The big money is not in the individual fluctuations, but in the main movements. That is, not in reading the tape but in sizing up the entire market and its trend.

Jesse Livermore – 1923

Here we go again. Open any financial news app, click on any “guru’s” YouTube channel, and I guarantee your screen will be flooded with the same headlines: “NVIDIA Hits Another All-Time High!”, “The AI Revolution! NVIDIA is the Sole Arms Dealer!”, “Analysts Unanimously Raise Price Targets to $XXXX!”… 🤯 Sound familiar? Every time the market finds a new shiny toy, the mainstream media and so-called “experts” swarm like sharks that smell blood, hyping the same story to the moon and back. Their goal is to instill in you a severe case of FOMO (Fear Of Missing Out), making you feel like you’re about to miss the boat. They’ll tell you, “This time it’s different. This time, it’s a real industrial revolution.” 😴

But I want you to sit down, take a breath, rub your eyes, and think for a second: who are these “news” stories really for? Are they for the people who are already winning in the market, or for the people who are about to be left holding the bag? When a story becomes so mainstream that your Uber driver and the barista at your local coffee shop are telling you how revolutionary AI chips are, doesn’t a little alarm bell go off in your head? Are these “positive headlines” the fuel for takeoff, or are they the final glass of champagne the pilot serves before quietly grabbing a parachute? 🤦

Today, we’re going to use NVIDIA as the perfect case study to dissect exactly how Wall Street masterfully crafts a world-class, Michelin-star information banquet for you, the “fundamental believer.” And then, while you’re feasting on the narrative, they quietly transfer the money from your pocket to theirs. Remember, in this world, there are only two types of investors: the hunter who reads the map, and the sheep who reads the news. Which one do you want to be? Keep reading, and you’ll find your answer.

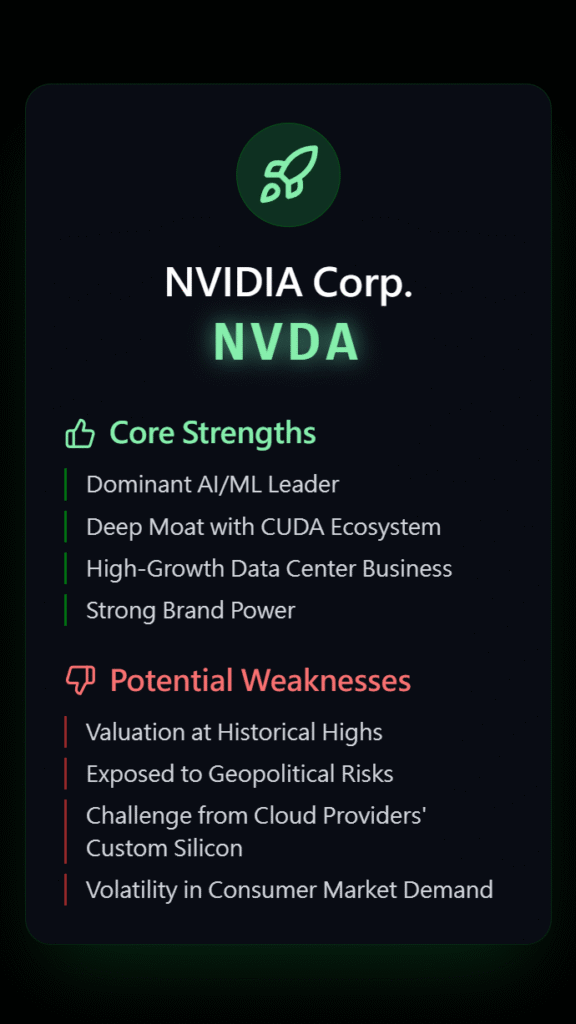

The Fundamental Narrative: The “Official Story” Wall Street Wants You to Hear

Alright, first, let’s put on our “Fundamental Analyst” hat. Let’s play their game and lay out the “Official Story” that Wall Street has so carefully prepared for you. It’s a beautiful story, filled with compelling data, authoritative projections, and a grand vision that would make any untrained investor’s heart race.

The story begins like this: We are living at the dawn of the Fourth Industrial Revolution—the Artificial Intelligence (AI) Revolution. And the beating heart of this revolution is computational power. Without it, all the AI models, self-driving cars, and cloud computing dreams are just that—dreams. According to market research firm Gartner, the global AI chip market is projected to explode from approximately $70 billion in 2024 to over $300 billion by 2030, a staggering compound annual growth rate (CAGR) of over 30%. Another respected firm, Precedence Research, is even more bullish, forecasting a market size approaching $400 billion by 2032. This isn’t just growth; it’s the birth of a new epoch, a golden opportunity that rivals, and perhaps even surpasses, the dot-com boom.

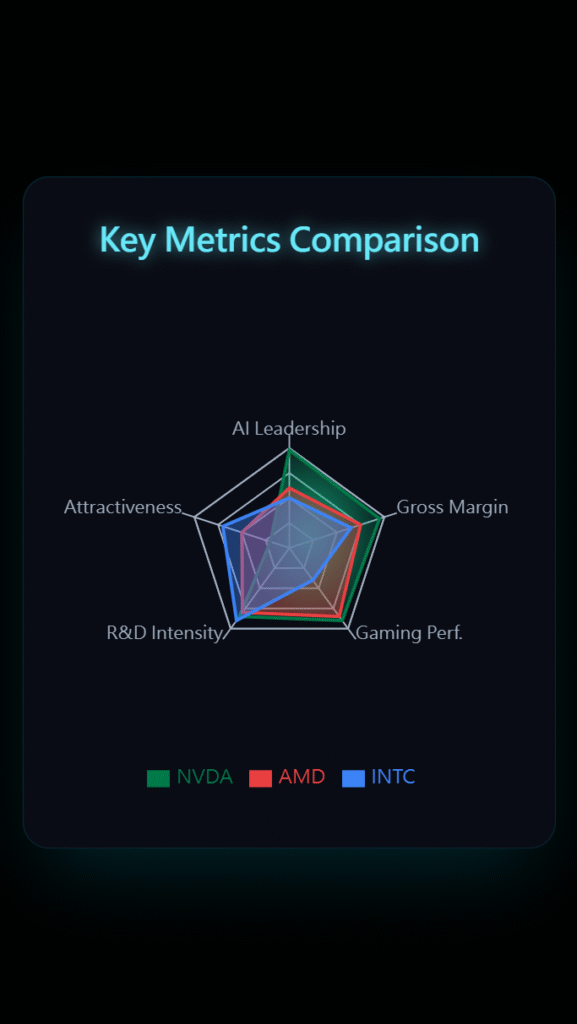

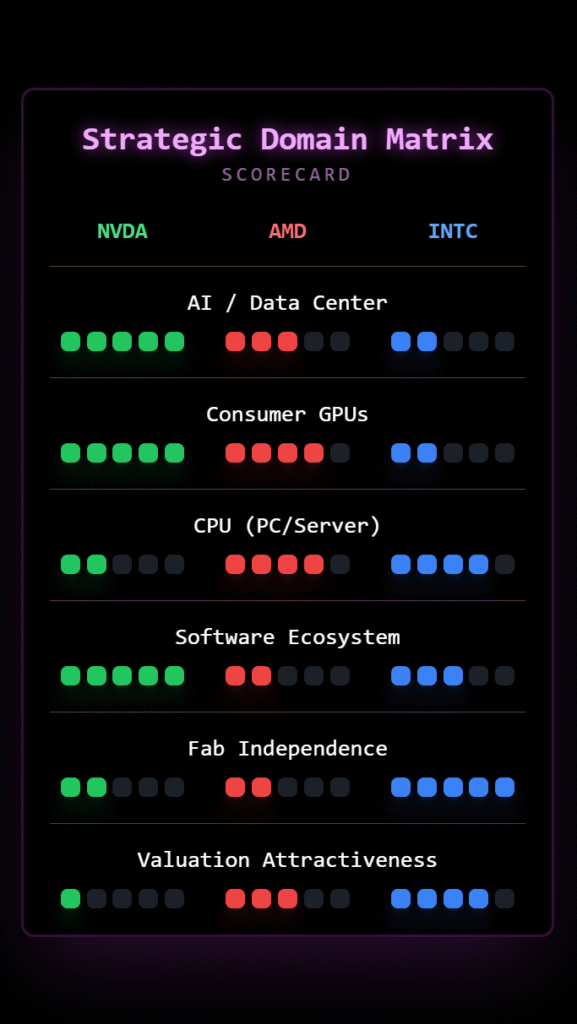

And on this golden racetrack, there are three main players, their roles cast as if in a meticulously scripted Hollywood epic:

👑 The King: NVIDIA (NVDA)

- Arsenal:

The CUDA Moat: This isn’t just a software platform; it’s an ecosystem, a religion. For over a decade, NVIDIA has used CUDA to lock in the vast majority of AI developers worldwide. The switching cost is astronomical. It’s like asking a lifelong Windows power user to suddenly switch to Linux for their daily work—painful and impractical. Data from Jon Peddie Research consistently shows NVIDIA’s market share in the discrete GPU market hovering above 80%. In the data center AI accelerator market, that number is a terrifying 90%+. If that’s not a monopoly, what is?

Full-Stack Solution: From the foundational chips (H100, B200) to the mid-layer networking tech like NVLink and Infiniband, all the way up to the top-layer software libraries like CUDA and cuDNN, NVIDIA isn’t just selling chips. It’s selling a plug-and-play AI factory. Customers aren’t buying parts; they’re buying certainty and efficiency. This one-stop-shop approach leaves competitors in the dust.

Pricing Power: When you have the product everyone is desperate for, you set the rules. It’s reported that an H100 chip costs around $3,000 to produce, yet it sells for anywhere between $25,000 and $40,000. That gross margin (over 75%) is nothing short of a license to print money. And it’s this “money-printing” ability that Wall Street analysts use to justify their eye-watering price targets.

- Achilles’ Heel:

Astronomical Valuation: Herein lies the devil in the details. When all the good news is already baked into the stock price and the P/E ratio is soaring in the stratosphere, any slight turbulence—like a minor deceleration in growth—could trigger a catastrophic sell-off. Wall Street will tell you, “You have to pay a premium for quality,” but they won’t tell you how thin the air is at this altitude.

Supply Chain Dependency: NVIDIA’s cutting-edge chips are entirely dependent on Taiwan Semiconductor Manufacturing Company (TSMC) for production using their most advanced process nodes. This represents a colossal geopolitical risk. Any bottleneck in the supply chain or escalation in regional tensions could bring the money-printing machine to a screeching halt.

Regulatory Scrutiny: Whether it’s the U.S. government’s export bans to China or antitrust investigations from various governments sniffing around a monopoly, a regulatory sword of Damocles hangs over NVIDIA’s head. This “policy risk” is the hardest factor for fundamental analysis to quantify, yet it can have the most devastating impact.

⚔️ The Challenger: AMD (Advanced Micro Devices) (AMD)

- Arsenal:

The MI300 Series: This is the sword AMD has been sharpening for years, aimed directly at NVIDIA’s H100. On certain performance metrics, the MI300X even claims to outperform the H100, and it offers a very attractive proposition in terms of performance-per-dollar. For big customers (like Microsoft and Meta) who are desperate to avoid being held hostage by NVIDIA, AMD provides a crucial “second source.”

Open-Source Strategy: In stark contrast to NVIDIA’s walled garden, AMD is championing its open-source software platform, ROCm. The philosophy is to “unite the anti-NVIDIA alliance,” attracting developers who crave more freedom and customization. This strategy is slow to bear fruit, but in the long run, it could chip away at CUDA’s foundations.

CPU + GPU Synergy: AMD is the only company in the market that can offer both high-performance CPUs (Epyc) and GPUs (Instinct). This integrated capability allows it to provide more holistic and optimized solutions for data centers, an advantage that NVIDIA currently cannot match.

- Achilles’ Heel:

The Software Abyss: ROCm has a noble vision, but reality is harsh. Compared to CUDA, which has been refined and entrenched for over a decade, ROCm’s maturity, stability, and community support are worlds apart. A developer might be tempted by cheaper hardware, but they will never sacrifice their development efficiency for an unstable environment. This is AMD’s most critical weakness.

Brand Perception & Trust: In the high-stakes AI market where failure is not an option, customers are buying insurance as much as they are buying performance. NVIDIA’s brand is synonymous with that insurance. It will take a long time and countless success stories for AMD to build that same level of trust.

🐘 The Old Giant: Intel (INTC)

- Arsenal:

Foundry Services: Intel’s IDM 2.0 strategy is its biggest trump card. It’s not just designing its own chips; it’s opening its factories (fabs) to build chips for other companies. If it can successfully catch up to TSMC’s process technology, it could become the most important chip manufacturer in the Western world, directly challenging NVIDIA’s reliance on Taiwan.

Gaudi Accelerators: Through its acquisition of Habana Labs, Intel possesses the Gaudi series, a secret weapon designed specifically for AI training. In terms of price-performance, the Gaudi 3 chip is positioned to compete aggressively with NVIDIA’s older-generation chips, making it an attractive option for cost-sensitive customers.

Established Enterprise Relationships: For decades, Intel has built an unparalleled network of customers in the data center market. It can leverage these existing channels to push its AI solutions, an advantage that newer players simply don’t have.

- Achilles’ Heel:

Process Node Lag: Intel’s repeated delays in advancing its manufacturing technology over the past decade have turned it from a leader into a chaser. While it claims its “five nodes in four years” plan is on track, market confidence has been shattered. In the world of semiconductors, one step behind often means you’re permanently behind.

Late to the AI Party: Intel is showing up with a boxed lunch after NVIDIA has been feasting at the all-you-can-eat AI buffet for over a decade. Its product line, software ecosystem, and market strategy all feel a step behind. Finding a seat at this crowded party will be incredibly difficult.

After reading this “Official Story,” doesn’t it all seem so comprehensive and logical? You start to think that if you can just figure out whose “arsenal” is stronger and whose “weakness” is less severe, you’ll discover the Holy Grail of investing. You start running the numbers, calculating market share, growth rates, and P/E ratios. You feel like a brilliant general, commanding armies from a hilltop.

But now, I’m going to tell you…

The Critical Twist: The Chart is the Only Truth

None of that matters.

The countless hours you spent poring over earnings reports, analyst ratings, and market size projections… you think you’ve armed yourself with knowledge, but all of that information is the rear-view mirror. It tells you where the car has been, but it will never tell you whether to turn left or right at the next intersection. The big players on Wall Street, the ones actually making the big money, do not drive by looking in the rear-view mirror. They are holding a highly detailed map.

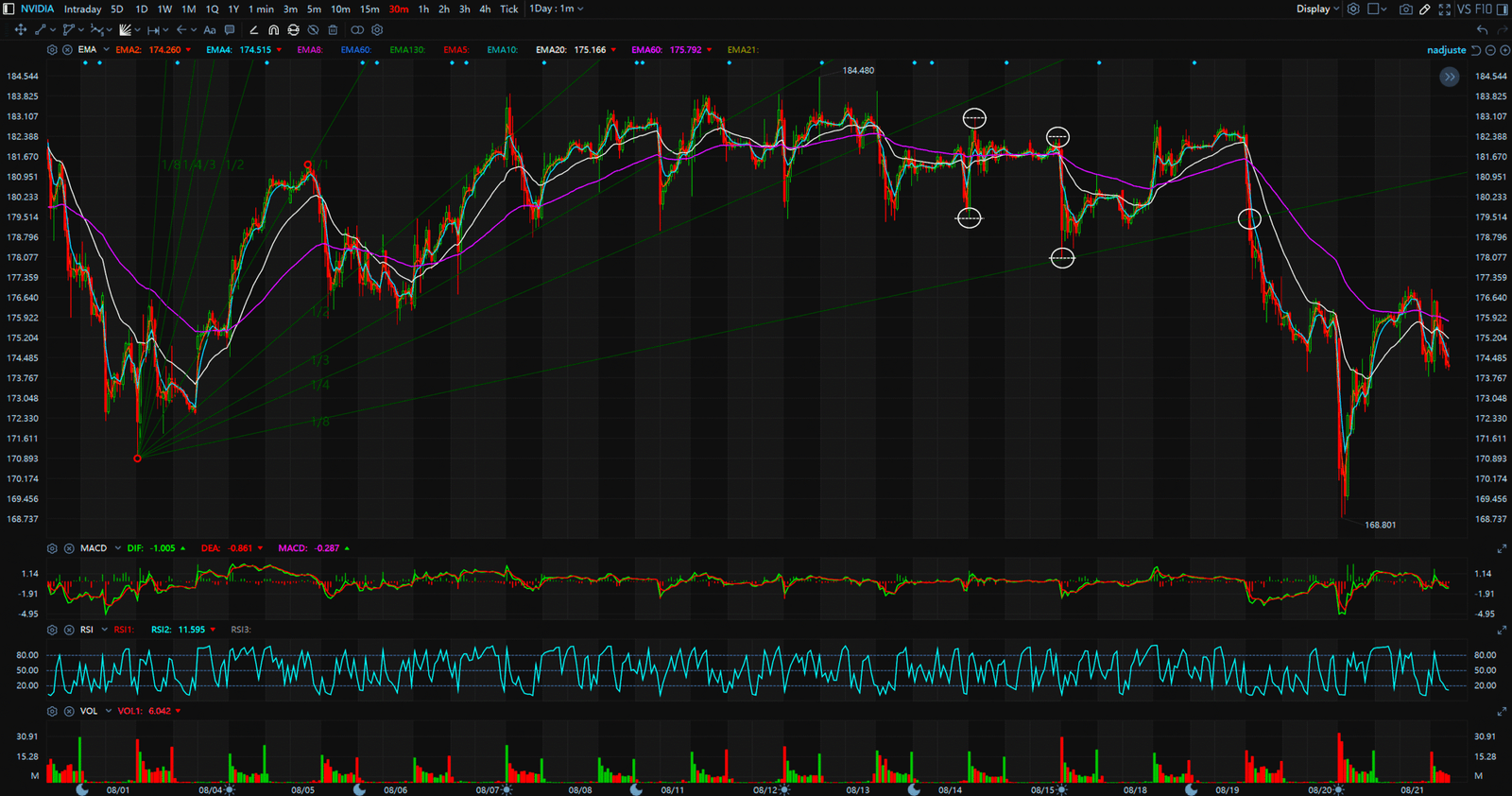

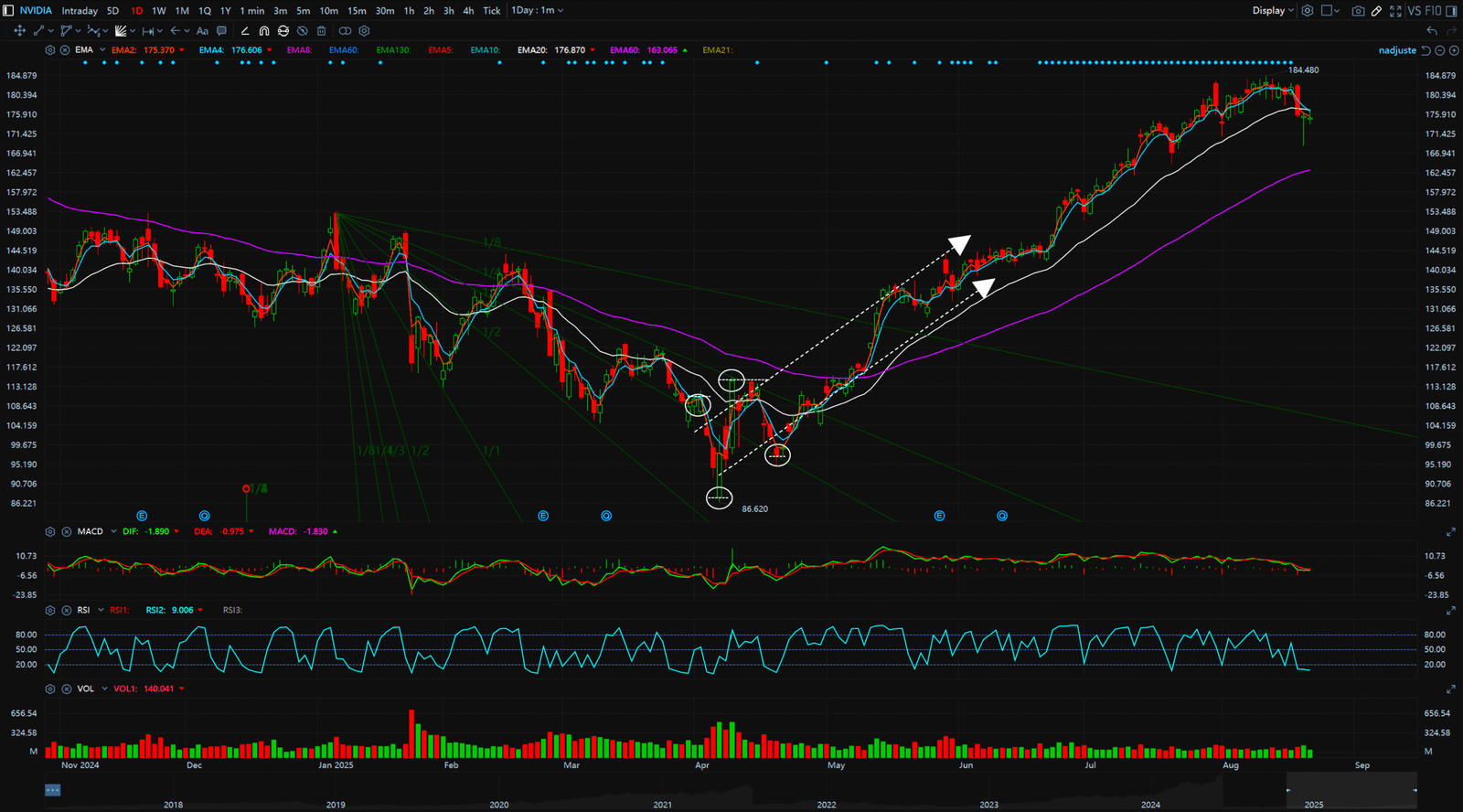

That map is the price chart. The candlesticks, the volume, the trendlines, the indicators… this isn’t black magic. This is the documented evidence of footprints left by money after millions of market participants have cast their votes with real dollars. Every buy order and every sell order is driven by greed and fear. The chart is the language that translates the emotions and decisions of millions into a format you can read. It is the EKG of the market. Long before a heart attack, the EKG shows abnormalities.

The “news” and “earnings reports” you read are nothing more than breadcrumbs scattered by the smart money after they have finished accumulating their positions, designed to lure you, the retail investor, in to buy their shares at a higher price. When they were quietly buying in the low-price consolidation zones, the market was silent. No one was writing articles then. When they have accumulated their fill and are ready to mark up the price, they use their media channels to unleash a flood of “positive news” and hire “experts” to perform a well-rehearsed play. The beautiful earnings report you see, the optimistic forecast you read—it’s all just part of the script. And you are the audience member who bought the most expensive ticket, only to realize at the very end that the hero was the villain all along.

Let’s run a thought experiment.

Imagine, three months ago, NVIDIA released the “greatest earnings report in history.” Every metric blew past expectations. That night, the media described it in “nuclear” terms. The next morning, you see the stock gap up at the open and you immediately jump in. You feel secure, believing you’ve bought the best company in the world. But what happens next? The stock might trade sideways for weeks, or even suffer a deep correction. You start questioning everything. “The fundamentals are perfect, so why is it dropping?” You anxiously scan the news every night, hoping for another dose of good news to “support” the price. Your emotions are now completely tethered to the daily whims of the stock price; you are being controlled by the market.

Now, let’s rewind the clock to a few weeks before that earnings report. If you had looked at the chart then, what would you have seen? You might have noticed that at the bottom of a long consolidation range, the trading volume was beginning to increase abnormally, yet the price wasn’t falling. What is that a signal of? That is the signal of “Smart Money” accumulating shares. They don’t buy with a bullhorn; they buy with a vacuum cleaner, silently sucking up all the shares that retail investors are selling out of fear and impatience. Then, just days before the earnings release, the price breaks out of a key resistance level with conviction. That is the hunter’s signal to fire.

When the map (the chart) has already clearly shown you that the army is about to march, are you still busy studying whether their supply lines (the fundamentals) are sufficient for a three-month campaign? I’m sorry, but by the time you’ve finished reading your report, they’ve already conquered the city and are waiting for reinforcements like you to arrive so they can sell you their shares at a premium.

Conclusion: Stop Being the Sheep. Learn to Read the Map.

So, is NVIDIA a god or a bubble? The question itself is a trap. Because in the world of technical analysis, we don’t need to answer it. We don’t predict the future. We follow the trend.

When the chart tells us the uptrend is intact and money is flowing in, we ride the wave and enjoy the King’s glory. The moment the chart shows a bearish divergence, abnormal volume on a stalled price (churning), or a break of a critical uptrend line, we exit without hesitation—no matter how rosy the headlines are. We don’t need to wait for the company to announce bad news, because the chart will always tell us beforehand that something is wrong.

There are two types of investors in this world, and there will only be two outcomes:

One will continue to be a sheep who reads the news. Your information will always be lagging, your emotions will be manipulated by the media, and your wealth will ultimately become food for the market. You will spend your life chasing one “story” after another—from AI to weight-loss drugs to electric vehicles—always chasing, and always ending up in the same place.

The other will become a hunter who reads the map. You will learn the only universal language of the market: the chart. You will ignore the noise and focus only on the flow of money. You will be fearful when others are greedy, and you will find opportunities for greed in the charts when others are fearful. You will master your own rhythm and become the master of your own wealth.

Acquiring this “map-reading skill” is not an option; it is the only skill that matters for survival in the brutal arena of the financial markets. It is the true path to financial freedom. If you are tired of being led to the slaughter, if you yearn to master a craft that will serve you for a lifetime, we invite you to visit our website. There, we will teach you the real rules of the game. Stop waiting for the next “headline” to save you. The power should be in your hands.

Sources:

- Gartner, Inc. – Forecast Analysis: AI Semiconductors, Worldwide

- Precedence Research – AI Chipset Market Size & Growth Report

- Jon Peddie Research – GPU Market Share Reports

- NVIDIA, AMD, Intel Corporate Earnings Reports & Investor Presentations

Unlocking Technical Analysis: Power Moves with Diagrams

Daily Timeframe

30-Minutes Timeframe