Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

What’s up, degens and future crypto millionaires!

Tired of staring at charts, getting rekt, and missing every single moonshot? Are you watching price action that looks more like your heart rate during a rug pull?

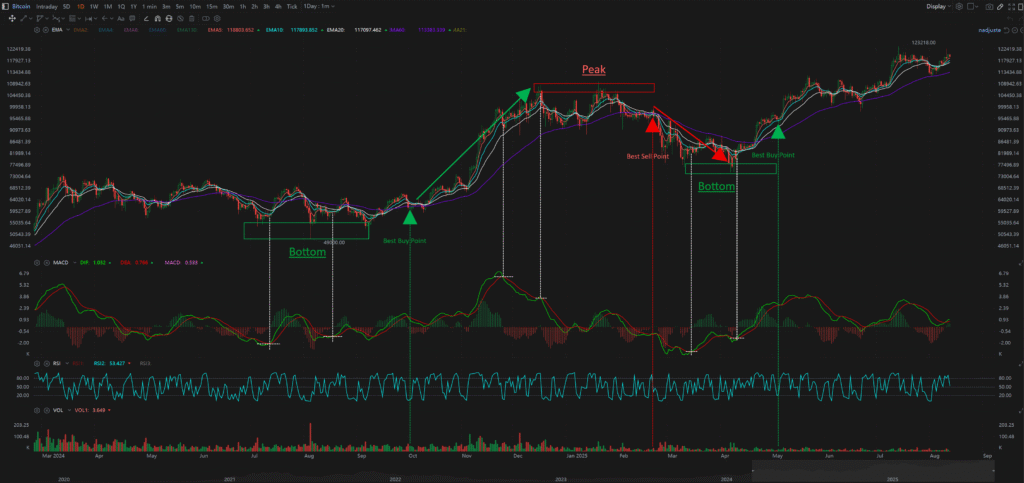

Today, your resident trading guru is here to drop some serious alpha. I’m talking about a killer combo using two “boomer” indicators, MACD and RSI, that’s so simple it’s almost embarrassing, yet so effective it feels like a crime. Don’t believe me? This exact setup was the golden ticket to catching that insane 77% Bitcoin rally at the end of 2024.

This strategy slaps on the daily chart, but if you’re an impatient scalper, it works just as well on the 1-minute, 5-minute, or 30-minute charts.

Step 1: Spot the Bottom – The MACD Bullish Divergence

First, you need to hunt for a “Bullish Divergence” on your chart like a hawk.

Step 2: Wait for the Green Light – MACD Lines Cross Above Zero

This is the secret sauce. The absolute game-changer. After you spot the divergence, you need to have the patience of a monk and wait for both the MACD line (the fast one) and the Signal line (the slow one) to blast off above the zero line.

Step 3: Snipe the Entry – RSI(2) Dips Below 20 is Your Go-Time!

Once the MACD lines are chilling above zero, the price will almost always do a little pullback to shake out the weak hands. This is the golden pocket we’re waiting for.

Check the chart. At the end of September 2024, Bitcoin was in the gutter, but the MACD was screaming “Bullish Divergence” (Step 1 ✅).

Then, in early October, the MACD lines finally shot above the zero line (Step 2 ✅).

And the final piece of the puzzle: on October 2nd, the price pulled back, and the RSI(2) took a nosedive below 20. Bingo! That was your Best Buy Point (Step 3 ✅). Sure, the price dipped slightly below the entry a few days later (that’s called a “stop hunt,” designed to scare you), but it quickly reversed and kicked off a face-melting rally, pumping around 77% in just over two months.

See? Stupidly simple, ridiculously effective.

No strategy is a holy grail that prints money 100% of the time. This play is about stacking the odds heavily in your favor. Always set a stop-loss, manage your risk, and for the love of God, don’t degen your entire bag into one trade. Trade smart.