The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

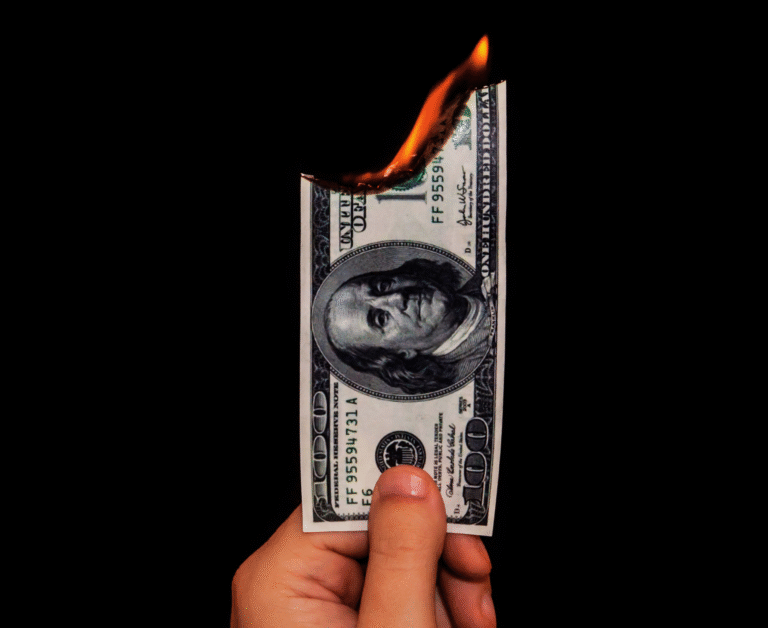

Open any financial news app today, and the headline is all about Netflix’s “stunning” numbers: “Netflix’s Ad-Supported Tier Surpasses 40 Million Subscribers, Wall Street Analysts Raise Price Targets!” 🤯 Seeing these headlines, I just feel a mix of pity and amusement. The mainstream media and their so-called experts act as if they’ve discovered a new continent, making a huge fuss about a capital flow trend that was blatantly obvious on the charts weeks, if not months, ago. They excitedly tell you how successful Netflix’s ad strategy is, how bright its future growth looks… Oh, here we go again. 😴 This “news” was never written for the smart money. It’s the “breadcrumbs” fed to the retail investors who are always late to the party. By the time you read the news and rush into the market, you’re merely taking the baton from the institutional giants who established their positions at the lows months ago. You think you’re catching a trend? You sweet summer child. You’re just watching a meticulously choreographed puppet show, and you’re the one in the audience giving a standing ovation.

The Fundamental Narrative: A “Game of Thrones” Scripted by Wall Street

To make this show feel more authentic, Wall Street’s scriptwriters have crafted a very compelling “official story” for the streaming industry. They’ll tell you that, according to Grand View Research, the global video streaming market size reached a staggering $615 billion in 2023 and is projected to soar at a compound annual growth rate (CAGR) of nearly 20% through 2030, creating a trillion-dollar market. This story has all the elements of a blockbuster script: a massive runway, clear growth projections, and three well-defined protagonists.

- The King 👑: Netflix (NFLX)

- The Official Script: As the industry’s pioneer and undisputed leader, Netflix boasts a colossal subscriber base of over 270 million globally. Its “Core Advantage” lies in its powerful original content engine and a world-class recommendation algorithm. From House of Cards to Squid Game, Netflix has repeatedly proven its ability to create global cultural phenomena. Recently, its ad-supported tier has been hailed as a “stroke of genius,” successfully opening up a new revenue stream and once again demonstrating its unparalleled market adaptability. Wall Street will tell you that Netflix’s moat is its brand and user data, a fortress no one can breach.

- The Achilles’ Heel (The B-Side of the Script): But the B-side of the script—the part they hope you’ll ignore—is the underlying anxiety behind Netflix. Its annual content spend, a gargantuan $17 billion, is a bottomless pit, a constant cash burn required to maintain user growth. Meanwhile, the crackdown on password sharing, while boosting subscriber numbers in the short term, risks long-term user alienation, creating openings for competitors. These “weaknesses” are usually mentioned in passing in the script, designed to make the story appear more “balanced” and “objective.”

- The Challenger ⚔️: Disney+ (DIS)

- The Official Script: As the challenger, Disney was born with a silver spoon in its mouth. Its “Core Advantage” is its unrivaled treasure trove of intellectual property (IP): Marvel, Star Wars, Pixar, plus Disney’s own classic animations. This is the stuff of childhood memories for generations, an emotional connection that Netflix couldn’t buy with hundreds of billions of dollars. Wall Street tells you that when Disney integrates these super-IPs into the Disney+ platform, combined with the synergy of its theme parks and merchandise, its potential is limitless. Their goal isn’t just to be a streaming platform, but to build an all-encompassing entertainment empire.

- The Achilles’ Heel (The B-Side of the Script): But what the scriptwriters won’t shout from the rooftops is that Disney+ has been perpetually stuck in a profitability quagmire. Its Direct-to-Consumer (DTC) segment has been a money-loser for years, only recently scraping by to break-even. To chase subscriber numbers, Disney engaged in aggressive price promotions, resulting in an average revenue per user (ARPU) far lower than Netflix’s. Furthermore, while its content library is powerful, its over-reliance on major IPs has led to a certain creative homogeneity, lacking the diverse, localized content strategy that Netflix has mastered.

- The Old Giant 🐘: Warner Bros. Discovery (WBD)

- The Official Script: Representing the old guard, WBD is the product of a merger between two media titans, Warner Bros. and Discovery. Its “Core Advantage” lies in its immensely vast and diverse content library. On one hand, you have HBO’s high-quality prestige dramas like Game of Thrones and The Last of Us; on the other, you have Discovery’s endless catalog of reality shows and documentaries. In theory, they can cater to every taste. The post-merger platform, Max, is portrayed as a “super platform,” a formidable competitor poised to form a triumvirate with Netflix and Disney+.

- The Achilles’ Heel (The B-Side of the Script): Reality is far harsher than the script. The biggest problem facing WBD is the mountain of debt left over from the merger, to the tune of over $40 billion. This “Achilles’ Heel” is a lead weight tied to its ankle, crippling its ability to invest in new content. To cut costs, management has made a series of baffling moves, such as removing classic HBO shows from the platform and shelving already-completed films, severely damaging the confidence of both creators and audiences. Their streaming strategy is a chaotic mess, and they have yet to offer the market a clear sense of direction.

This is the story Wall Street wants you to see. A king, a challenger, and a struggling giant. They provide you with ample “fundamental” information, making you feel like a professional analyst weighing the pros and cons. You feel like you have insider knowledge, but what you really have is the script they wanted you to read.

The Critical Turn: But Does Any of This Actually Matter?

While you’re lost in analyzing Netflix’s user growth, Disney’s IP value, and WBD’s debt crisis, you’re missing the most fundamental question: Does any of this information actually matter when it comes to making money in the market?

The answer is, not in the slightest. All of this so-called “fundamental” data is a view in the “rear-view mirror.” It’s a summary of past events, of facts that have already occurred. By the time a glowing earnings report is released, an analyst upgrades a stock, or a news story hits the headlines, the associated price movement has already been completed weeks, or even months, prior by the real “smart money.” What you’re seeing are the “breadcrumbs” they left behind. Making decisions based on this lagging information is, in essence, a losing gamble. The market does not pay for old news.

Using fundamental analysis to invest is like trying to drive a car forward while only looking at the rear-view mirror. The mirror tells you what you’ve just passed and how smooth the road was, but it can never tell you if there’s a cliff ahead or an open highway. Technical analysis, on the other hand, is your “map” and “GPS.” Every candlestick, every bit of volume on a price chart, is the result of market participants voting with their real money. They are the “footprints” of capital flow, the “electrocardiogram” (EKG) of market psychology. These footprints don’t lie. They will quietly tell you, long before the news breaks, whether the smart money is accumulating shares or silently distributing them.

A Thought Experiment: You, Three Months Ago

Let’s conduct a simple thought experiment. Go back in time three months. Back then, the mainstream media was filled with skepticism about WBD’s post-merger strategy. Headlines were dominated by “debt crisis” and “strategic chaos.” If you were a believer in fundamentals, you would have seen nothing but a bleak outlook and would never have considered buying the stock. But what if you had opened WBD’s price chart back then? You might have noticed that after a long period of decline, the price began to stabilize at a key support level. You might have seen an unusual spike in volume at these low prices, and certain technical indicators showing bullish divergence. These are the markings on the map. They were telling you that something was afoot. Although the news was overwhelmingly negative, some large, informed players were likely accumulating shares against the trend. Then, a few months later, when the company suddenly announced some “good” news (perhaps a hit show or successful cost-cutting), the stock price jumped, and the news-watchers finally woke up and rushed in. And you, as a hunter who reads the map, would have already captured a significant portion of the profit at the lows, preparing to hand your shares over to these late-coming “sheep.” This is the difference between the rear-view mirror and the map. It is the difference between winning and losing.

Conclusion: Stop Being a Sheep, Start Being a Hunter

In the brutal arena of the financial markets, information is everything. But the critical question is, are you a consumer of information, or an interpreter of it? Will you continue to be a docile sheep, chasing the stale, pre-digested “fundamental” fodder fed to you by the mainstream media? Or do you want to become a hunter, holding the map, tracking the footprints of the beast, and arriving at the destination long before anyone else even knows where the prey is?

In the brutal arena of the financial markets, information is everything. But the critical question is, are you a consumer of information, or an interpreter of it? Will you continue to be a docile sheep, chasing the stale, pre-digested “fundamental” fodder fed to you by the mainstream media? Or do you want to become a hunter, holding the map, tracking the footprints of the beast, and arriving at the destination long before anyone else even knows where the prey is?

Sources:

- Gartner, Inc. – Forecast Analysis: AI Semiconductors, Worldwide

- Netflix, Inc. (2025). Q2 2025 Earnings Report.

- The Walt Disney Company. (2025). Q3 2025 Earnings Report.

- Warner Bros. Discovery, Inc. (2025). Q2 2025 Earnings Report.

Unlocking Technical Analysis: Power Moves with Diagrams

Daily Timeframe (Netflix)

Daily Timeframe (Disney+)

Daily Timeframe (Warner Bros. Discovery)