Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

Here we go again. You opened your finance app last night, and what did you see? Analysts fawning over Salesforce (CRM) “beating expectations” once more. Praising their “vast customer relationship universe” and “seamless” AI integration. Right on cue, a flood of “Buy” and “Overweight” ratings, making you feel that familiar FOMO, that itch to jump in before you’re left behind. 🤯 Wake up. While the entire market throws a party for this “good news,” we, the Navigators, are watching from the sidelines, looking at a completely different map. This so-called news is nothing but a carefully crafted bedtime story from Wall Street, designed to lull you, the sheep, into a comfortable state right before you willingly hand over your hard-earned money. 😴

So, what’s the “Official Story” Wall Street wants you to hear? They’ll tell you the Customer Relationship Management (CRM) software market is a goldmine. According to projections from Grand View Research, the global CRM market is set to explode to over $300 billion by 2030, boasting a compound annual growth rate of 13.9%. And in this vast empire, Salesforce is the undisputed king.

But does any of this actually matter? Analysts telling you about Salesforce’s market share, HubSpot’s growth rate, Microsoft’s ecosystem… this is all driving while looking in the rearview mirror. This information is all “what has happened,” the “breadcrumbs” that anyone can find with a few minutes of searching online. By the time this “good news” reaches your ears, what do you think the whales on Wall Street are doing? They’ve likely already finished positioning and are preparing to harvest.

A thought experiment: Imagine Salesforce announces a groundbreaking new AI feature tomorrow. The news breaks, and the stock immediately jumps 5%. You, the sheep, see the news and rush in, thinking you’re clever. But what you didn’t see was that for two weeks leading up to the announcement, the volume on the chart was showing anomalous spikes, and the price was consolidating perfectly above a key support level, forming a textbook bull flag. We, the Navigators, boarded the ship quietly during that time. We don’t need the news. We don’t need analyst reports. Because the chart—the “footprints” of capital flow—had already written the script in plain sight. The news is merely the final act, designed to lure the audience in to buy tickets at the top.

In this zero-sum game, you have only two choices: continue to be a “sheep,” grazing on news, listening to stories, and waiting to be sheared, or learn to read the map and become a “Navigator” who dictates their own destiny. Fundamental analysis gives you a blurry, outdated map, showing a landscape from months, or even years, ago. Technical analysis, on the other hand, is your real-time satellite feed, clearly displaying the flow of capital, the sentiment of the market, and the storms and opportunities that lie directly ahead.

Stop letting their “Official Story” lead you by the nose. The real rules of the game are written in candlesticks and volume. Do you want to learn this language? Do you want to see the moves before the big players make them public? Visit our website now. Start learning the craft of technical analysis and take back control of your financial fate. Stop being a sheep. It’s time to become a Navigator.

Sources:

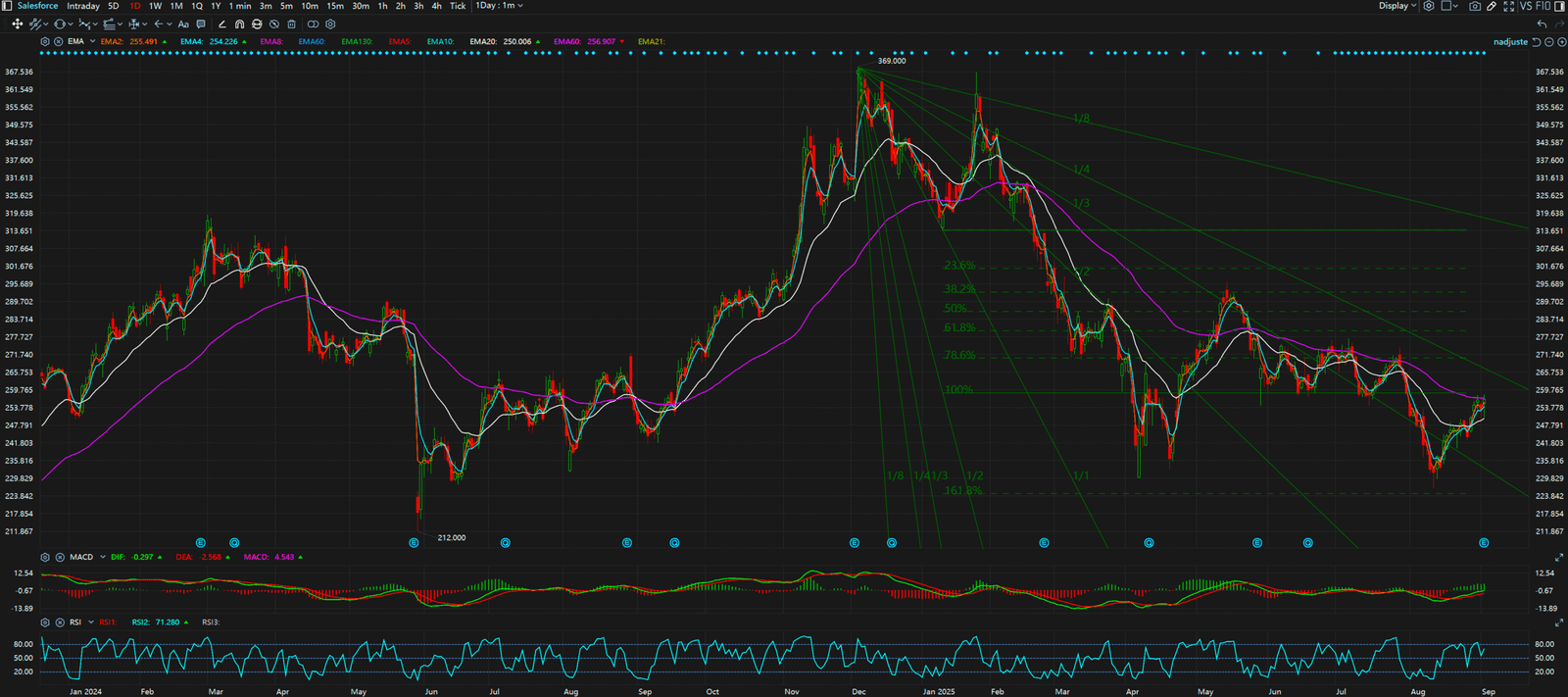

Daily Timeframe – Salesforce (CRM)

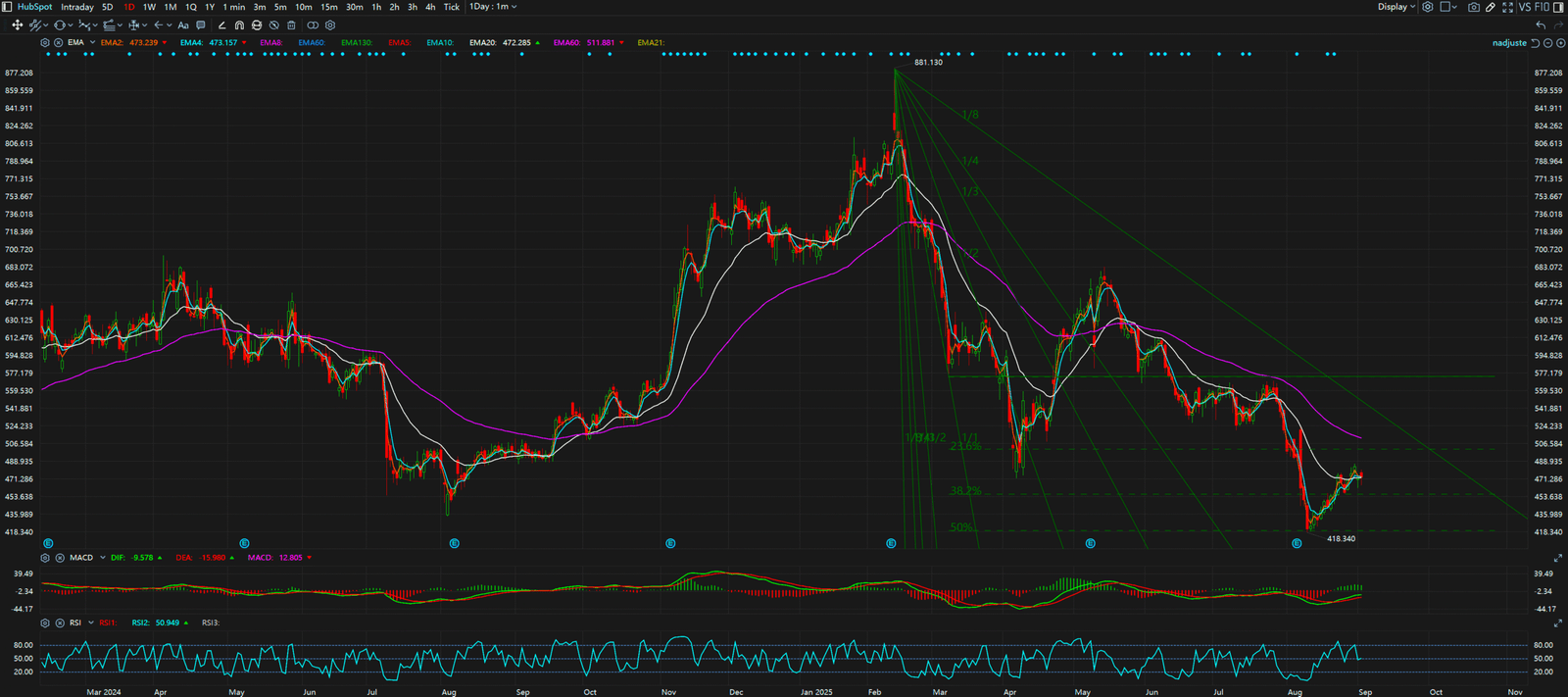

Daily Timeframe – HubSpot (HUBS)

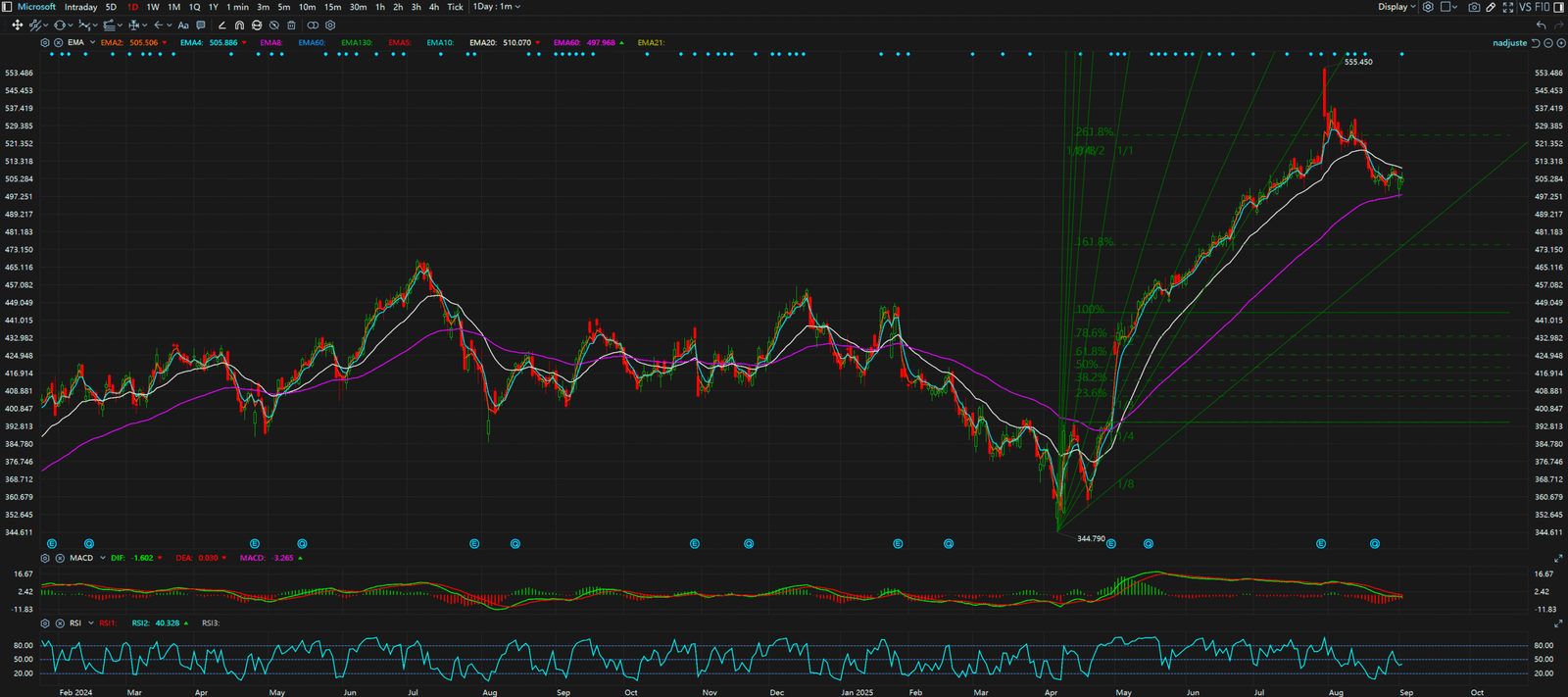

Daily Timeframe – Microsoft (MSFT)