Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

Here we go again. Every single day, you open your finance app, and the so-called “experts” are screaming at each other over Tesla’s (TSLA) latest delivery numbers or something Elon Musk tweeted at 3 AM. One minute, it’s “demand is falling off a cliff,” the next, it’s “FSD is the future of civilization.” 🤯 It’s a non-stop circus designed to whip retail investors into a frenzy of emotional highs and lows. Yesterday, TSLA was the messiah of tech. Today, it’s a bubble about to burst. Tomorrow, it’ll probably be a legend again because of a meme. Are you not tired? 😴 Trading based on this noise is like trying to drive a Lamborghini by only looking in the rear-view mirror. You’re going to crash. 🤦

Wall Street loves to tell stories, and the “Official Story” of Tesla is perhaps its greatest masterpiece of the last decade. The narrative goes something like this:

According to data from Precedence Research, the global electric vehicle market was valued at $384.65 billion in 2023 and is projected to skyrocket to $2,564.48 billion by 2032, growing at a staggering CAGR of 23.49%. Sounds amazing, right? A golden ticket. And in this grand Wall Street script, there are three main characters:

👑 The Leader: Tesla (TSLA)

⚔️ The Challenger: BYD

🐘 The Incumbent: Volkswagen Group

Achilles’ Heel: The curse of the incumbent. The bureaucratic inertia of a legacy automaker and its vested interest in the internal combustion engine business make its transition slow and painful. In an era of software-defined vehicles, its infotainment systems and user experience feel a generation behind Tesla’s.

But does any of this actually matter?

You spend months poring over dense industry reports, memorizing every line of the financial statements, and you start to feel like an expert. Then, Elon Musk posts a single tweet, and all your hard work evaporates into thin air. This so-called “fundamental analysis” is a dangerously lagging indicator. It’s a map that shows you where the treasure was, long after it’s been moved. The “breadcrumbs” Wall Street throws you (these reports and news headlines) are designed to lure you, the “sheep,” into the pen, so they can sell their shares to you at the top.

Let’s run a “thought experiment”:

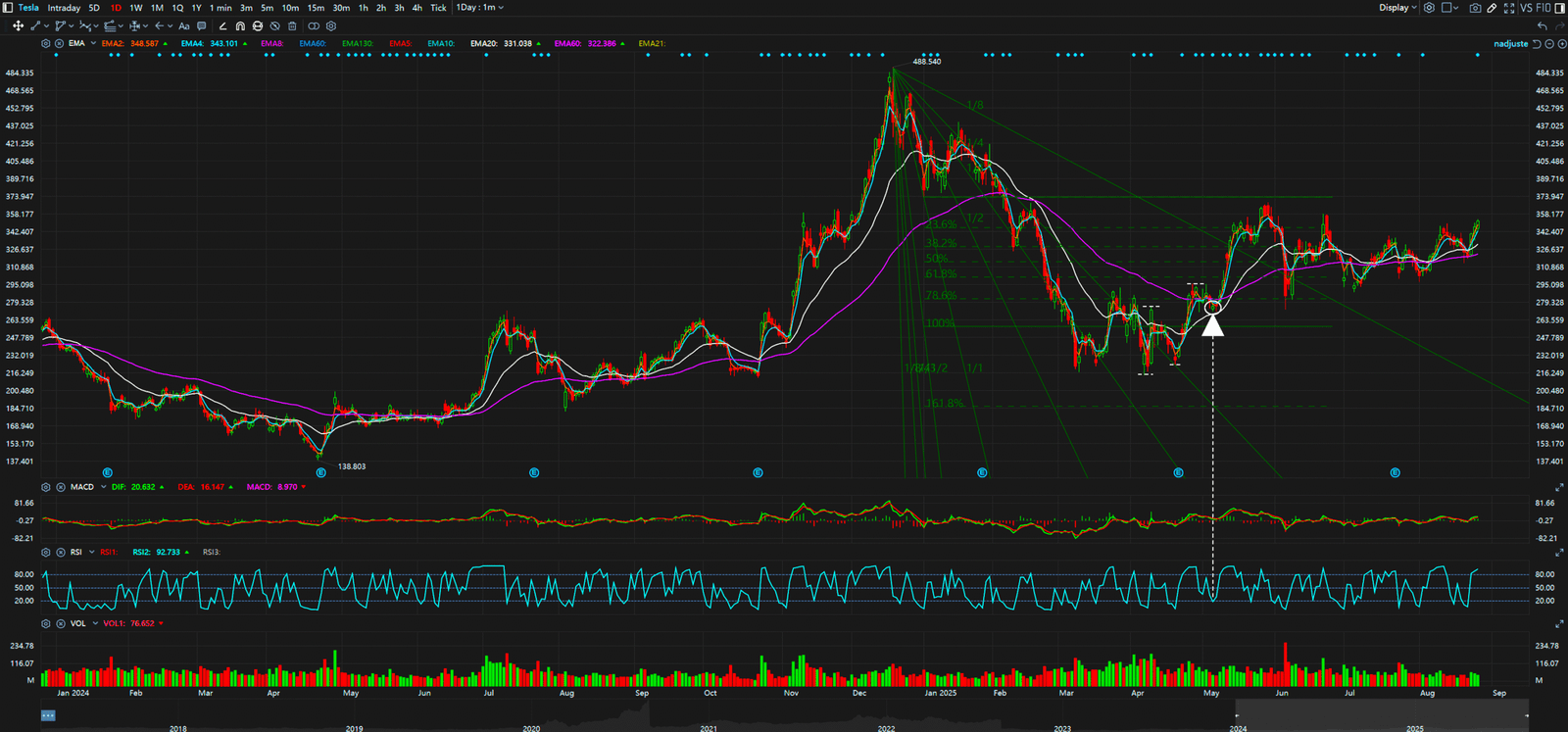

Who is the real player here? The answer is obvious. All the news, all the earnings, all the forecasts are eventually priced into one thing: the chart. The chart is the “footprint” of money flow. It doesn’t lie, because it is a real-time EKG of market psychology and institutional positioning. Your job isn’t to guess what the next earnings report will say; it’s to read the script the chart is already showing you.

In the brutal arena of the financial markets, you have two choices: be a sheep, led to the slaughter, or be a navigator, holding the map.

The sheep chase headlines and hot tips, their emotions manipulated by the constant noise, ultimately becoming liquidity for the smart money. The navigator, however, ignores the noise. They trust only the chart in front of them—the only map that can forecast the future. They know the “Official Story” is a smokescreen; the only language of truth is written in candlesticks, volume, and trendlines.

Do you want to keep being a sheep, or are you ready to take control of your financial destiny? Stop feeding on breadcrumbs. Visit our website now to learn the “real rules of the game” and become a market navigator who sees the future before it happens. Your path to financial freedom starts with learning to read the map.

Sources:

Daily Timeframe (Tesla)