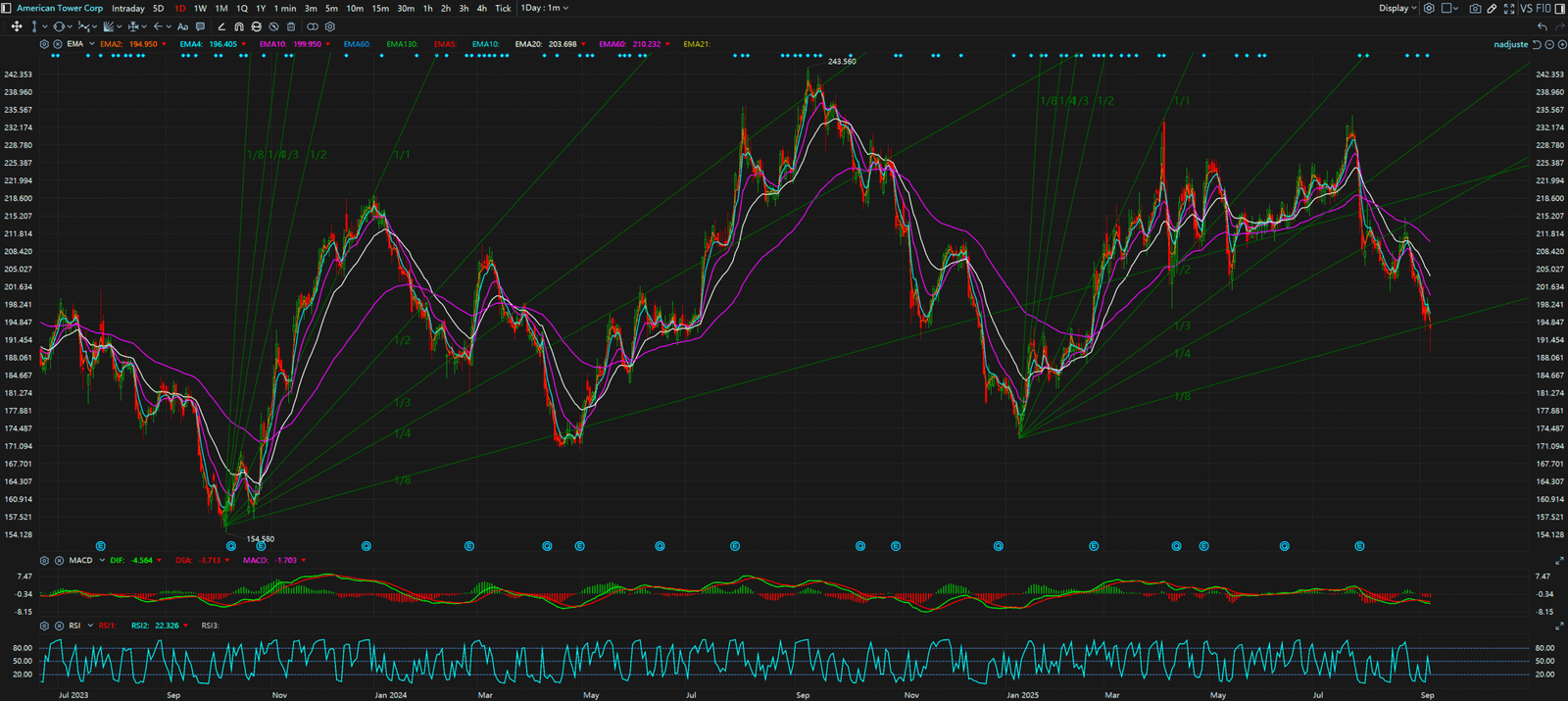

There are only two types of people in the market: the sheep who read the news, and the Navigators who read the charts. The sheep are destined for slaughter. They chase the “breadcrumbs” Wall Street sprinkles for them—earnings reports, news headlines, analyst ratings—playing a tragic role in a script that was written long before they showed up. The Navigators are the masters of the game. They don’t need to listen to the noise because they hold the only source of truth: the chart, the ECG of market sentiment, the literal map of money flow. What’s the story with Equinix? It doesn’t matter.

What matters is the story the chart is telling. Do you want to continue being a sheep, led to the slaughter? Or do you want to become a Navigator, in control of your own financial destiny? The choice is yours. Stop being hypnotized by the “Official Story” and come to our site to learn the real rules of the game. There are no fancy narratives here, only the brutal, honest language of the charts. Master it, and you can navigate your own course in this ruthless market.

Source:

Daily Chart – Equinix (EQIX)

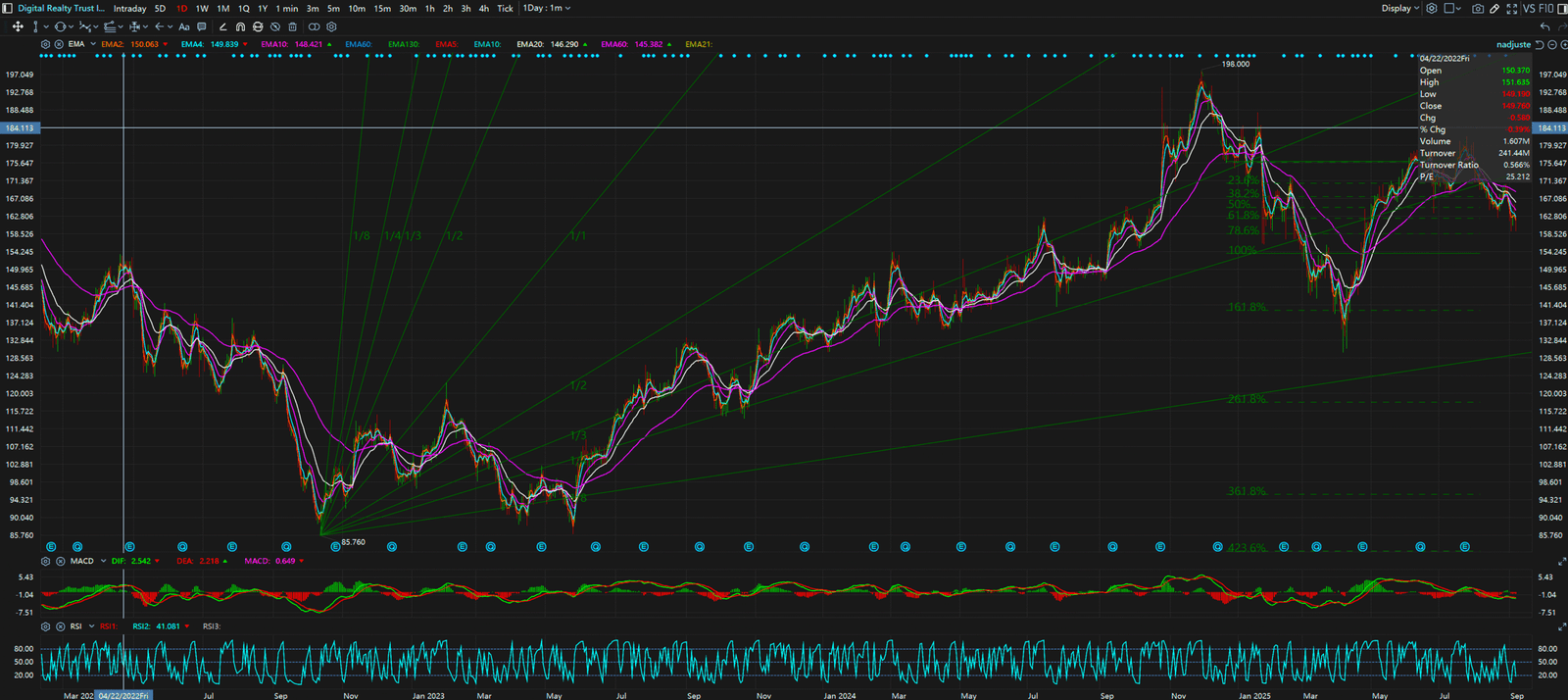

Daily Chart – Digital Realty (DLR)

Daily Chart – American Tower (AMT)