Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

Here we go again. 🤦 The financial media headlines are just now, with an air of grand discovery, reporting that “U.S. brokerages broadly beat second-quarter profit estimates, benefiting from increased market volatility and a rebound in retail investor engagement.” (Source: Reuters, August 2025). They report this as if it’s breaking news, describing a reality that was cemented on the price charts months ago. While mainstream analysts are still busy calculating P/E ratios and dissecting management’s carefully scripted conference calls, trying to unearth “growth drivers” from polished press releases, those of us who read the charts simply look at our screens and let out a quiet sigh. For anyone who understands the language of the market, this is all ancient history. This so-called “good news” is nothing more than the breadcrumbs Wall Street leaves behind after they’ve finished their feast, tossed to the retail crowd to lure them into buying at the top and providing the liquidity for the next cycle of fleecing. The script of this game never changes, only the actors and the lines they recite.

To understand this grand production, we must first examine the official script—the story Wall Street wants you to believe. It goes something like this: the U.S. securities brokerage and dealing industry is a colossal market, valued in the hundreds of billions. According to the latest industry reports, it’s projected to grow at a steady compound annual growth rate (CAGR) of 5.8% through 2027 (Source: Grand View Research). The pillars of this growth narrative are the perpetual accumulation of wealth, the great wealth transfer from retiring Baby Boomers, and the rise of a new generation of investors (Millennials and Gen Z). On this grand stage, the key players each have their perfectly cast roles.

Now, let’s take a deep breath and ask the most fundamental question of all: Does any of the above actually matter? Do these lengthy dissertations on market size, client assets, and business models—these “Official Stories” so carefully crafted by corporate PR and Wall Street analysts—actually help you make money in the market?

The answer is an unequivocal NO.

This fundamental information is, at best, a rearview mirror. It tells you what happened in the past and explains why a company’s stock is priced where it is today. But investing is a game about the future. You need a map, not a rearview mirror. When a glowing earnings report is released, you might think you’ve struck gold. In reality, the positive results in that report were priced into the stock by smart money months ago. The “news” you are reading is the leftovers from a banquet you weren’t invited to. The investment decisions you make based on these breadcrumbs are, in essence, you paying for someone else’s profits.

This entire exercise of fundamental analysis is a meticulously designed puppet show. Morgan Stanley’s “stability,” Robinhood’s “growth,” Schwab’s “scale”—these are just scripts held by the actors. They read their lines aloud on stage, determined to make you believe the story is real. But the real players never watch the actors’ lips. They watch the puppeteer’s hands—the flow of capital. And that flow is recorded truthfully and irrefutably in only one place: the chart. The rise and fall of candlesticks, the ebb and flow of volume, the breach of key support and resistance levels—this is the language of the market, the only footprints that money leaves behind.

Let’s conduct a simple thought experiment. Imagine that three months ago, you read an analyst report praising Robinhood’s incredible user growth and the boundless potential of its crypto business. You were captivated by this “growth story” and confidently bought shares of HOOD. And then what? You endured the subsequent long decline or sideways grind, frantically refreshing the news every day, hoping for a sliver of good news to soothe your bleeding account. Now, let’s rewind and play it differently. What if, instead of the news app, you had opened the price chart for HOOD? What would you have seen? You might have noticed that despite the universally positive news, the stock was repeatedly failing at a key resistance level. You would have seen that volume was not confirming the price advances, and that bearish divergences were appearing. The chart was telling you in the clearest possible language: smart money is exiting. This is not an opportunity; it’s a trap. You didn’t need to know about PFOF or user metrics. The chart had already revealed the secret Wall Street didn’t want you to know.

In the brutal, zero-sum game of the market, you have only two choices: you can either continue to be a docile sheep, content to graze on the stale, expired fundamental fodder the media feeds you while you wait for your turn to be sheared. Or, you can evolve into a formidable hunter and learn to read the only map that matters—the technical chart.

Fundamental analysis gives you a false sense of security. It makes you feel like you’ve grasped a company’s intrinsic value and made a rational decision. But that “value” has already been priced in. Technical analysis does the opposite. It strips away the narratives, the noise, and the lies, and confronts the raw essence of the market: supply, demand, and mass psychology. It doesn’t study what a company should be worth; it studies where capital is actually flowing.

Mastering the ability to read a chart is not magic. It is the single most critical survival skill in this dark forest. It allows you to identify the footprints of money, to align yourself with the Wall Street giants who write the scripts, instead of being a casualty in their play. This is the only path to financial freedom, the only way to escape the fate of being the retail exit liquidity.

Stop driving while staring at the rearview mirror. It’s time to look up and learn to read the map ahead.

Visit our website now. Stop guessing, and start learning the real rules of the game.

Sources:

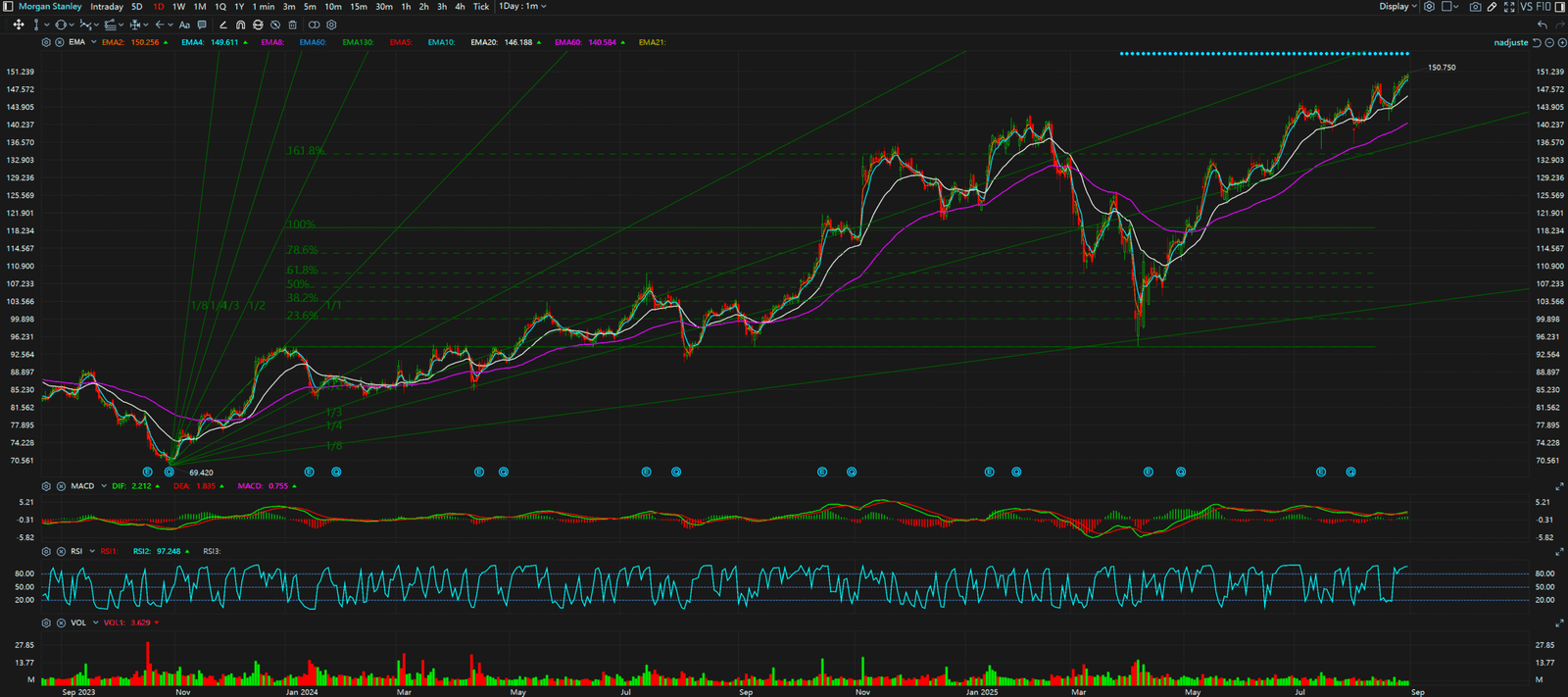

Daily Timeframe (MS)

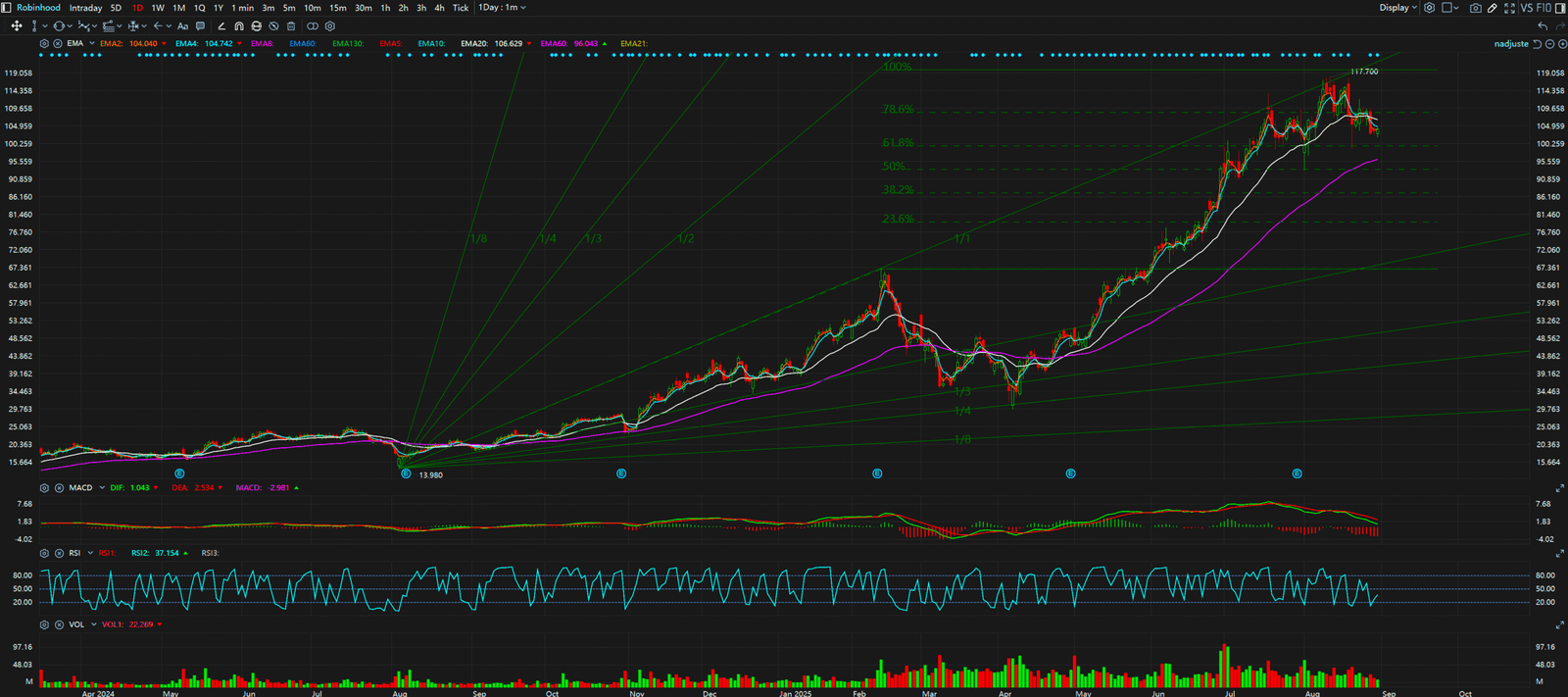

Daily Timeframe (HOOD)

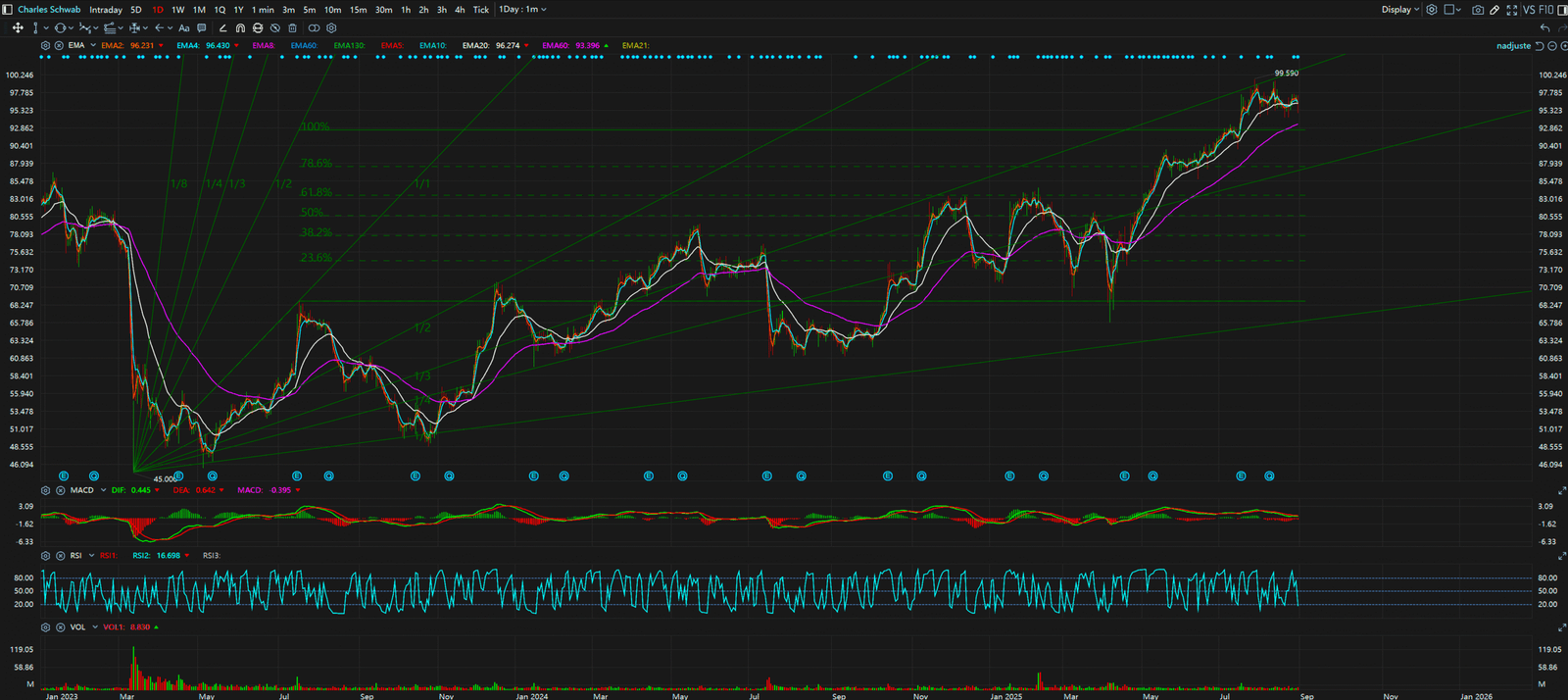

Daily Timeframe (SCHW)